Wall Street's Most Accurate Analysts Weigh In On 3 Energy Stocks With Over 8% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

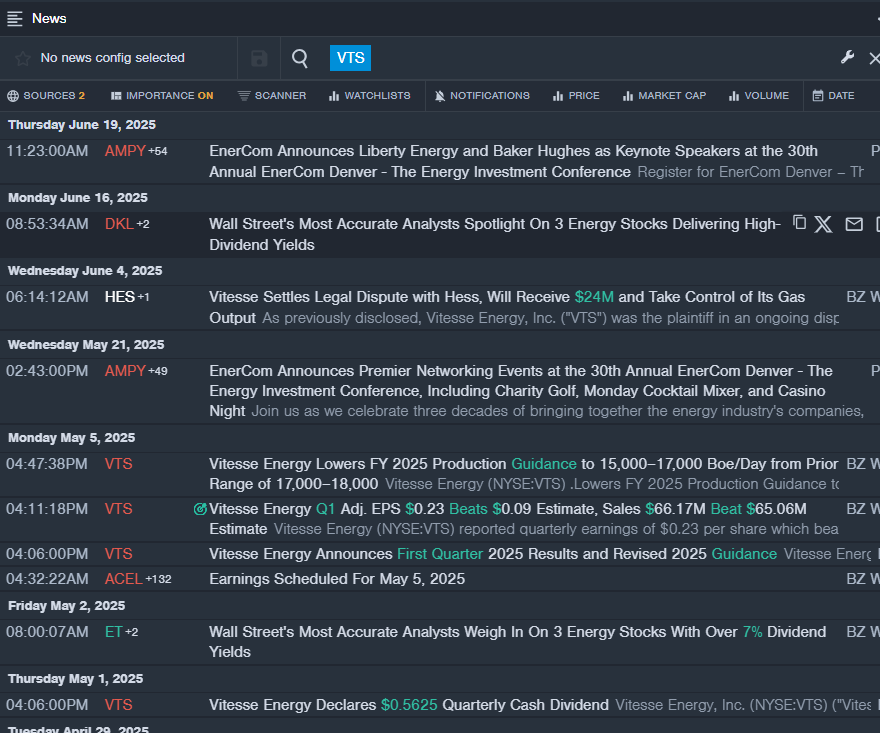

Vitesse Energy, Inc. (NYSE:VTS)

- Dividend Yield: 10.19%

- Roth MKM analyst John White maintained a Buy rating and boosted the price target from $30.5 to $33 on April 2, 2025. This analyst has an accuracy rate of 66%.

- Evercore ISI Group analyst Chris Baker reinstated an In-Line rating with a price target of $28 on March 19, 2025. This analyst has an accuracy rate of 69%.

- Recent News: On May 5, Vitesse Energy reported upbeat earnings for the first quarter, but lowered its FY 2025 production guidance.

- Benzinga Pro’s real-time newsfeed alerted to latest VTS news.

