Wall Street's Most Accurate Analysts Spotlight On 3 Utilities Stocks With Over 5% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

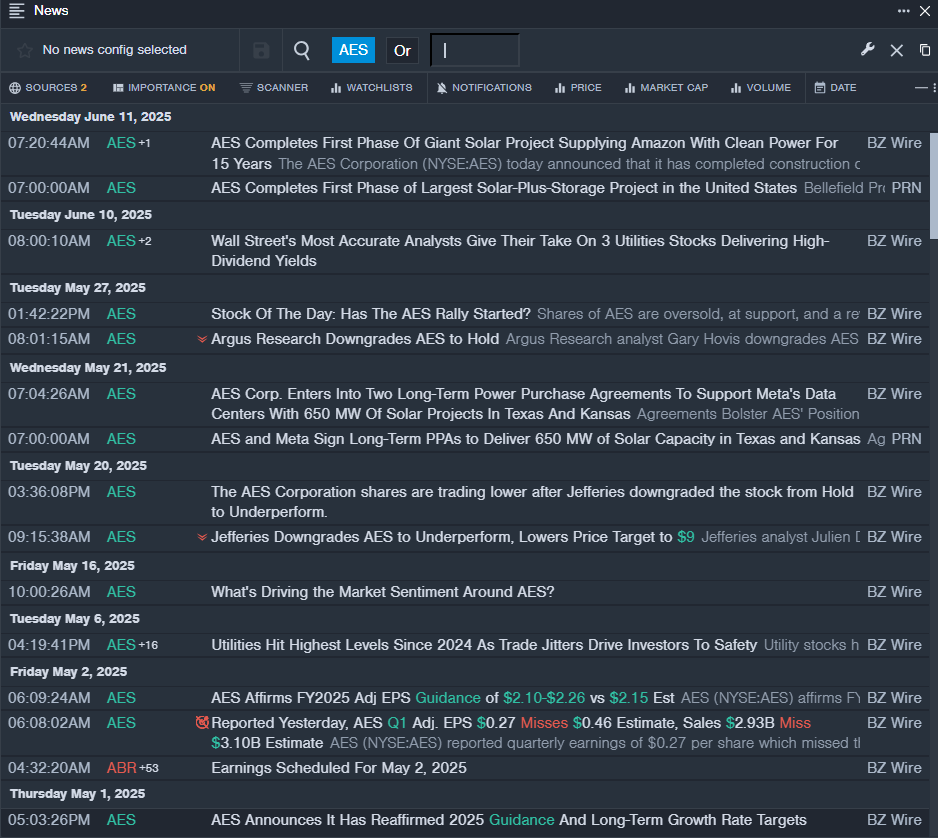

The AES Corporation (NYSE:AES)

- Dividend Yield: 6.87%

- Argus Research analyst Gary Hovis downgraded the stock from Buy to Hold on May 27, 2025. This analyst has an accuracy rate of 62%.

- Jefferies analyst Julien Dumoulin-Smith downgraded the stock from Hold to Underperform and slashed the price target from $10 to $9 on May 20, 2025. This analyst has an accuracy rate of 67%.

- Recent News: On May 1, AES announced it has reaffirmed 2025 guidance and long-term growth rate targets.

- Benzinga Pro’s real-time newsfeed alerted to latest AES news.

