Nvidia's Earnings Around The Corner: Can AI Stalwart Bulldoze Its Way To Another Superlative Quarterly Performance?

Nvidia Corp. (NASDAQ:NVDA) reports fiscal fourth-quarter earnings after the market closes on Wednesday, holding significant weight for both the chipmaker and the overall market. As a leader in the AI revolution, Nvidia’s performance is key to investor sentiment.

Q4 Expectations: Wall Street unanimously anticipates another strong quarter, with analysts averaging $4.64 non-GAAP EPS and $20.62 billion in revenue, according to Benzinga Pro data.

The consensus expectations vis-à-vis past performances are as follows:

Consensus

Q4’23

Estimated Y-o-Y Growth

Q3’24

Estimated Q-o-Q Growth

Guidance

Revenue

$20.62B

$6.05B

+241%

$18.12B

+13.8%

$20B +/- 2%

Non-GAAP EPS

$4.64

88 cents

+427%

$4.02

+15.4%

N/A

Focus on AI Powerhouse: Chris Fasciano, Portfolio Manager at Commonwealth Financial Network, said, “This week is about one thing and one thing only, and that’s Nvidia’s earnings report.”

Nvidia has become the “poster child for all things artificial intelligence, so analysts will certainly be focused on the earnings report for what it means for NVIDIA going forward and their earnings power, as it has clearly been one of the stock market leaders,” he added.

Morgan Stanley analyst Joseph Moore predicted a strong quarter in line with recent expectations. He acknowledged mixed data points but highlighted those closest to end demand as the strongest, attributing mixed supply-chain data to non-GPU bottlenecks and product cycle transitions (from H100 to H200 and B100). Moore forecasts $21 billion in Q4 revenue.

Rosenblatt’s Hans Mosesmann also forecasts a beat-and-raise, driven by product cycle momentum and upcoming offerings. Nvidia guided to fourth-quarter non-GAAP gross margin of 75.5% ± 50 basis points, compared to 75% in the third quarter.

See Also: How To Buy Nvidia (NVDA) Stock

Data Center Strength: Data Center remains Nvidia’s primary revenue driver, followed by Gaming. In the third quarter, Data Center revenue surged 206% annually and 34% over the previous quarter to $18.12 billion (80% of the total), propelled by robust sales of the NVIDIA HGX platform for training and inferencing in large language models, recommendation engines, and generative AI applications.

Oppenheimer analyst Rick Schafer modeled 390% yearly growth for fourth-quarter Data Center revenue, led by AI accelerators. He broke down the end market as 50% Cloud Service Providers, 30% consumer internet companies, and 20% enterprises.

Schafer said he anticipates a 5% sequential decline in Gaming revenue but 48% year-on-year growth. He noted potential exaggeration of Gaming GPU demand due to Chinese cloud repurposing for AI workloads.

The Auto segment (1% of revenue) may see 2% sequential growth but a 9% year-on-year decline. While Level-3 ADAS vehicles are launching, Schafer noted that Nvidia’s Orin chip secured design wins with major Chinese EV OEMs in 2023.

Forward Outlook: Street expectations for the first quarter stood at $4.99 EPS and $22.11 billion in revenue, with Morgan Stanley slightly above consensus at $22.8 billion.

Nvidia Stock: Evercore ISI’s Julian Emanuel aptly summarized the market’s dependence on Nvidia: “NVDA, The Stock That Is The Market, reporting 2/21 is likely to be a FOMO market mover as it has been since GenAI surged in early 2023.”

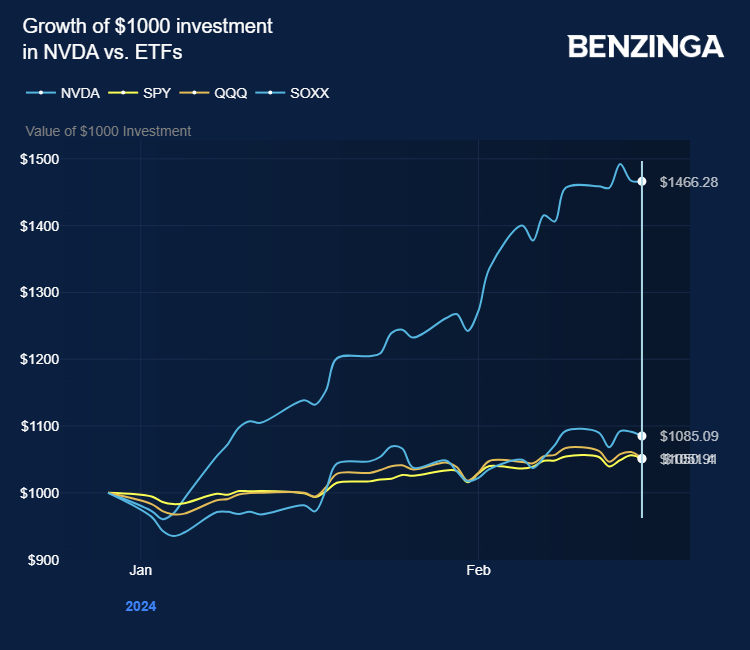

Nvidia stock is up 40.25% year-to-date, outperforming major ETFs such as the SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust (NASDAQ:QQQ), and the iShares Semiconductor ETF (NASDAQ:SOXX). This follows a 240% surge in 2023.

Source: Benzinga

After reaching an all-time high of $746.11 on Feb. 12 and becoming the fourth-most valued global company, the stock has pulled back due to earnings concerns, slipping to the 6th position in terms of market cap.

Morgan Stanley’s Moore sees additional catalysts beyond earnings, expecting insights into new products at the March graphics technology conference.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: artificial intelligence BZ Data ProjectEarnings Equities News Previews Top Stories Tech