Updated: Powell At Noon

Good Morning Everyone!

The AI chatbot race takes off with competition heating up between:

- ChatGPT (OpenAI & Microsoft)

- Bard AI (Google)

- Ernie (Baidu)

Who will win?

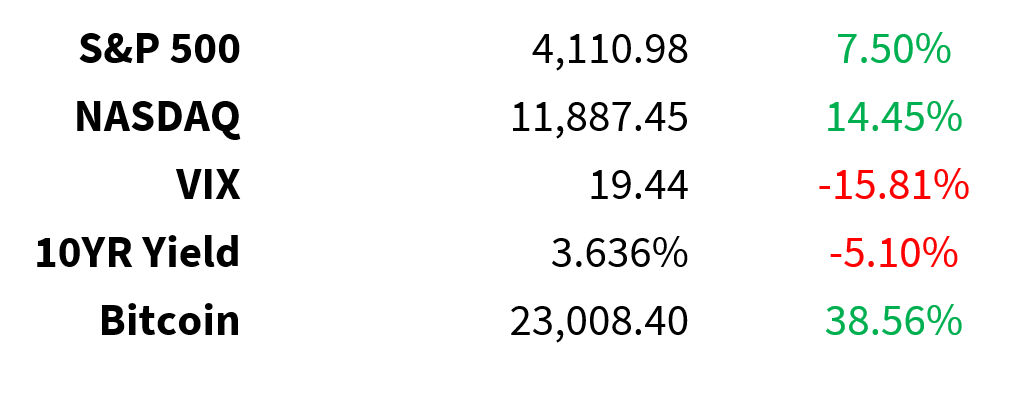

Prices as of 4 pm EST, 2/6/23; % YTD

MARKET UPDATE

Tonight U.S. State of the Union

12 p.m. Fed Jerome Powell speaking

-

February 1 hike 25 basis points 4.50%-4.75%

-

March 22 hike 25 basis points 4.75%-5.0%

-

May 3 hike or pause? 5.0%-5.25%

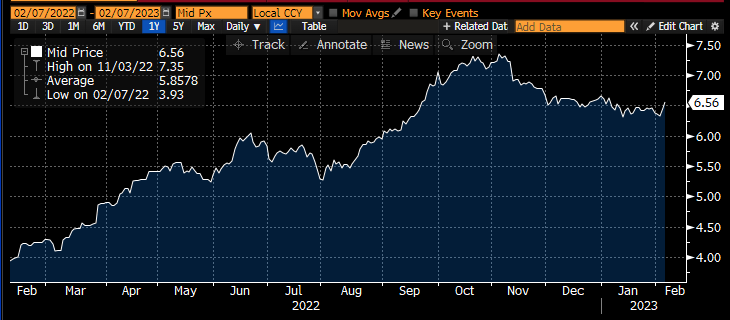

U.S. 30-year mortgage rates

-

Down almost 1% from its high but

-

Well above the 3% range from a year ago

Crude 75 +1.7%

-

Impact of the earthquake in Turkey and Syria & shutdown of Johan Sverdrup

Google (NASDAQ: GOOGL)

-

Testing their new AI service

-

Plans a broader public launch in coming weeks

-

New search engine to combat ChatGPT

-

1 p.m. today Microsoft (NASDAQ: MSFT) to highlight Bing/ChatGPT combo

Earnings

-

Activision Blizzard (NASDAQ: ATVI) +3% will Microsoft get approved to buy ATVI, $95 offer vs. $74 stock

-

Simon Property (NYSE: SPG) flat EPS in-line, occupancy rate 94.9%, guide light

-

Pinterest (NYSE: PINS) flat Q4 weaker, Q1 guide weaker, focus expense efficiency

-

Take-Two Interactive (NASDAQ: TTWO) flat EPS miss, guide cut, cautionary purchasing behavior

-

BP (NYSE: BP) +5% increased dividend and extended the buyback

-

Fiserv (NASDAQ: FISV) +3% EPS in-line, guide better than street

-

KKR (NYSE: KKR) +1% $0.92 distributable earnings vs $1.59 year ago, $500B assets

-

Centene (NYSE: CNC) flat modest topline beat, guide in-line

-

Carrier (NYSE: CARR) -4% in-line, orders down 10% as expected, guide in-line

-

DuPont (NYSE: DD) +1% in-line, Q1 guide light similar to other chemical companies

-

Royal Caribbean (NYSE: RCL) +4% loss better than expected, structural cost increases

CRYPTO UPDATE

Digital Currency Group (DCG)

-

Selling shares in top funds at steep discounts

-

Including Grayscale (its asset management business)

-

-

Seeking to raise capital to pay Genesis (its lending arm) creditors

-

Owes +$3 billion

-

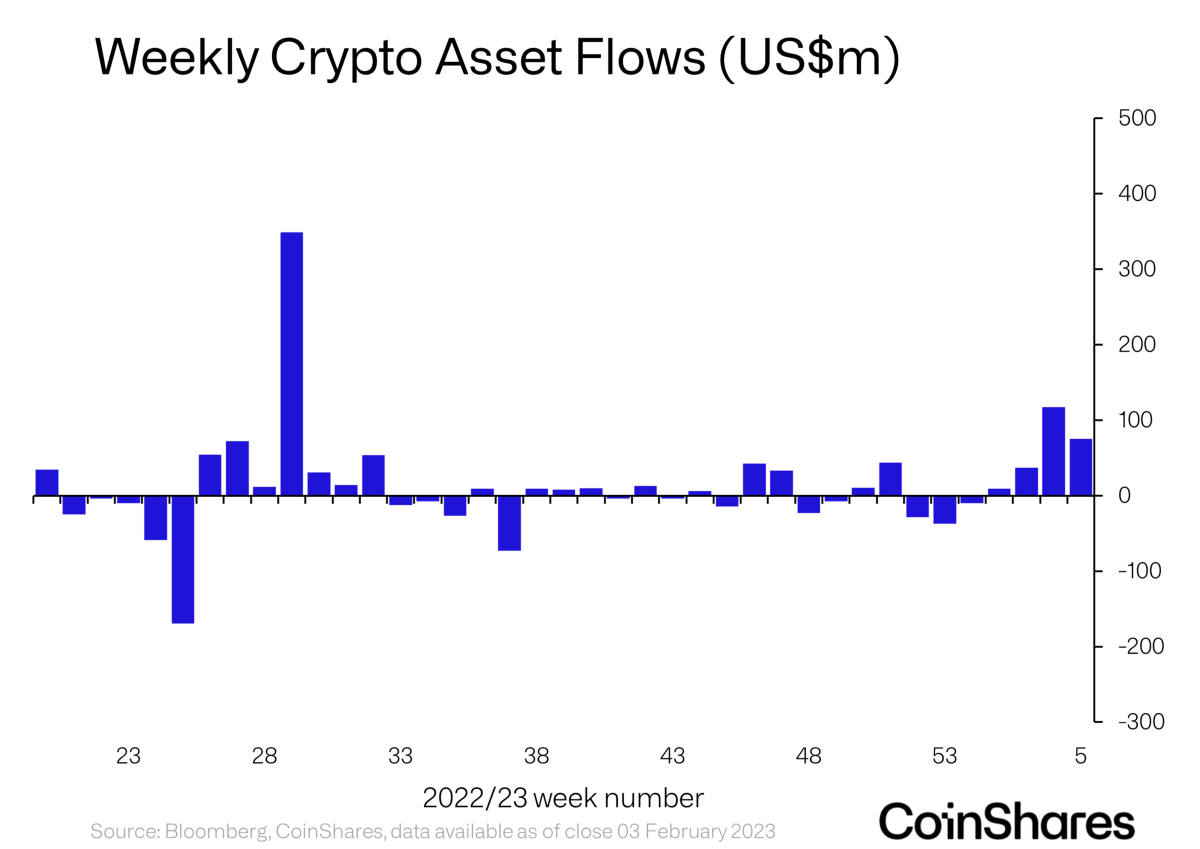

Digital asset fund flows

-

4th consecutive week of inflows

-

$76 million

-

-

YTD inflows = $230 million

-

Total AUM +39% ($30.3 billion)

-

-

Bitcoin 90% of flows ($69 million)

-

$8.2 million to short-Bitcoin products

-

Rest of flows muted

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: ChatGPT contributors DCG Jerome PowellEarnings News Markets Tech