Two US Lawmakers On The Armed Services Committee Quietly Snapped Up L3Harris Shares Leading Up To Iran Tensions: 'This Shouldn't Be Legal'

Two U.S. lawmakers are being called out after disclosing their stock purchases involving defense contractor L3Harris Technologies Inc. (NYSE:LHX), in the lead up to conflict with Iran, while serving on the Congressional Armed Services Committee.

What Happened: On Monday, in a post on X, Nancy Pelosi Stock Tracker, which tracks the trades made by politicians, highlighted one such trading disclosure in recent weeks, involving Sen. Markwayne Mullin (R-Okla.) and Rep. Gil Cisneros (D-Calif.).

The post sheds light on the fact that these two lawmakers, who serve on Armed Services Committees in Congress, have bought shares of L3Harris over the past month, in the lead up to the conflict between Israel and Iran, in which the U.S. played a significant role.

See Also: Nancy Pelosi’s Portfolio Crushed Wall Street Hedge Funds With Jaw-Dropping Returns Last Year

“This shouldn't be legal,” the post says, given the deep ties that contractors such as L3Harris, which sells weapons systems and classified communications infrastructure, have with the government.

Why It Matters: Just recently, the same account reported on three Congressional representatives purchasing shares of IDEXX Laboratories Inc. (NASDAQ:IDXX) while serving on a committee that was directly tied to the “National Biotech Initiative Act of 2025,” which was expected to create substantial tailwinds for the company.

This comes amid growing calls for a ban on Congressional stock trading, with economist Justin Wolfers calling it “simply absurd” that representatives are allowed to trade stocks while regularly receiving “top secret briefings” and information.

The outsized gains reported in the private portfolios of political leaders have come under increasing scrutiny in recent years. Former House Speaker Nancy Pelosi, for instance, has famously outperformed several leading hedge funds, with gains of 65% in 2023 and 54% in 2024.

Her performance, however, pales in comparison to those of her colleagues, who’ve returned 70% to 149% over the past year, fueling concerns regarding a conflict of interest.

Price Action: Shares of L3Harris were up 0.58% on Monday, trading at $251.11, but are down 1.64% after hours, following the de-escalation of tensions between Iran and Israel.

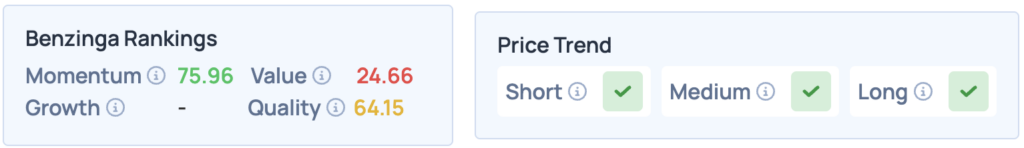

L3Harris scores well on Momentum, and has a favorable price trend in the short, medium, and long term. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Justin Wolfers Nancy Pelosi Rep. Gil Cisneros (D-Calif.). Sen. Markwayne Mullin (R-Okla.)Insider Trades Markets