Northstar Realty Finance Diversifies Again With European Office Portfolio

The Dow 30 Index on Tuesday closed above 18,000 for the first time, buoyed by the good news concerning growth of the U.S. economy. Amid the euphoria, diversified equity REIT Northstar Realty Finance Corp (NYSE: NRF) announced a definitive agreement to purchase 11 Class-A office buildings located in seven major European markets for €1.1 billion.

The portfolio totaling 2 million square feet is 93 percent leased, primarily to credit tenants, with a weighted average term of six years remaining. Approximately half of the base rents are derived from trophy properties located in London and Paris.

Northstar Realty Finance expects to generate a 13 percent initial levered yield based upon first year estimated NOI.

A Deeper Dive

The euro to US dollar exchange rate just hit a 2.5-year low of 1 euro to $1.22 USD, making this portfolio purchase worth $1.34 billion USD.

This Northstar acquisition was backed by Cale Street Partners, a limited liability partnership with ties to the Kuwait Investment Authority sovereign wealth fund.

Economies in Europe have not bounced back as quickly as the United States. This deal was initially reported by EuroProperty, in a November article divulging that the seller SEB Asset Management "continues to liquidate its €3.9bn Immoinvest fund, which was forced to terminate by regulators because it closed for redemptions during the downturn."

According to EuroProperty, "SEB will be retained as asset manager for the portfolio, which will aid its efforts to sell its €12bn property fund management arm, as it does not reduce its assets under management."

NorthStar Emphasizes Flexibility

Northstar CEO David Hamamoto commented, "We are extremely pleased to announce this differentiated and rare portfolio acquisition. The size and execution complexity of this transaction, spanning seven countries and three currencies, demonstrates the strength of our investment platform."

"While our base case assumption is that we retain these high quality assets as we expect rents to grow and cap rates to compress in the coming years, we believe the optionality of this portfolio is very valuable, both from an asset level standpoint and from a corporate standpoint given the quality and scale of the portfolio."

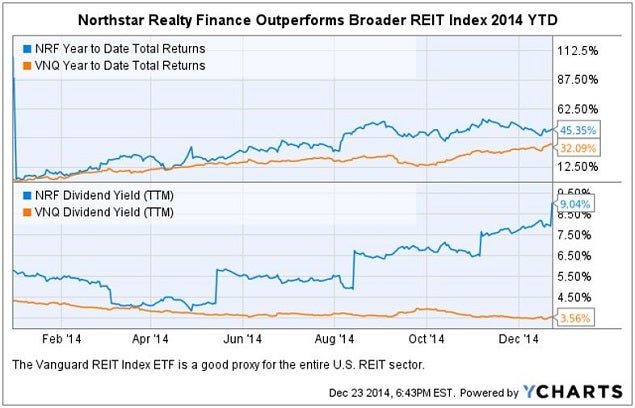

Northstar Asset Growth - Rewarded Investors During 2014

Northstar Realty Finance - A Huge Q4 2014

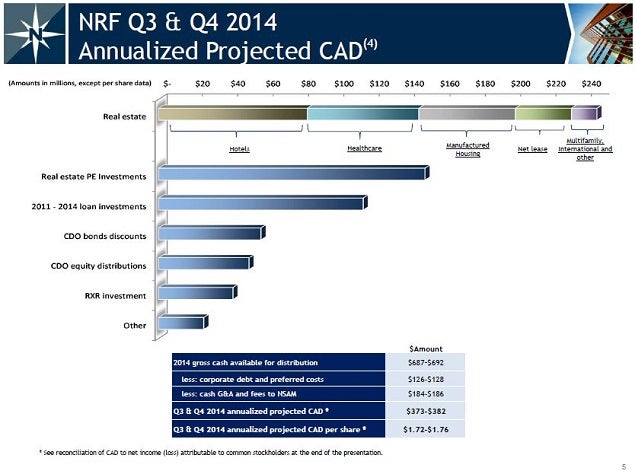

In addition to announcing this definitive $1.34 billion office purchase agreement, Northstar completed two other transformative acquisitions during Q4.

- Hotels: On November 18, it closed acquisition of a $1.8 billion hotel portfolio from Inland American Real Estate Trust. The $3 billion Northstar Realty Finance hotel portfolio is now comprised of 155 upscale extended stay and select service hotels with over 20,000 rooms.

- Healthcare: On December 3, it closed the $4 billion acquisition of Griffin - American Healthcare REIT II, increasing Northstar Realty Finance's healthcare assets to $5.8 billion, diversified by geography, asset class and tenant/operator.

These two deals transformed Northstar Realty Finance into an equity REIT with 80 percent of assets owned real estate.

Northstar's Diverse Asset Portfolio

The purchase of these 11 Class-A European office properties continues to diversify the sources of cash available for distribution across yet another asset class.

Bottom Line

The 9 percent dividend yield paid by Northstar reflects a considerable "complexity discount" by Mr. Market in the price of Northstar Realty Finance shares compared to single-asset class, or pure-play REIT peers.

It is also notable that Northstar Realty Finance is externally managed by NorthStar Asset Management Group Inc (NYSE: NSAM), while REIT investors generally prefer internal management with incentives closely aligned with shareholders.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: American Healthcare REIT II Cale Street Partners David HamamotoLong Ideas REIT Global Trading Ideas Real Estate Best of Benzinga