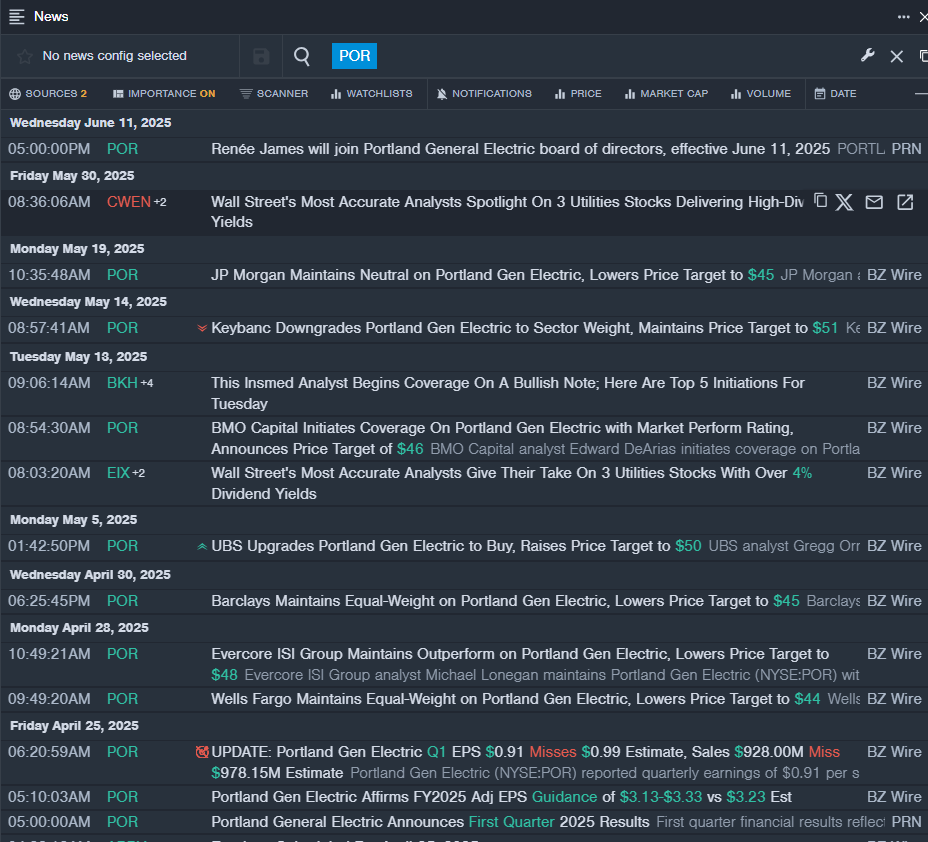

Portland General Electric Company (NYSE:POR)

- Dividend Yield: 5.11%

- Barclays analyst Nicholas Campanella maintained an Equal-Weight rating and cut the price target from $48 to $45 on April 30, 2025. This analyst has an accuracy rate of 62%.

- Wells Fargo analyst Sarah Akers maintained an Equal-Weight and lowered the price target from $46 to $44 on April 28, 2025. This analyst has an accuracy rate of 67%.

- Recent News: On April 25, Portland Gen Electric posted downbeat quarterly results.

- Benzinga Pro's real-time newsfeed alerted to latest POR news

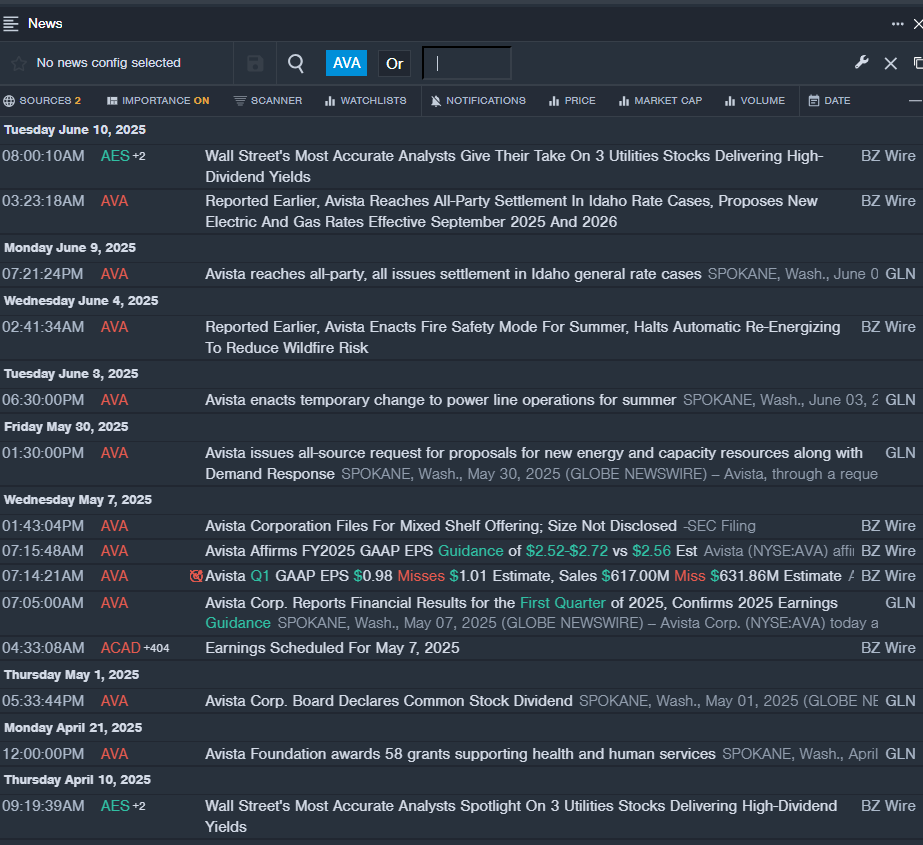

Avista Corporation (NYSE:AVA)

- Dividend Yield: 5.13%

- Jefferies analyst Julien Dumoulin-Smith maintained a Hold rating and lowered the price target from $40 to $39 on Jan. 28, 2025. This analyst has an accuracy rate of 67%.

- B of A Securities analyst Ross Fowler reinstated an Underperform rating with a price target of $37 on Sept. 12, 2024. This analyst has an accuracy rate of 61%.

- Recent News: On June 9, Avista reached all-party, all issues settlement in Idaho general rate cases.

- Benzinga Pro’s real-time newsfeed alerted to latest AVA news

Read More:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas