Wall Street's Most Accurate Analysts Give Their Take On 3 Tech Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

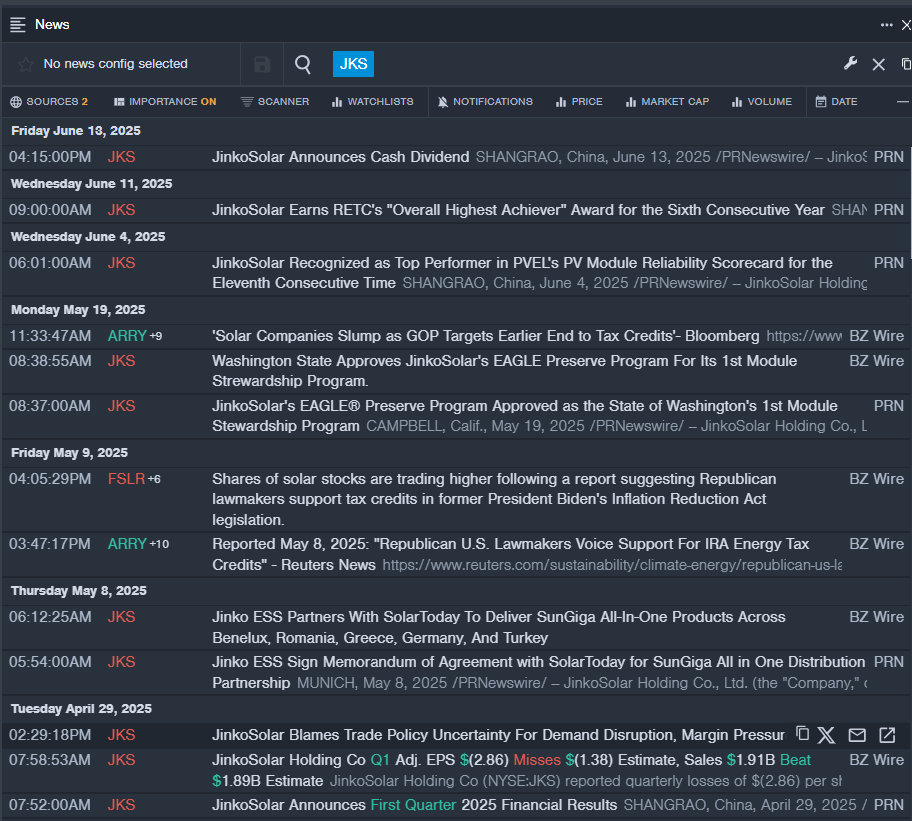

JinkoSolar Holding Co., Ltd. (NYSE:JKS)

- Dividend Yield: 13.12%

- UBS analyst Jon Windham maintained a Neutral rating and cut the price target from $25 to $22 on March 27, 2025. This analyst has an accuracy rate of 60%.

- GLJ Research analyst Gordon Johnson maintained a Sell rating and slashed the price target from $13.08 to $10.95 on Jan. 23, 2025. This analyst has an accuracy rate of 62%.

- Recent News: On April 29, the solar module manufacturer's revenue decreased 39.9% year-over-year to $1.908 billion, beating the analyst consensus estimate of $1.89 billion. Adjusted loss per ADS of $2.86 missed the analyst consensus loss estimate of $1.38.

- Benzinga Pro’s real-time newsfeed alerted to latest JKS news.

