Top 3 Energy Stocks That Are Preparing To Pump In November

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

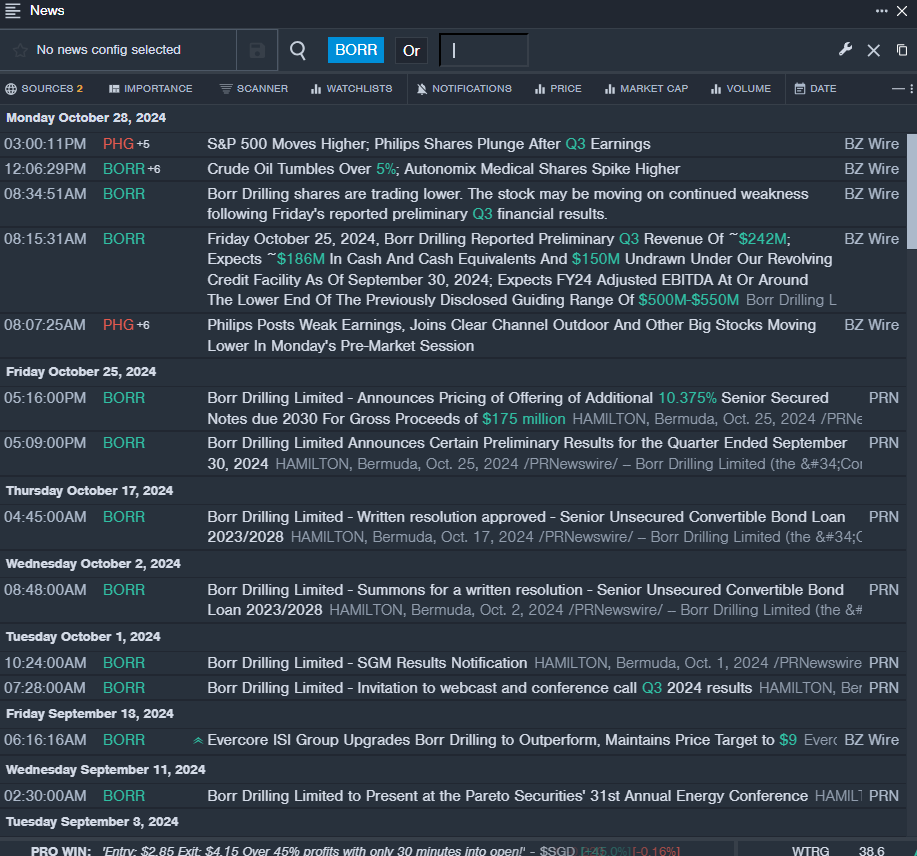

Borr Drilling Ltd (NYSE:BORR)

- On Oct. 25, Borr Drilling announced certain preliminary results for the quarter ended Sept. 30, 2024. The company's stock fell around 24% over the past month and has a 52-week low of $4.12.

- RSI Value: 26.27

- BORR Price Action: Shares of Borr Drilling gained 1.2% to close at $4.19 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest BORR news.

