US Stocks On Track For Strong Start With VIX Plunging: Why This Analyst Says Next Move 'More Likely Higher Than Lower'

After stocks scraped through on Wednesday, the market mood has lifted from a general increase in risk appetite. With volatility plunging, all risky bets, such as equities and cryptocurrencies, are rising higher. Crude oil prices rose solidly, and the bond yields moved lower as traders continued to discount an accommodating monetary policy environment based on the recent spate of soft data.

The revised third-quarter GDP report and a Fed speech scheduled for the day could also offer some cues for trading.

Cues From Tuesday’s Trading:

U.S. stocks ended Tuesday’s lackluster session on a modestly positive note, thanks to a pullback in bond yields amid the release of soft data. The major averages opened slightly lower but cut their losses over the morning session and rose to their highs by early afternoon trading.

Although the Dow Industrials stayed above the unchanged line through the remainder of the session, it closed well off the highs of the session. The 30-stock blue-chip average settled at the highest level since August 4.

The Nasdaq Composite and the S&P 500 indices gave back their gains in the afternoon and flitted in and out of the unchanged line before closing modestly higher.

Among the economic reports, the results of two separate house price surveys showed a slight slowdown in house price growth in September. Conference Board’s consumer confidence index rose in November, although a downward revision to the previous month’s reading took some sheen off the reading.

LPL Financial Chief Economist Jeffery Roach sees a silver lining in the cloud. The economist said that much of how consumer spending will pan out depends on the job market. “As the labor market cools, investors should expect consumer spending to slow down,” he said.

Roach also pencils in a weaker job report for November and sees the Fed keeping unchanged at current levels at the December rate-setting meeting.

US Index Performance On Tuesday

Index

Performance (+/-)

Value

Nasdaq Composite

+0.29%

14,281.76

S&P 500 Index

+0.10%

4,554.89

Dow Industrials

+0.24%

35,416.98

Russell 2000

-0.4%

1,792.81

Analyst Color:

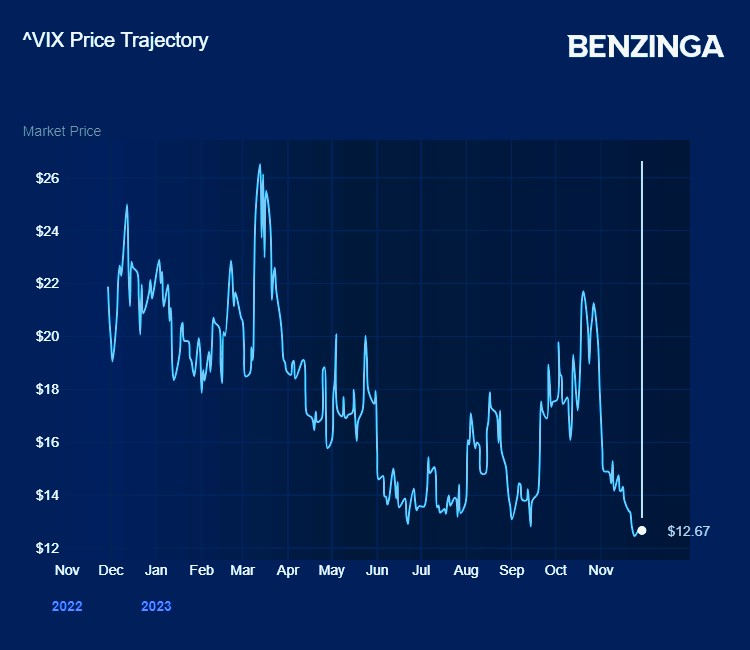

Commenting on the market movement, fund manager Louis Navellier said stocks were treading water with the CBOE Volatility Index, or VIX, near historic lows. “A sub-13 VIX indicates that not many investors want to short the market going into year-end,” he said, adding that the index has dropped from 20 only a month ago and has rarely been much lower in the last 30 years.

Chart Courtesy of Benzinga

That said, the fund manager sounded a word of caution. “While this is comforting that the recent gains will likely hold, it also leaves the VIX with only one way to go from here,” he said. “In the past, it hasn’t stayed this low for long.”

