GBP/USD Forecast: Sterling To Slide Lower Targeting 1.2850-1.2800 As The UK Manufacturing Slumps

- The UK Prime Minister Theresa May rejected opposition’s appeal to UK-wide customs union making any Brexit deal passing the parliament harder.

- The UK fourth-quarter GDP decelerated to 0.2% Q/Q after 0.6% in the three months to September period.

- The UK manufacturing output fell -0.7% in December, falling -2.1% over the year.

- Sterling dwells at the brink of 1.2900 targeting 1.2850-1.2800 next.

The GBP/USD is trading little changed on the downside at around 1.2920 after the UK Prime Minister Theresa May rejected claims from the opposition Labor party for a UK-wide customs union with the EU that would ease the Brexit tension, especially at the Irish border.

The UK fourth-quarter GDP rose 0.2% in the final quarter of 2018, decelerating from 0.6% quarterly increase in three months to September period while the GDP rose 1.3% over the year in the fourth quarter, missing the market forecast.

The UK manufacturing confirmed the fears of sharp deceleration as the manufacturing output fell -0.7% over the month while falling -2.1% over the year in December, both figures coming out fell below forecast and pressing on Sterling to slump below 1.2900 as the reaction.

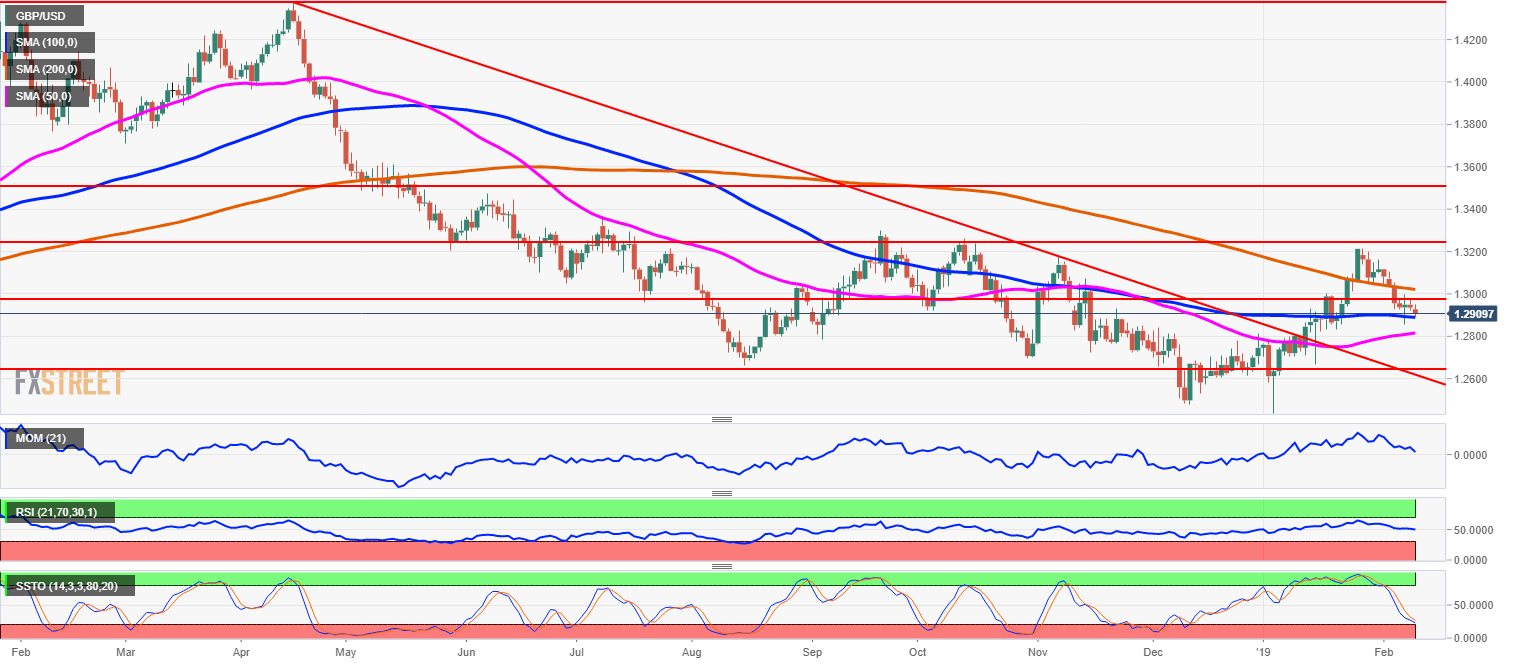

Technically the GBP/USD is moving within a corrective trend after breaking the psychologically important 1.3000 and 38.2% Fibonacci retracement line of 1.2970 last week.

The technical oscillators like the Relative Strength Index (RSI) and Slow Stochastics (SS) are both pointing lower with Slow Stochastics making a bearish crossover in the Overbought territory indicating future price declines. Should the GBP/USD break below 1.2900 level representing 100-DMA, the target price is at 1.2850 and 1.28000 level representing a 50-DMA on a daily chart. On the upside, the 1.2970-1.3000 levels are expected to hold as a resistance line.

GBP/USD daily chart

Posted-In: Brexit FXStreetNews Eurozone Forex Global Markets General