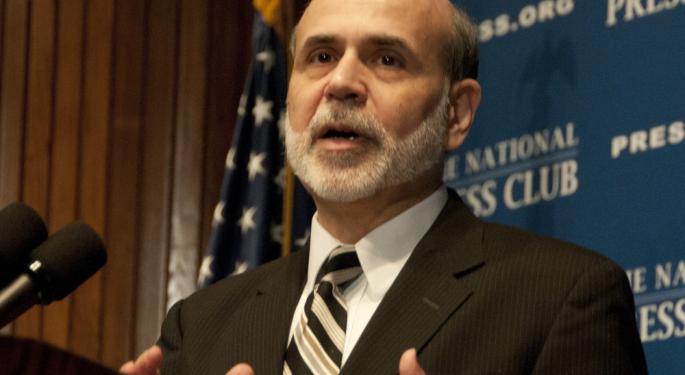

UPDATE: Bernanke Talks Down Tapering Fears As Markets Plunge

Stocks sank following the Fed's interest rate decision and continued to trade lower during Chairman Bernanke's press conference. He talked down tapering fears while dodging questions related to his future at the Fed and hinted that easing could continue longer than previously thought.

Not a Threshold

Previously, the Fed had indicated that at 6.5 percent unemployment or two percent inflation, the Fed would begin tightening policy. However, Bernanke, in an effort to alleviate fears over tapering and imminent monetary tightening, said that the number "is a threshold, not a trigger," and that the Fed could adjust these thresholds.

Also, Bernanke noted that he expects inflation to tick back up towards two percent. The Fed's revised forecasts call for inflation to trend below two percent through 2015 and only in optimistic cases see inflation reaching two percent by the end of 2014, maintaining scope for further easing by the FOMC.

No Comment

Bernanke declined to comment on his personal plans when his term ends in January when asked directly. A recent interview with President Obama aired on Charlie Rose indicated that Bernanke was hesitant to take a second term and now may be looking towards the exit from the Fed and will return to the private sector.

The Chairman also failed to shed light on why he is missing the Jackson Hole conference in August. In the last few years, Bernanke has used the event to outline Fed policy. However, Bernanke will be missing the event due to personal conflicts, which some are taking as a signal that he will not be continuing in his current role past 2013.

Tapering in 2014

The current forecasts and statement from Bernanke are consistent with tapering beginning later this year with purchases ending sometime in 2014. However, markets may be under-appreciating the risk of the Fed increasing purchases, rather than tapering them, if inflation expectations and employment do not improve.

Former Bank of England Monetary Policy Committee member and Dartmouth economist Danny Blanchflower said that Bernanke made it clear that if the economy weakened, then the Fed will do more QE to bolster against weakness. Therefore, markets could actually see purchases accelerate, rather than taper, if inflation expectations worsen.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Federal Open Market Committee Federal Reserve Chairman Ben BernankeNews Events Global Econ #s Economics Intraday Update Best of Benzinga