Natural Gas Prices Hit 30-Month Low, But Cheniere Energy Is Trading Higher

Henry Hub natural gas prices fell 4.5% on Tuesday to $2.02/MMBtu, hitting the lowest point in more than 30 months, owing to persistently low demand due to above-than-normal winter temperatures and large inventories.

Working stocks of natural gas in underground storage were 1,900 billion cubic feet on March 17, the most for this time of year since 2020, according to the U.S. Energy Information Administration. Consumption in both January and February 2023 reached the lowest levels since 2018. Natural gas flows to liqueified natural gas export facilities are on course to set new records after Freeport LNG's Texas export facility restarted.

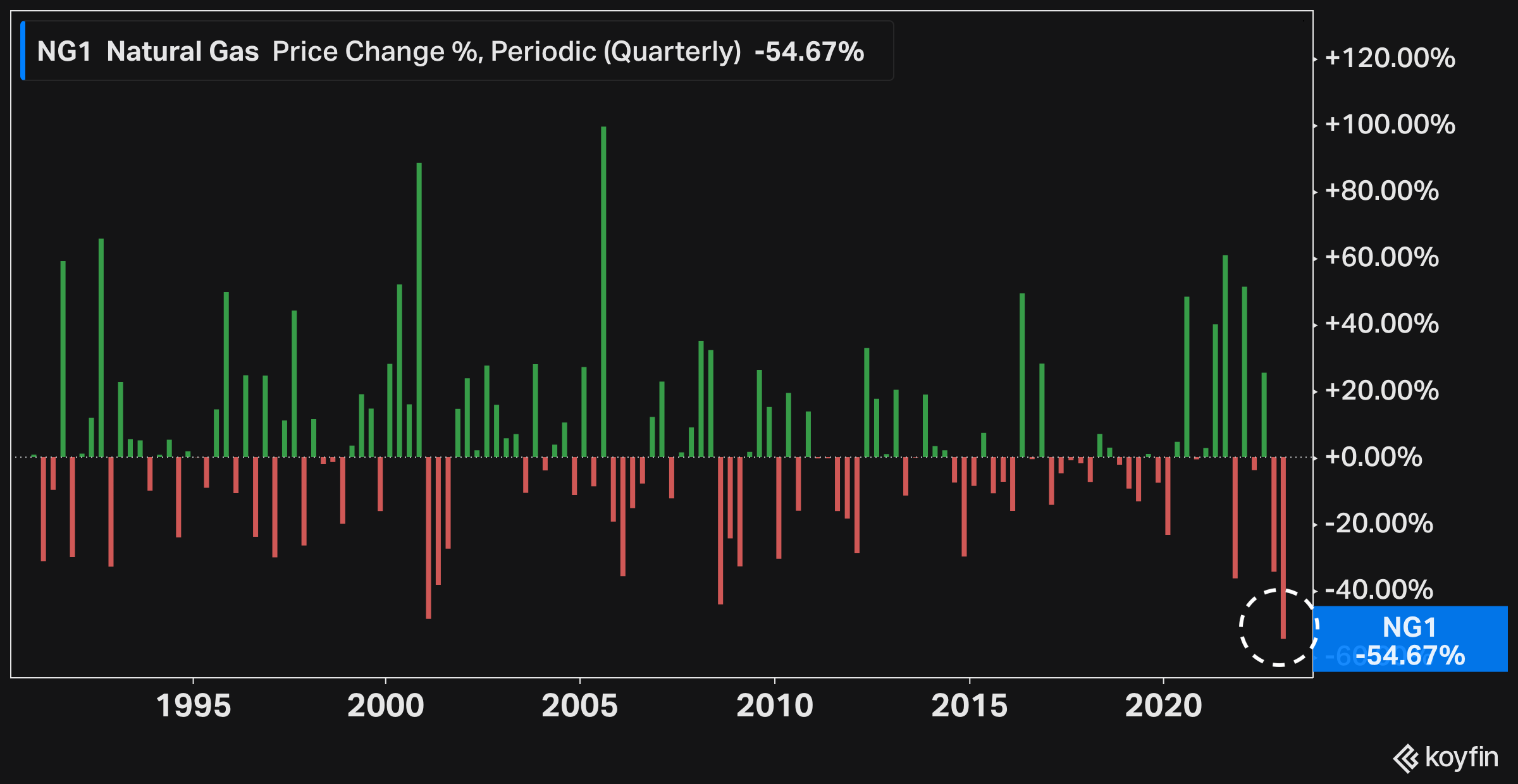

Thus far, the first quarter of 2023 has been the worst on record for natural gas prices, with a drop of about 50%.

U.S. Natural Gas quarterly performance – Chart: Koyfin

Cheniere Disconnected With Natural Gas Prices: When it comes to stocks in the natural gas market, Cheniere Energy, Inc. (NYSE: LNG) continues to trade at levels that are exceptionally higher than what commodities prices would imply.

Cheniere Energy traded at $153.52 on Tuesday, up $4.82 or 3.2% from the previous trading session. LNG has risen 9.2% year-to-date.

Last month, the company reported a spectacular 162% positive surprise in fourth-quarter EPS versus consensus estimates, but the next earnings release due on May 3 might begin to reflect the significant fall in natural gas prices during the quarter.

Cheniere Energy vs Natural Gas – Chart: TradingView

Cheniere Outperforms Natural Gas Peers: Not only does Cheniere Energy seem to trade at a significant premium to natural gas prices, but the stock has also substantially outperformed its rivals in the sector.

EQT Corp (NYSE: EQT) is down 3% year-to-date, Kinder Morgan Inc (NYSE: KMI) by 5.3%, Southwestern Energy Co (NYSE: SWN) by 11.3%, Chesapeake Energy (NASDAQ: CHK) by 12%, Comstock Resources Inc. (NYSE: CRK) by 15% and Antero Resources Corp (NYSE: AR) by 22%.

LNG vs peers, ytd performance as of March 28, 2023 – Chart: TradingView

Photo via Shutterstock.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: energy stocks Natural GasPenny Stocks Commodities Top Stories Markets Best of Benzinga