AMD Shares Drop After CEO Guides Q1 Data Center Revenue Down 7%

Advanced Micro Devices, Inc. (NASDAQ:AMD) shares are diving Wednesday following its fourth-quarter earnings release on Tuesday. Data center segment revenues and guidance given on the company's conference call are weighing on investors.

What To Know: AMD's Datacenter fourth-quarter revenue came in below analyst expectations of $4.14 billion, per CNBC, and the company guided for further declines ahead.

CFO Jean Hu said on the company's earnings call that data center revenue is expected to decline by about 7% in the first quarter, in line with the company's overall revenue.

Read Next: Amazon ‘Relatively Well-Positioned’ To Face Trump’s Tariffs: Analyst

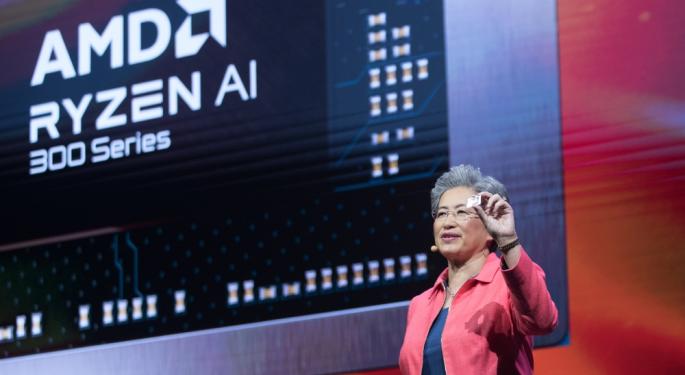

CEO Lisa Su added more color to the Q1 guidance and attributed the anticipated decline to seasonality across business segments.

"And the way that breaks out in each of the segments assume that data center would be down just about that average, so the corporate average. We would expect the client business and the embedded business to be down more than that. Just given where seasonality is for those businesses. And then we would expect gaming business will be down a little less than that," Su said.

Su declined to give exact figures, but forecasted AMD's data center revenues for the first half of 2025 to be "consistent with the second half of ’24."

Summit Insight analyst Kinngai Chan commented on investor sentiment surrounding AMD's data center segment and possible loss of market share to Nvidia Corp. (NASDAQ:NVDA).

“AMD’s AI GPU is probably not tracking to investors’ expectations. We continue to believe Nvidia is opening a gap against AMD in AI GPU performance and value,” Chan said, as reported by Reuters.

Looking Ahead: Su said that demand for AI-related compute is strong. She reiterated the previous forecast for a total addressable data center market of "upwards of $500 billion by the time we get out to 2028."

"So, yes, we are bullish on the long term, and we’ll certainly give you progress as we go through each quarter in 2025," Su added.

Read Next:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: AI artificial intelligence Jean HuEarnings News Guidance Movers Tech