Elon Musk's X Plans To Launch In-App Stock Trading To Challenge Robinhood, SoFi — CEO Says You'll 'Whole Financial Life' Could Be On The Platform

Social media platform X, formerly known as Twitter, is planning to roll out features that allow users to trade and invest directly from the app, according to CEO Linda Yaccarino.

What Happened: On Thursday, in an interview with the Financial Times, Yaccarino unveiled the company’s roadmap, which includes everything from peer-to-peer payments and tipping to buying and trading stocks, and even X-branded credit and debit cards by the end of this year.

“You'll be able to come to X and be able to transact your whole financial life on the platform,” Yaccarino said at the Cannes Lions advertising festival this week.

Yaccarino believes that given the platform’s massive user base, “a whole commerce ecosystem and a financial ecosystem is going to emerge,” which does not exist today.

This comes at a rather precarious time for the company, which has bled advertising dollars and clashed with marketers over content safety in recent months.

When asked about the company threatening brands with lawsuits for not advertising on X, Yaccarino dismissed it as “hearsay,” adding that it was all from “unnamed sources, and random third-party commenters.”

Why It Matters: This expansion of X into financial services is expected to intensify pressure on incumbents such as Robinhood Markets Inc. (NASDAQ:HOOD), SoFi Technologies Inc. (NASDAQ:SOFI), and Block Inc.’s (NYSE:XYZ) Cash App.

Payments strategist Dwayne Gefferie sees a familiar pattern playing out. Just like “the auto industry waited on Tesla and aerospace waited on SpaceX,” he says, today's payment giants are standing still while Musk takes the lead with X Money.

“They'll wait to see if X Money succeeds, and when it does work, they'll scramble to react,” he says, adding that the real question is “why no one else in payments is taking this kind of risk.”

Early this month, xAI, which owns X, targeted a valuation of $113 billion while pursuing a $300 million share sale. In March, the transaction involving xAI’s acquisition of X, pegged the social media platform’s valuation at $33 billion, falling short of the $44 billion that Musk paid for it in 2022.

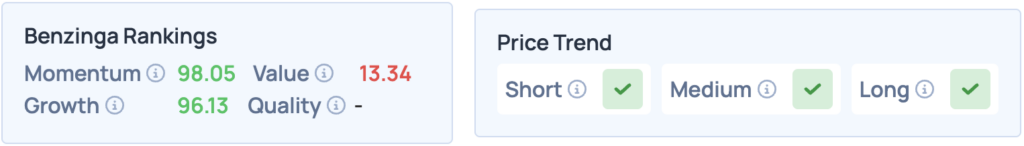

Price Action: Robinhood shares were up 4.54% on Thursday, trading at $78.35, and are up 0.28% after hours.

Shares of Robinhood Markets show strong Growth and Momentum, while having a favorable price trend in the short, medium, and long term. Click here for deeper insights on the stock, and how it compares with competitors such as Sofi.

Photo Courtesy: Mamun_Sheikh on Shutterstock.com

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Financial Times Linda YaccarinoFintech News Financing Markets