“Being up 10% in 4 weeks takes a little digestion, but the wind remains at the market’s back, and the next move is more likely higher than lower,” Navellier said.

Futures Today

Futures Performance On Wednesday

Futures

Performance (+/-)

Nasdaq 100

+0.52%

S&P 500

+0.39%

Dow

+0.21%

R2K

+0.67%

In premarket trading on Wednesday, the SPDR S&P 500 ETF Trust (NYSE:SPY) jumped 0.41% to $456.80, and the Invesco QQQ ETF (NASDAQ:QQQ) gained 0.56% to $392.37, according to Benzinga Pro data.

Upcoming Economic Data:

The Mortgage Bankers Association will release the weekly mortgage applications volume at 7 a.m. ET. Mortgage applications volume for the week ended November 17 rose a seasonally adjusted 3% from the previous week. On an unadjusted basis, the index was down 0.1%. The increase followed a 30-year fixed mortgage rate dip to 7.41 percent, the lowest rate in two months, amid a pullback in bond yields.

The Bureau of Economic Analysis is scheduled to release the second read of third-quarter GDP data at 8:30 a.m. ET. Advance estimate released in late October showed the GDP growing at a robust annualized quarter-over-quarter rate of 4.9%, more than double the pace of the 2.1% rate seen for the second quarter. Traders may closely monitor the GDP price index and core personal consumption expenditure index.

The Energy Information Administration will release the weekly Petroleum Status report at 10:30 a.m. ET.

Cleveland Fed President Loretta Mester speaks is scheduled to speak at 1:45 a.m. ET.

The Fed is due to release the Beige Book report at 2 p.m. ET. The report is a compilation of anecdotal evidence of economic conditions in the 12 Federal Reserve districts.

See Also: How To Trade Futures

Stocks In Focus:

- Workday, Inc. (NASDAQ:WDAY) rallied nearly 9% in premarket trading following the release of its quarterly results.

- GameStop Corp. (NYSE:GME) tacked on its gains and traded up over 10%.

- Okta, Inc. (NASDAQ:OKTA) fell about 7% on disclosure regarding a data breach.

- NetApp, Inc. (NASDAQ:NTAP) soared over 12%, also in reaction to its earnings report.

- Bilibili Inc. (NASDAQ:BILI), Dollar Tree, Inc. (NASDAQ:DLTR), Foot Locker, Inc. (NYSE:FL), Donaldson Company, Inc. (NYSE:DCI), and Patterson Companies, Inc. (NASDAQ:PDCO) are among the notable companies announcing their quarterly results ahead of the market open.

- Those reporting after the close include Five Below, Inc. (NASDAQ:FIVE), Nutanix, Inc. (NASDAQ:NTNX), Okta, PVH Corp. (NYSE:PVH), Salesforce, Inc. (NYSE:CRM), Synopsys, Inc. (NASDAQ:SNPS), Snowflake Inc. (NYSE:SNOW), Zuora, Inc. (NYSE:ZUO) and Victoria’s Secret & Co. (NYSE:VSCO).

Commodities, Bonds, Other Global Equity Markets:

Crude oil futures climbed 1.53% to $77.58 in early European session on Wednesday following Tuesday's 2.07% rally. The upside is under the twin impact of the dollar weakness and apprehensions ahead of Thursday’s OPEC+ meeting.

The benchmark 10-year Treasury note fell 0.046% percentage points to 4.29% on Wednesday.

In the currency market, the U.S. dollar is firmer against most major currencies, except for the Swiss franc and the Canadian dollar.

Reflecting the rise in risk appetite, cryptocurrencies rallied hard, with the apex crypto, Bitcoin (CRYPTO: BTC), trading above the $38,000 mark.

The sentiment in Asia was mostly negative, with the sharply declining Hong Kong and Chinese markets. The New Zealand market ended flat with a slight negative bias as the nation’s central bank left key interest rates unchanged at its November meeting, in line with expectations.

European stocks advanced strongly and were solidly higher in late-morning trading on Wednesday, encouraged by the tamer German inflation data.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings Equities News Futures Previews Top Stories Economics Federal Reserve