Verizon Fourth-Quarter Earnings: Wired for Challenges Such As $5.8B Write Down, But Wireless Could Be Triumphant

Verizon Communications (NYSE:VZ), the U.S. telecoms operator, is expected to report a decline in fourth-quarter earnings on Tuesday following a large write-down in its business services division, which was announced last week.

The consensus estimate for fourth-quarter earnings per share is $1.07, down 10.1% from the same period a year ago.

In the third quarter, the company reported earnings per share of $1.13 which was down from $1.17 in the same quarter a year ago.

Revenues are expected to come in at around $34.6 billion which would be down 2% on the year-ago number.

Also Read: Verizon to take $5.8 bln hit in fourth quarter from unit write down

Wireline Write-Down

While the company has reported strong growth in its mobile division and growing average revenues per account (ARPA), its legacy wireline operations, which provide fixed-line communications services to businesses and government agencies, have been lagging.

Last week, the company reported a $5.8 billion write-down in the value of this division — which accounts for around a fifth of the company’s total revenues — due to pressure from competition, weaker economic conditions and the shift to wireless services.

The impairment charge on wireline services leaves the business unit with a balance of $1.7 billion at the end of 2023, the company said.

The company was upbeat at its third-quarter earnings presentation in October. Although it reported a dip in earnings, largely due to one-off amortization charges, it said its key metrics such as wireless service revenues were up. The company increased its cash position and reduced its debt.

C-Band: ‘Game Changer’

The company is particularly excited, moving forward, about the early release of access to its remaining C-Band spectrum that allows much faster wireless speeds and enables customers access to 5G networks.

“C-Band is a game changer for our business, giving us better customer retention and step up as well as strong broadband opportunity with fixed wireless access,” said Hans Vestberg, chairman and CEO.

He added: “Every day, we see the benefits of our generation investment in C-Band spectrum and the impact it will have for our customers for years to come.”

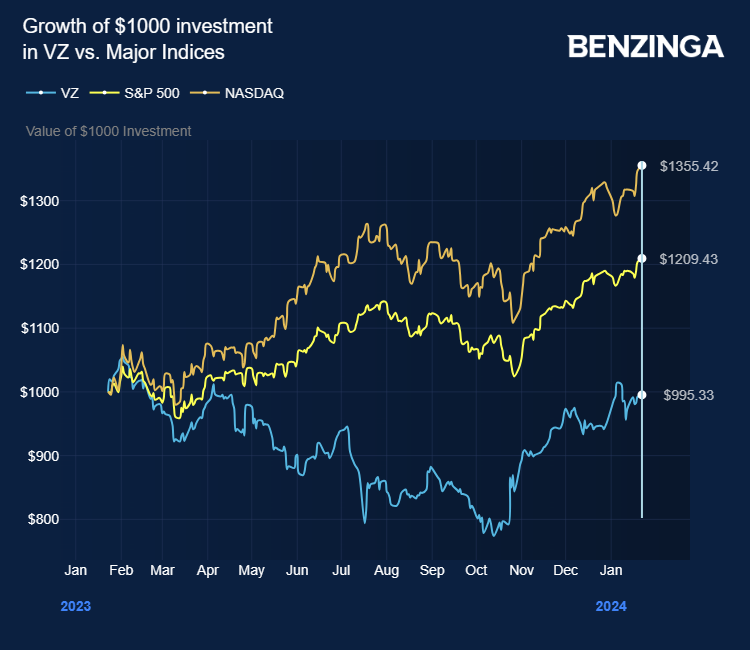

Investors, despite the lukewarm third-quarter report, welcomed Verizon stock into the fourth-quarter equity market rally and the shares added 28%.

Meanwhile, analysts remain bullish on Verizon. Of the seven analysts to have rated the company in the past three months, two rated it a Strong Buy while four rated it a Buy.

The company sports a healthy dividend yield of 6.84%, having declared a regular quarterly dividend of $0.66 per share on Dec. 7.

VZ Price Action: Verizon is currently trading up on Monday 0.14% at $39.39 with the 52-week high at $42 and the 52-week low at $30.14.

Now Read: AI Stocks Dominate In January: Nvidia, Juniper, Palo Alto Lead The Charge

Photo: Shutterstock

Latest Ratings for VZ

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | JP Morgan | Downgrades | Overweight | Neutral |

| Jan 2022 | Tigress Financial | Maintains | Buy | |

| Dec 2021 | Daiwa Capital | Initiates Coverage On | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings Equities Large Cap News Price Target Markets Analyst Ratings General