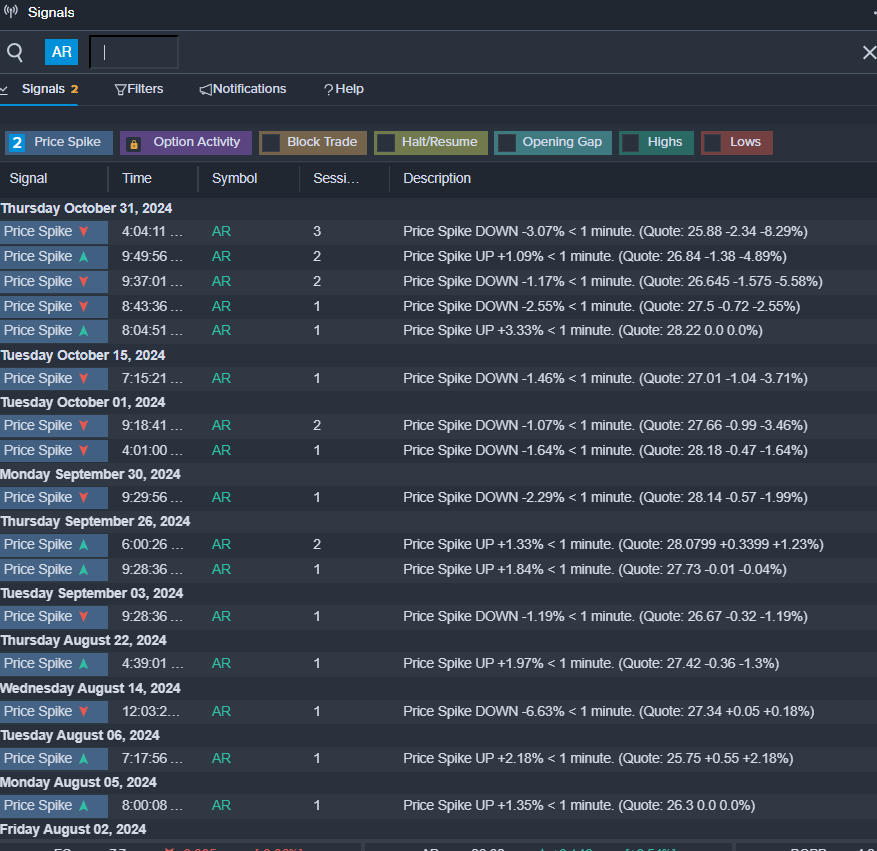

Antero Resources Corp (NYSE:AR)

- On Oct. 30, Antero Midstream announced third quarter 2024 results and new appointment to the board of directors. Paul Rady, Chairman, CEO and President of Antero Resources commented, “During the third quarter we continued to improve our capital efficiency. Over the last two years, we have reduced the average number of days to drill a well by 20% to just 11 days versus 14 days previously. These meaningful gains result in an efficient maintenance production program that requires just two rigs to maintain 3.3 to 3.4 Bcfe/d of production going forward." The company's stock fell around 10% over the past month and has a 52-week low of $20.10.

- RSI Value: 29.22

- AR Price Action: Shares of Antero Resources declined 8.3% to close at $25.88 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in AR shares..

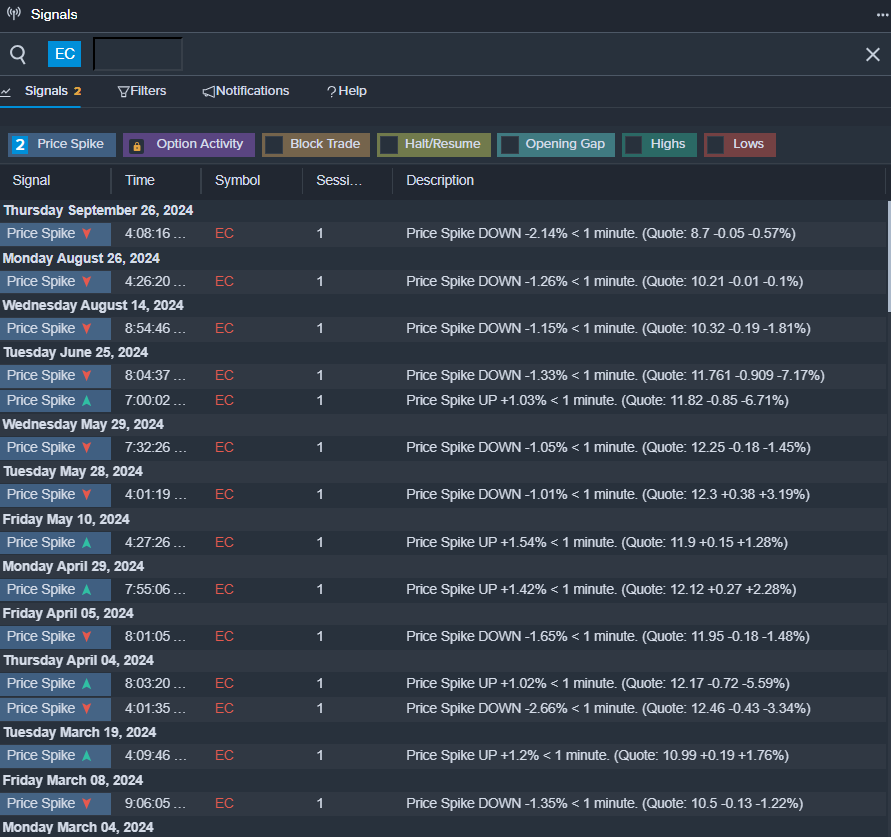

Ecopetrol SA (NYSE:EC)

- Ecopetrol will release third-quarter results on Wednesday, Nov. 13. The company's stock fell around 15% over the past month and has a 52-week low of $7.62.

- RSI Value: 23.35

- EC Price Action: Shares of Ecopetrol fell 1.4% to close at $7.70 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in EC shares.

Read More:

Latest Ratings for BORR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jun 2020 | Citigroup | Maintains | Neutral | |

| Apr 2020 | BTIG | Downgrades | Buy | Neutral |

| Mar 2020 | Citigroup | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: energy Expert IdeasNews Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas