Apple Has So Much Cash In Reserve It Could Buy 10 Snap Incs, Almost 20 Twitters

Apple Inc. (NASDAQ: AAPL) revealed in its fiscal second-quarter report it is sitting on more than one-quarter of a trillion dollars in pure hard cash. To be specific, the company is holding $256.8 billion, up more than $10 billion from just the prior quarter.

The problem is $239 billion is held overseas, which would be subject to a hefty 35 percent tax rate if it is brought home, making the prospect of an immediate shopping spree less likely. But, if the White House introduces a one-time tax holiday or reduction, then Apple could bring home hundreds of billions of dollars and put it to use.

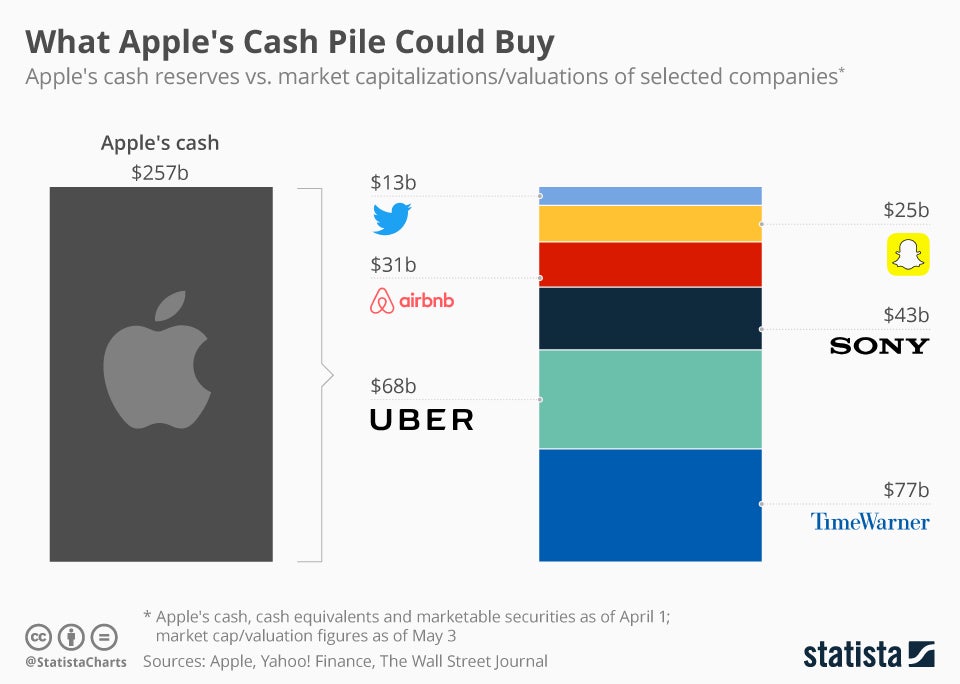

Statista compiled a "shopping list" of companies Apple can buy instead of spending tens of billions of dollars in dividend payments and stock buybacks.

As a whole, Apple could enter the social media space by acquiring Twitter Inc (NYSE: TWTR) ($13 billion), Snap Inc (NYSE: SNAP) ($25 billion), ride-sharing platform and major self-driving car player Uber ($68 billion) and tech giant Sony Corp (ADR) (NYSE: SNE) ($43 billion).

Apple would have plenty of cash leftover to buy Airbnb ($31 billion), another major player in the on-demand economy, and satisfy investors hoping for an expansion into media and entertainment by buying out Time Warner Inc (NYSE: TWX) ($77 billion).

Related Links:

Apple Investors Shouldn't Get Carried Away With Hopes For iPhone 8

Gene Munster Talks Apple Growth: 'It's Still All About The iPhone 10'

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Airbnb Apple Apple Cash StatistaEarnings News Guidance Media Best of Benzinga