5 Slide Summary: Simon's Rationale For Acquiring Macerich

One of the loudest rumors on Wall Street was confirmed Monday when Simon Property Group Inc's (NYSE: SPG) letter detailing its 50/50 cash and SPG common-share bid for Macerich Co (NYSE: MAC) was made public.

Simon's $91 per share hostile takeover offer also revealed that competitor General Growth Properties Inc (NYSE: GGP) had agreed in principle to acquire some of the Macerich portfolio if Simon gains control of Macerich.

Notably, the Simon offer was specifically not contingent upon financing or General Growth's participation.

Shares of Macerich closed Monday at $92.76, almost 2 percent above the Simon offer.

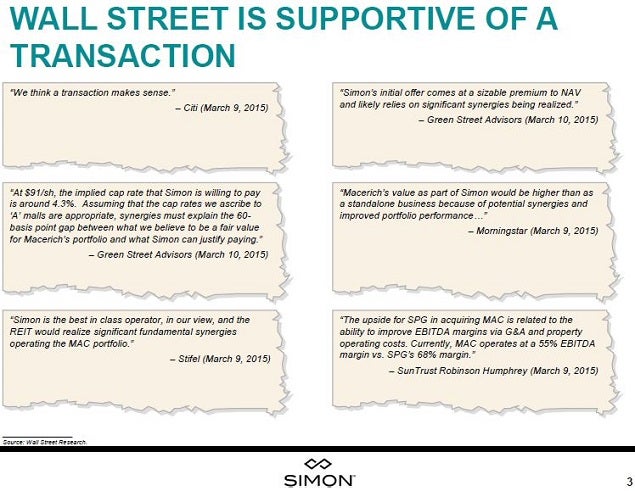

In response midday Tuesday, Simon posted a 20-slide presentation making a case for its $91 bid being a good deal for both SPG and MAC shareholders.

Simon's Full Court 'Press'

Metrics At A Glance

The SPG 2014 spin-out of its Washington Prime Group Inc (NYSE: WPG) assets does notably help with Simon's FFO/CAGR comparisons below.

However, the overall picture does appear to show that when it comes to managing the metrics to Mr. Market, Simon makes a good argument for why Macerich shareholders could be better off accepting an offer from Simon.

The potential G&A savings from the proposed merger notably would fall to the bottom line.

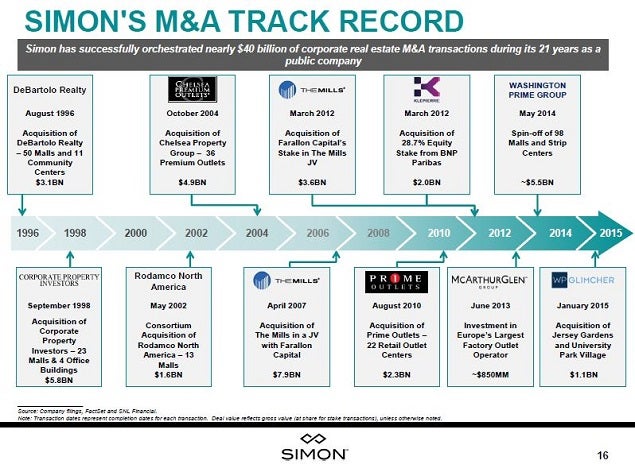

Definitely Not Simon's First Rodeo

The experience in integrating other acquisitions should help Simon to identify and realize the potential operational synergies from the combined organization.

A Key Metric For REIT Investors

Many REIT investors are income oriented. A growing dividend also helps to support the price of REIT shares in a rising interest rate environment.

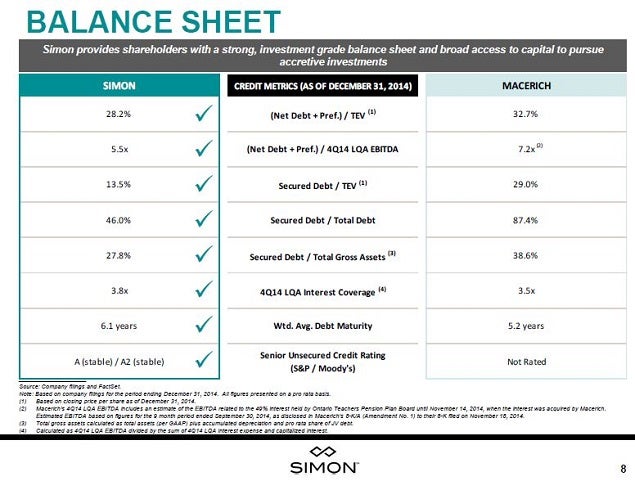

Simon's Financial Strength

Simon's strong A/A2 investment grade rating is certainly a competitive advantage when it comes to the weighted average cost of capital.

While balance sheets in and of themselves aren't particularly exciting or sexy when things are going well, the relative strength of the Simon balance sheet provides a compelling argument in favor of the proposed merger.

Balance Sheet – 1 Slide To Rule Them All?

The carnage of the Great Recession should still be relatively fresh in the minds of most investors who own shares in U.S. retail REIT sector.

Good Times Don't Last Forever

The growth in the U.S. GDP, consumer confidence, falling oil prices and a rebound in the U.S. housing market have all contributed to creating a perfect storm to help drive Class-A mall outperformance.

However, this virtuous cycle will not last forever.

Global Risk Factors

Slower growth in Europe and Asia could pose headwinds for the U.S. economy. "Grexit" concerns could negatively impact the euro in ways that are not easy to predict. Geopolitical developments in the Ukraine or the Middle East could have unforeseen economic consequences, including impacting energy markets and the price of oil.

The ugly faces of terrorism and worldwide pandemics are both threats that could negatively impact regional mall performance moving forward.

Omnichannel Retailing Shifts

The Internet is both a threat and an opportunity for mall retailers and landlords. Although it is still in the early innings, it is clear that the speed at which the rules of the retail game are changing appears to have accelerated.

The mobile device and Internet genies are out of the bottle and could prove to be tricksters moving forward. It makes predicting the preferences of the millennial consumer far more difficult.

It also remains to be seen how this plays out in the demand for mall space moving forward.

Investor Takeaway

The negotiation of the final price and terms between the two sides still remains a zero-sum game.

However, Simon has done a good job of presenting a cogent case for why Macerich shareholders would be better off accepting the $91 per share offer.

The ball is now in the Macerich court to come up with a better plan.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Great Recession Grexit REIT Retail REITsM&A REIT General Real Estate Best of Benzinga