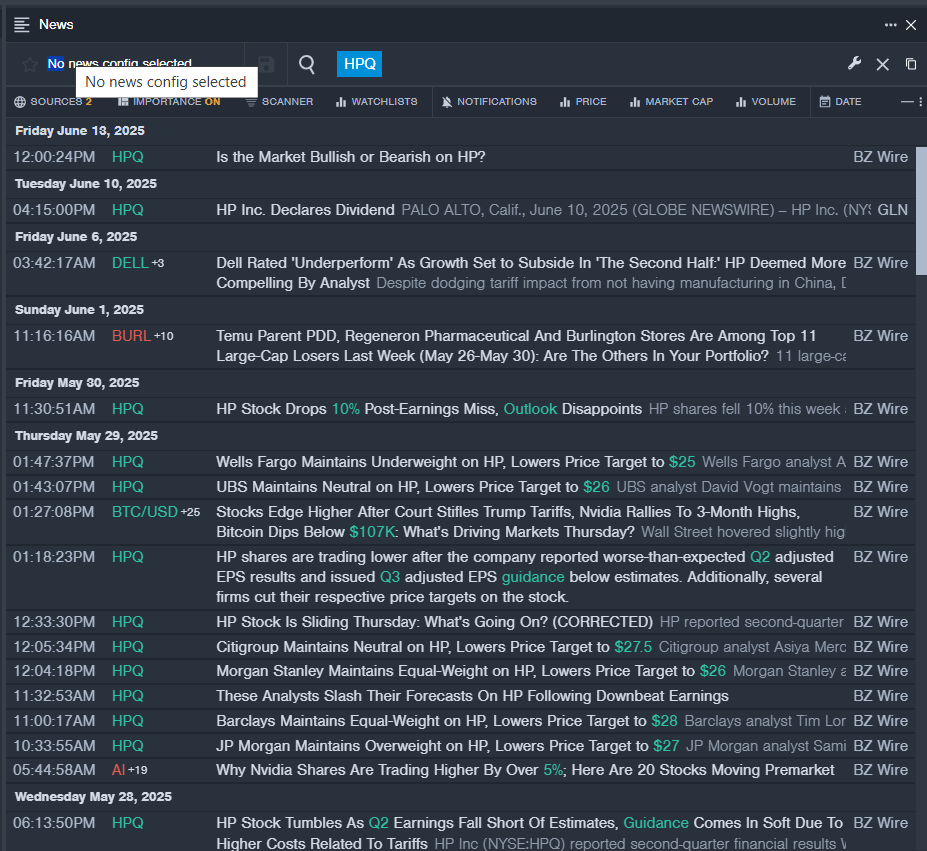

HP Inc. (NYSE:HPQ)

- Dividend Yield: 4.80%

- Wells Fargo analyst Aaron Rakers maintained an Underweight rating and cut the price target from $35 to $25 on May 29, 2025. This analyst has an accuracy rate of 84%.

- Citigroup analyst Asiya Merchant maintained a Neutral rating and lowered the price target from $29 to $27.5 on May 29, 2025. This analyst has an accuracy rate of 75%.

- Recent News: On May 28, HP reported worse-than-expected second-quarter adjusted EPS results and issued third-quarter adjusted EPS guidance below estimates.

- Benzinga Pro's real-time newsfeed alerted to latest HPQ news

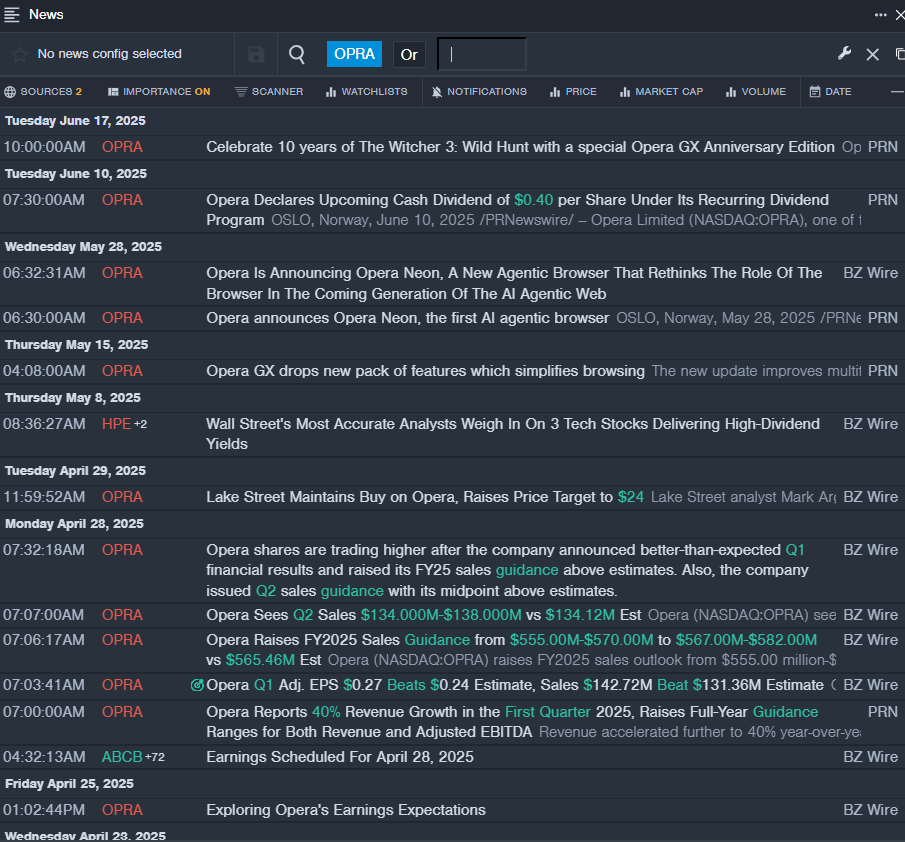

Opera Limited (NASDAQ:OPRA)

- Dividend Yield: 4.43%

- Goldman Sachs analyst Eric Sheridan maintained a Buy rating and lowered the price target from $26 to $22.5 on April 14, 2025. This analyst has an accuracy rate of 78%.

- TD Cowen analyst Lance Vitanza maintained a Buy rating and raised the price target from $25 to $28 on Oct. 30, 2024. This analyst has an accuracy rate of 75%.

- Recent News: On May 28, Opera announced Opera Neon, the first AI agentic browser.

- Benzinga Pro’s real-time newsfeed alerted to latest OPRA news

Read More:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas