The Curious Case Of Circle Stock: Wall Street Can't Agree On The Future Of Finance

Circle Internet Group, Inc. (NYSE:CRCL) has become one of the most polarizing stocks on Wall Street since its blockbuster IPO. Analyst coverage reveals a striking divergence in opinions on the stock, reflecting the complex and uncertain outlook for the company.

Bearish: On one end of the spectrum, bearish analysts cite concerns about overvaluation, stagnant USDC supply, margin pressures and regulatory risks.

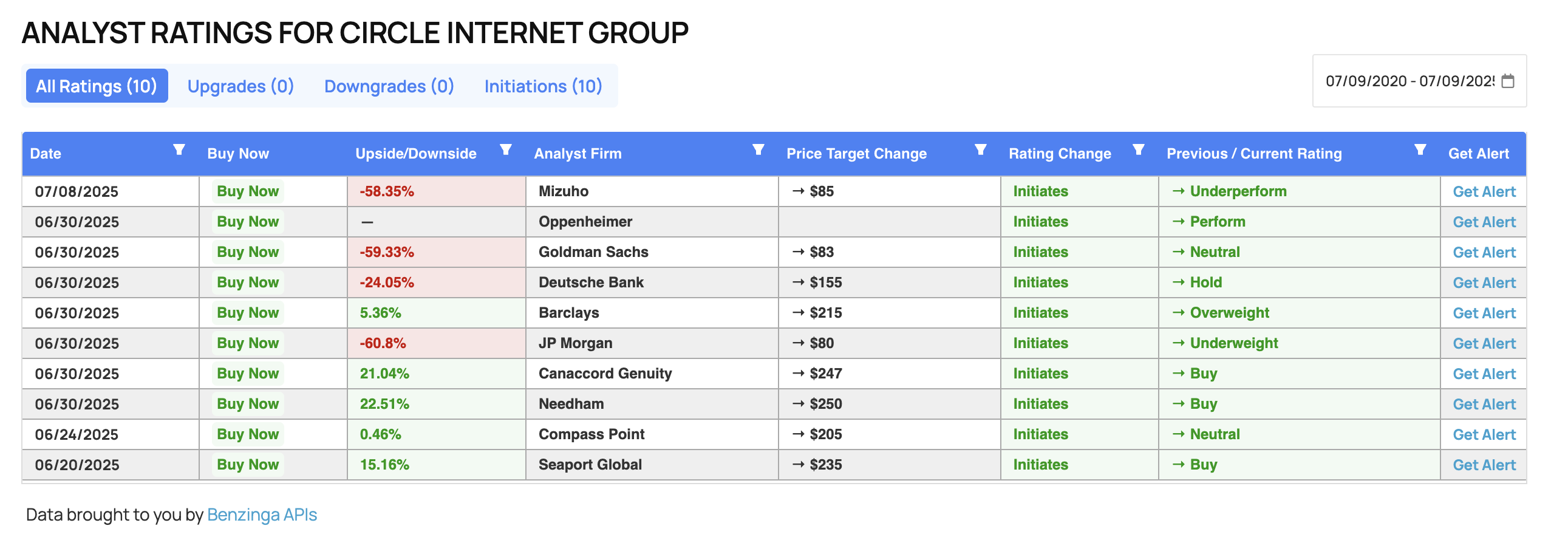

On Tuesday, Mizuho analyst Dan Dolev initiated coverage on CRCL stock with an Underperform rating and an $85 price target, signaling a potential downside of approximately 60% from current trading levels, which are above $200.

Read Next: Get Ready For 800 Hours Of Blackouts, Trump’s DOE Warns

Dolev questioned whether the market is overstating Circle’s medium-term growth prospects, particularly regarding its USDC (CRYPTO: USDC) stablecoin. He argued that current valuations do not properly account for significant risks to future earnings, including increased competition.

Analysts from JPMorgan and Goldman Sachs previously assigned Circle low price targets of $80 and $83, respectively.

Bullish: On the other hand, some analysts are notably bullish, issuing “buy” or “strong buy” ratings with price targets ranging from $215 to $250. These analysts have highlighted Circle's growth potential as a stablecoin leader and its expanding market presence.

In late June, Bernstein analysts rated CRCL stock as an Outperform with a price target of $230, second only to the Street high price target of $250 issued by Needham.

Bernstein called the stock a "must hold" for investors looking to participate in the evolution of digital dollar networks beyond crypto trading.

The firm's bullish stance is tied to Circle’s early regulatory advantages under the newly passed GENIUS Act, which establishes a clear framework for stablecoin issuers.

Seaport Global also initiated coverage on CRCL with a Buy rating and a $235 price forecast. The firm sees the stablecoin issuer as a top-tier crypto disruptor and well-positioned for substantial future growth.

Wide Range: Meanwhile, other firms, such as Goldman Sachs and Deutsche Bank, take a more neutral or cautious “hold” stance, weighing Circle's unique position and warning of elevated valuations.

Circle's wide range of ratings—from strong buy to sell—and price targets spanning from $80 to $250 show the polarized views on CRCL's future.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: KeyProjNews Initiation IPOs Analyst Ratings Movers Tech Trading Ideas