Dow Futures Jump Over 200 Points As Trump Announces Ceasefire, But Iran Says 'No Agreement' — Crude Plunges

U.S. futures markets are rallying on Monday night, after President Donald Trump announced a “ceasefire timeline” for the conflict between Iran and Israel.

The S&P 500 Futures trade at 6,112.50, up 0.58%, followed by Nasdaq Futures at 22,256.00, up 0.88%, and finally Dow Futures at 43,136.00, up 0.55%, at the time of writing this, just hours after Iran’s missile strikes against U.S. bases located in Iran and Qatar on Monday.

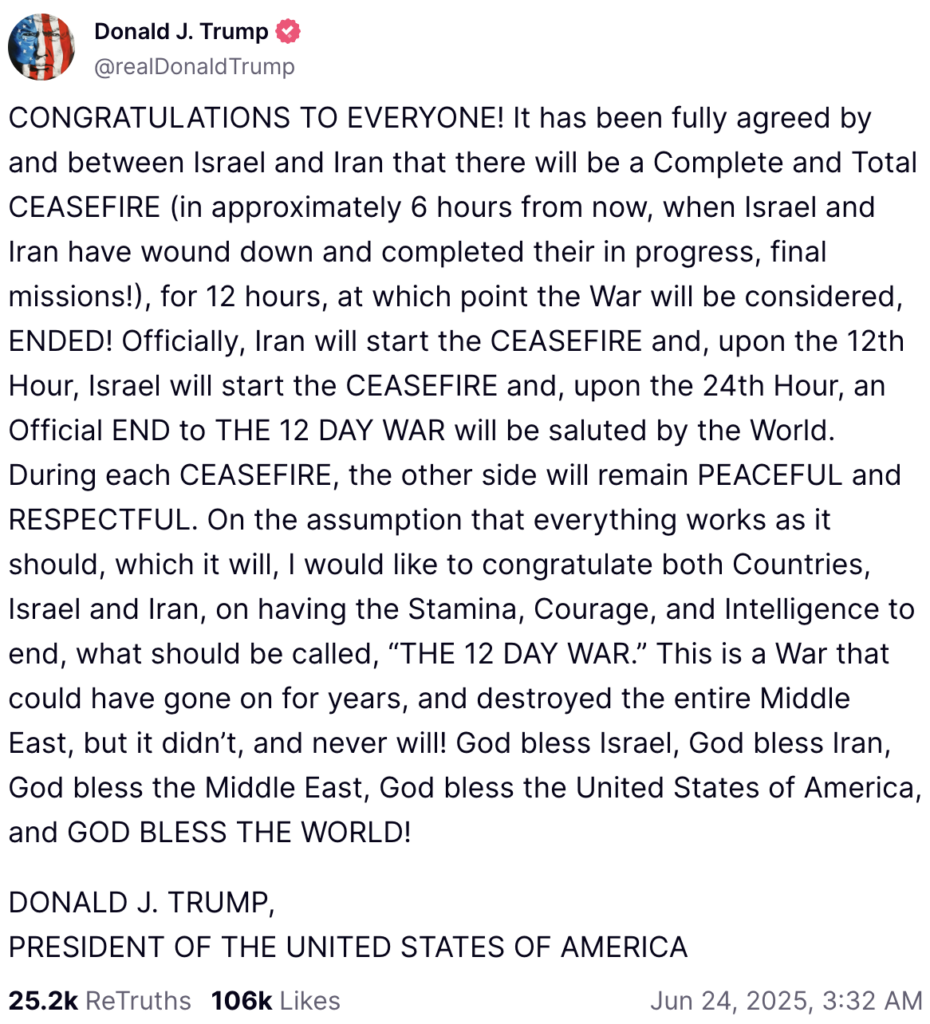

Trump shared a post on Truth Social on Monday, announcing a “Complete and Total CEASEFIRE,” at which point, he says, “THE 12 DAY WAR” will be considered “ended.”

See Also: Trump Says There Is A Ceasefire Between Israel And Iran

He further adds that this war could have gone on for years, destroying the entire Middle East, “but it didn’t, and never will,” Trump says, while congratulating both countries and everyone involved in this exercise.

The Foreign Minister of Iran, Syed Abbas Araghchi, has, however, refuted claims of a ceasefire, saying that there was “no agreement” for cessation of military operations, in a post on X.

He does go on to state that if the “Israeli regime stops its illegal aggression” against Iran by 4 AM Tehran time, then Iran will have no intention of continuing with its response. Araghchi adds that any “final decision on the cessation of our military operations will be made later.”

Asian markets opened higher on the news, with Japan’s benchmark Nikkei 225 up 1.02%, trading at 38,746.93 points, led by global, export-oriented companies.

Crude oil prices plunged following news of the ceasefire, with Brent trading at $68.63 a barrel, down 0.78% during the day, and 12.83% from its high point of $78.74 a barrel last week, when tensions continued to flare.

Oil prices are dragging down leading energy ETFs, with the United States Oil Fund LP (NYSE:USO) down 8.07% on Monday, and 3.19% after hours.

This was followed by the ProShares Ultra Bloomberg Crude Oil (NYSEARCA: UCO), down 11.23% during the day, and extending its decline by another 4.32% after hours. Finally, the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE:XOP) was down 3.62% and an additional 1.66%.

The U.S. Dollar Index (DXY) is down 0.18%, trading at 98.233 against a basket of foreign currencies, despite the easing of tensions in the Middle East. Gold spot prices are down 0.72%, trading at $3,344.41 per ounce.

The United States Oil Fund exhibits strong momentum and has a favorable price trend in the short, medium, and long term. Click here for deeper insights into the stock and how it compares with peers and competitors.

Photo courtesy: Maxim Elramsisy / Shutterstock.com

Read More:

Posted-In: Crude Oil Dow Jones Iran israelEquities News Commodities Markets