-

IRS Bumps Up 401(k) Limits For 2025 – Find Out How Much You Can Now Contribute

Sunday, November 10, 2024 - 10:33am | 768Read More...The IRS recently announced that contribution limits for 401(k) retirement plans will increase in 2025, allowing workers to save more for their future. Beginning next year, employees can contribute up to $23,500 to their 401(k) plans, $500 more than the limit in 2024. This increase also...

-

Your CPA Called: Here's What The IRS Should Know About Cannabis Businesses

Tuesday, October 29, 2024 - 10:16am | 490Read More...With tax season approaching, CPAs are calling on the IRS to prepare for potential changes impacting cannabis businesses. The American Institute of CPAs (AICPA) recently submitted recommendations to the U.S. Treasury and IRS, highlighting areas where guidance is needed to clarify tax obligations for...

-

2024 Cannabis Taxes: States Weigh In On New Approaches To Revenue

Wednesday, October 9, 2024 - 1:54pm | 722Read More...U.S. states have adopted different tax structures in their respective recreational cannabis markets, each with its pros and cons. Insights from a recently published article by the Tax Foundation show that ad valorem taxes, which are based on the sales price of cannabis, are still the simplest to...

-

US Companies Save Millions Due To 2017 Tax Law Loophole

Sunday, September 1, 2024 - 1:30pm | 525Read More...A loophole in the 2017 tax law is allowing large corporations to save millions of dollars that would have otherwise been paid to the government. What Happened: The Internal Revenue Service (IRS) attempted to rectify the issue with regulations, but the U.S. Tax Court unanimously ruled last week that...

-

Tax Preparers Conduct Clean Energy Tax Credit Scams For Financial Gain, Industry Group Says

Tuesday, July 30, 2024 - 3:03pm | 447Read More...The Internal Revenue Service has warned taxpayers against “unscrupulous” tax preparers carrying out clean energy tax credit scams. The ruse occurs when tax preparers illegally give taxpayers tax credits to which they are not entitled. “Unscrupulous (or misinformed) tax preparers...

-

Government To Match Retirement Savings For Millions Of Workers, Opening New Opportunities For Financial Advisors

Sunday, July 28, 2024 - 10:00am | 456Read More...The Saver’s Match, created by the SECURE 2.0 Act of 2022, is poised to transform retirement savings for low-income workers, and could bring a whole new audience to financial advisors. Set to launch in 2027, this program will convert the existing Saver’s Credit into a federal government...

-

IRS Warns Of 'Unscrupulous' Tax Preparers 'Misrepresenting' Clean Energy Tax Credits

Tuesday, July 23, 2024 - 12:14pm | 454Read More...The Internal Revenue Service (IRS) is warning taxpayers against a new tax-preparer scam involving certain tax credits. “In this latest scam, the IRS is seeing instances where unscrupulous tax return preparers are misrepresenting the rules for claiming clean energy credits under the Inflation...

-

IRS Finalizes 10-Year Rule For Retirement Withdrawals, Making Things 'Even More Insanely Complicated'

Sunday, July 21, 2024 - 10:00am | 418Read More...The Internal Revenue Service and Treasury Department have released final regulations updating required minimum distribution (RMD) rules for beneficiaries under the 10-year rule. These regulations, stemming from the SECURE and SECURE 2.0 Acts, confirm that most IRA beneficiaries must take...

-

End Of IRS' 280E On The Horizon? What Cannabis Rescheduling Means For Business Tax Deductions

Saturday, July 6, 2024 - 11:21am | 739Read More...The cannabis industry may be on the verge of significant financial relief with the Biden administration's proposal to reclassify cannabis to Schedule III of the Controlled Substances Act. This reclassification would eliminate the oppressive restrictions of Section 280E of the Internal Revenue Code...

-

Congressman Matt Gaetz Introduces Bill To Allow Federal Tax Payments In Bitcoin

Tuesday, June 25, 2024 - 2:31pm | 651Read More...Congressman Matt Gaetz (R-Fla.) has introduced a bill that would allow federal income tax payments to be made in Bitcoin (CRYPTO: BTC). What Happened: This proposed legislation aims to amend the Internal Revenue Code of 1986, providing a novel method for taxpayers to settle their federal tax...

-

'Bitcoin Jesus' Roger Ver Arrested In Spain On Tax Evasion Charges

Tuesday, April 30, 2024 - 4:51pm | 424Read More...Roger Ver, a prominent figure in the early days of Bitcoin (CRYPTO: BTC) and known as “Bitcoin Jesus,” has been arrested in Spain and charged with mail fraud, tax evasion, and filing false tax returns. The U.S. Department of Justice alleges that Ver evaded nearly $50 million in taxes....

-

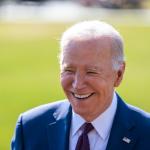

Biden Promised IRS Funding Wouldn't Increase Audits For Regular Americans As IRS Audits Poorest Americans 5X More Often Than Others

Wednesday, April 17, 2024 - 11:31am | 550Read More...Once it was announced that the IRS would receive $80 billion in additional funding as part of the Inflation Reduction Act, the Biden Administration sought to assure regular Americans that these funds would not make them more likely to get audited by the agency. Treasury Secretary Jannet Yellen said...

-

Joe Biden Tax Return Released: How Much Did President Make In 2023?

Tuesday, April 16, 2024 - 6:51pm | 494Read More...President Joe Biden is among the people who completed their taxes ahead of an April 15 deadline. Here's a look at Biden's earnings and taxes paid in 2023. Joe Biden's Tax Return: Biden's 2023 tax return was made public this week, which marks the third straight year as a president Biden has done...

-

How Does The Stock Market Perform Ahead Of Tax Day? 'Rough' At First, Data Shows

Monday, April 15, 2024 - 3:39pm | 634Read More...There are tons of interesting tidbits about Tax Day. According to the Internal Revenue Service (IRS): Officers answered more than one million taxpayer phone calls this season. They processed over 100 million individual tax returns through April 6. Tens of millions more filings will be made on the...

-

Cannabis Industry Facing High Cost Challenges As Tax Day Approaches

Tuesday, April 2, 2024 - 4:49pm | 788Read More...As the tax filing deadline of April 15 approaches, it's intriguing to examine the fiscal challenges and structural injustices faced by the cannabis industry. That's why we've prepared some back-of-the-envelope calculations: The cannabis sector has contributed significantly to states...