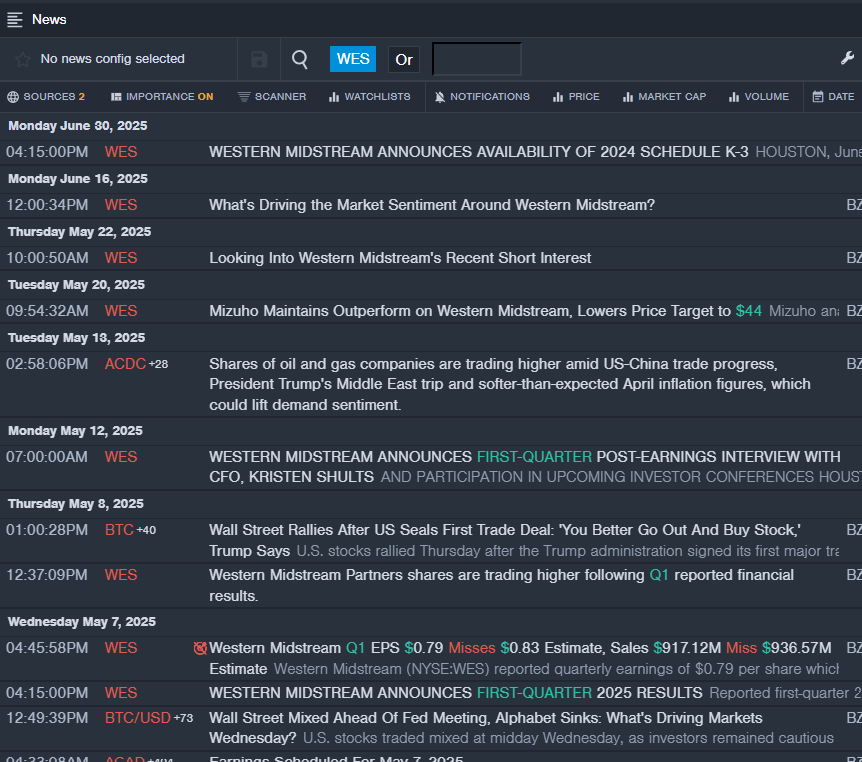

Western Midstream Partners, LP (NYSE:WES)

- Dividend Yield: 9.41%

- Mizuho analyst Gabriel Moreen maintained an Outperform rating and lowered the price target from $45 to $44 on May 20, 2025. This analyst has an accuracy rate of 72%.

- UBS analyst Shneur Gershuni maintained a Neutral rating and slashed the price target from $40 to $37 on Nov. 15, 2024. This analyst has an accuracy rate of 79%.

- Recent News: On May 7, Western Midstream posted downbeat first-quarter earnings.

- Benzinga Pro's real-time newsfeed alerted to latest WES news

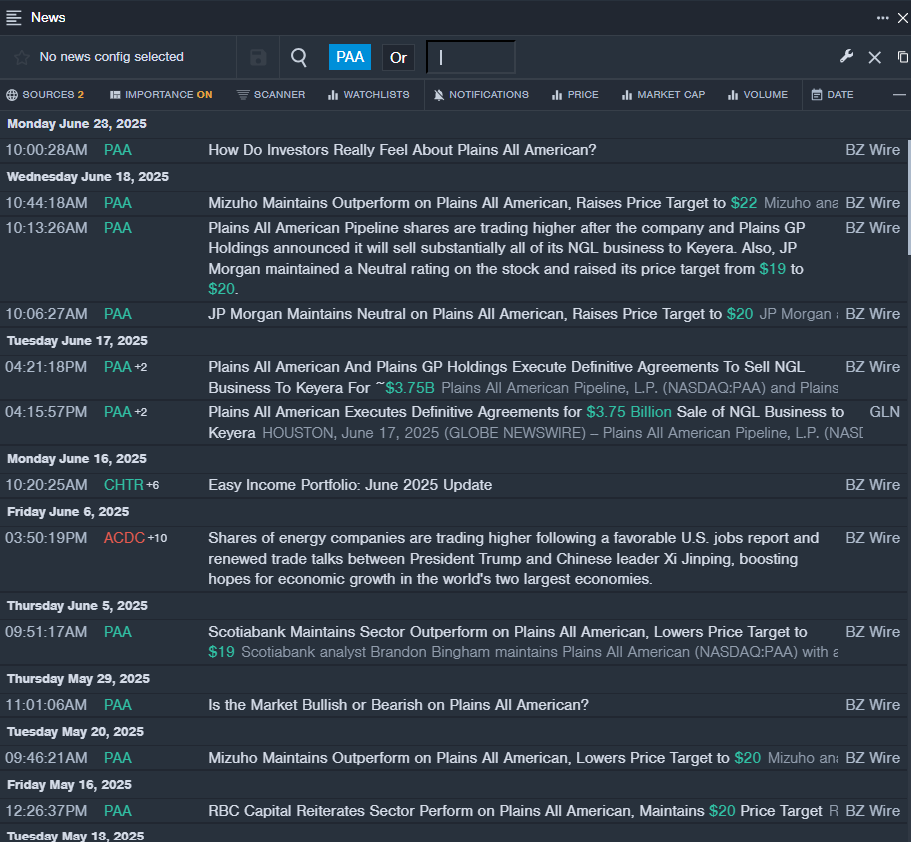

Plains All American Pipeline, L.P. (NYSE:PAA)

- Dividend Yield: 8.30%

- Mizuho analyst Gabriel Moreen maintained an Outperform rating and raised the price target from $20 to $22 on June 18, 2025. This analyst has an accuracy rate of 72%.

- Citigroup analyst Spiro Dounis maintained a Neutral rating and cut the price target from $21 to $18 on May 13, 2025. This analyst has an accuracy rate of 76%.

- Recent News: On June 17, Plains All American Pipeline and Plains GP Holdings announced it will sell substantially all of its NGL business to Keyera.

- Benzinga Pro’s real-time newsfeed alerted to latest PAA news

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldLong Ideas Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas