Mark Zuckerberg's Meta Could Rake In Over $10 Billion In Annual Ad Revenue From WhatsApp By 2028, Says Analyst

Meta Platforms Inc. (NASDAQ:META) could potentially generate over $10 billion in annual ad revenue from its WhatsApp messaging service by 2028, according to an analyst.

What Happened: Evercore ISI analyst Mark Mahaney estimated that if Meta could secure an average advertising revenue of $6 per daily user and boost daily usage of the Updates tab to 1.7 billion users by 2028. The new WhatsApp features could thus generate approximately $10.2 billion in annual advertising revenue by 2028, reported MarketWatch.

Mahaney also suggested that Mark Zuckerberg‘s Meta could add around $5 billion in operating income. He stated, “Meta has a proven track record of building new surfaces, monetizing them successfully, and ramping up profitability accordingly. Our strong guess is that WhatsApp Updates will add to its track record.”

Meta recently introduced new business tools for WhatsApp, including channel subscriptions, promoted channels, and ads in the status carousel. These updates aim to help businesses gain paying subscribers, boost channel visibility, and reach new potential customers through status-based advertising.

Why It Matters: Meta’s decision to introduce ads in WhatsApp is a significant move that could potentially boost the company’s revenue. This comes after Meta’s request to dismiss the FTC antitrust case in May, where the company argued that its acquisitions of Instagram and WhatsApp did not create an illegal social media monopoly.

While WhatsApp has been slow to generate revenue for Meta, it continues to grow steadily. In contrast, Instagram—more similar to Facebook—has been a stronger revenue driver, whereas WhatsApp remains primarily a messaging platform.

Earlier in March, analysts at Wolfe Research suggested that Meta could generate $30-40 billion in revenue from its business messaging services, a prospect that was undervalued by the market. The recent move to introduce ads in WhatsApp could further strengthen Meta’s position in the market and potentially lead to a significant increase in revenue.

On the stock market, Meta’s shares have been performing well. The company’s stock price rose after the announcement of the WhatsApp ads, indicating investor confidence in the potential revenue boost from this move.

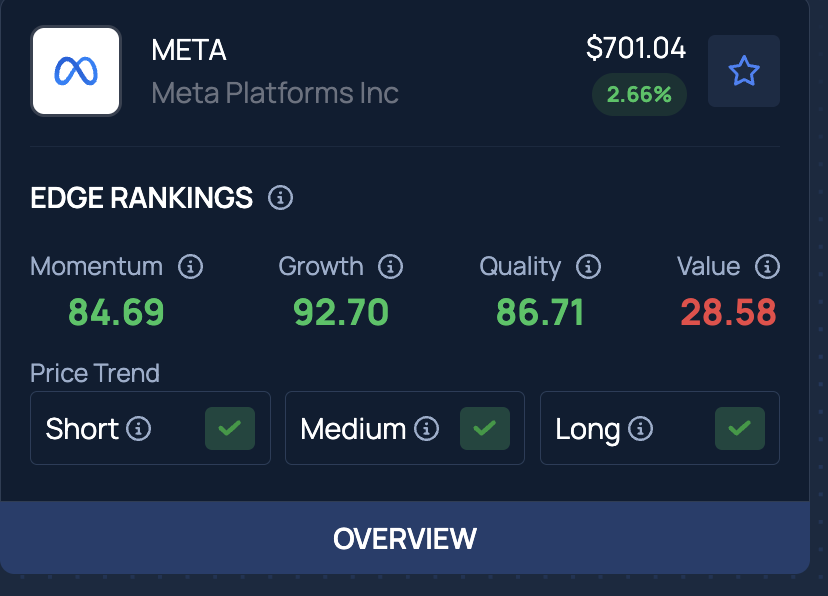

According to Benzinga Edge Stock Rankings, Meta has a growth score of 92.70% and a momentum rating of 84.69%. Click here to see how it compares to other leading tech companies.

On a year-to-date basis, the shares of Meta surged 17.17%.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: advertising revenue benzinga neuro Meta Platform subscribers WhatsAppNews