These OTC Securities Reported The Most Trading Volume In January – With Possible Sustained Interest In International Operators

Photo from Jason Briscoe on Unsplash

This post contains sponsored advertising content. This content is for informational purposes only and is not intended to be investing advice.

Following news of high inflation, the SPDR S&P500 (NYSEARCA: SPY) moved from a high of $478 to a low of $420.76. This move marked the first market correction – a decline of over 10% – since the COVID-19 pandemic emerged in 2020. According to Ned Davis Research, a securities market research shop, this move indicated the worst-ever start of the year for the SPDR S&P500. Other leading indices like the Dow Jones Industrial Average and the Nasdaq experienced similarly weak starts to the year.

Despite the shaky start to the year for markets, OTC Markets Group Inc. (OTCQX: OTCM) recorded a monthly total dollar volume of $53,023,723,310 across its markets.

International Presence

On the OTCQX – the OTC Markets’ top-tier – international operators experienced a percentage increase in trading volume relative to December. Notably, Roche Holdings AG (OTCQX: RHHBY), Infineon Technologies AG (OTQX: IFNNY), and BNP Paribas (OTCQX: BNPQY) experienced 87%, 94%, and 61% increases in trading volume compared to December respectively.

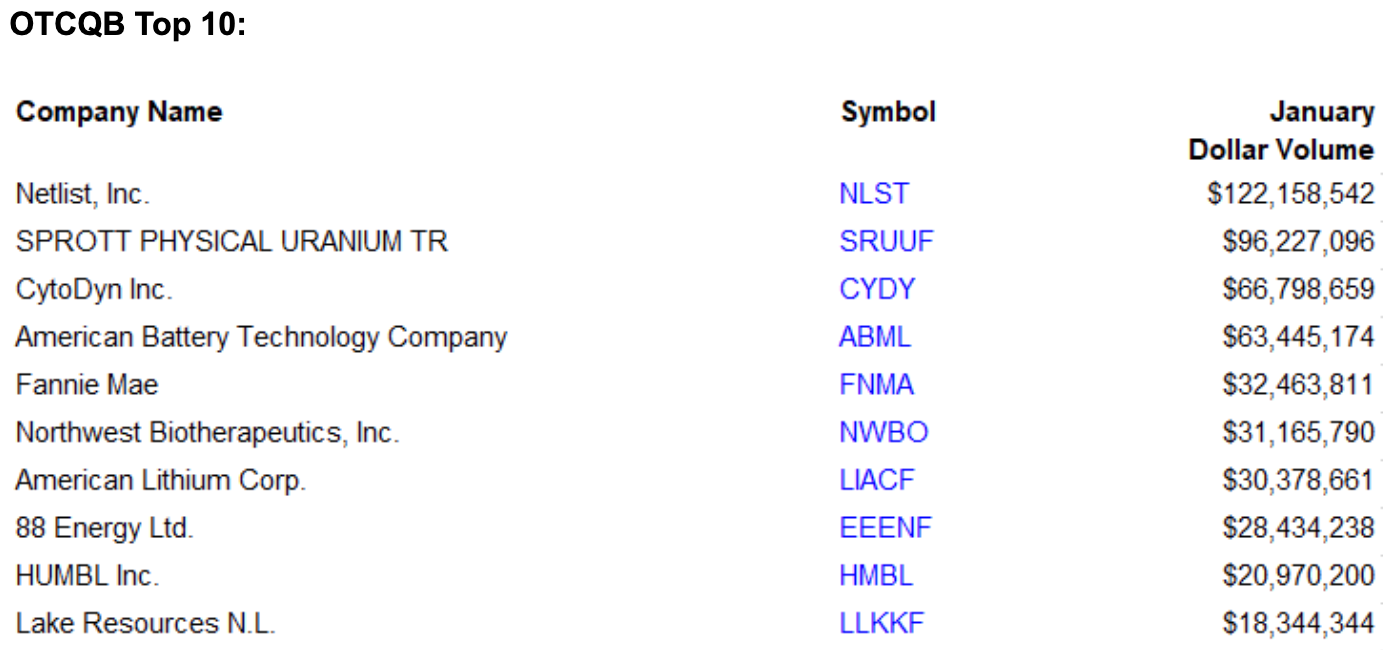

Of the 20 securities with the most volume on the OTCQX and OTCQB in January, more than half of them were international operators. Sprott Physical Uranium TR (OTCQB: SRUUF), American Lithium Corp. (OTCQB: LIACF), and Tokens.com (OTCQB: SMURF) constitute some of Canada’s significant presence on the OTCQB’s top 20, joined by Australia’s 88 Energy Ltd. (OTCQB: EEENF) and Lake Resource N.L. (OTCQB: LLKKF) and Israel's Todos Medical Ltd. (OTCQB: TOMDF). Notably, both Sprott and Carbon Streaming Corp. (OTCQB: OFSTF) closed above $10 on the OTCQB. Also, the cryptocurrency, energy, and medical industries all feature in OTCQB’s top 20, possibly showcasing the market’s ability to sustain interest in a wide variety of verticals.

Volume Profile

Of the 20 securities with the most volume, Grayscale Bitcoin Trust (OTCQX: GBTC) and Grayscale Ethereum Trust (OTCQX: ETHE) maintained their hold on traders’ interest, securing first and second place despite cryptocurrency’s January decline. Representing a shuffle from last month’s leaders, Sprott and CytoDyn Inc. (OTCQB: CYDY) lay claim to second and third place on the OTCQB’s list of 20 most traded securities, ushering out previous long-standing contenders Fannie Mae (OTCQB: FNMA) and Freddie Mac (OTCQB: FMCC).

The Top 10s

Below are the top 10 most actively traded securities on the OTCQX and OTCQB markets in January.

OTCQX Top 10:

OTCQB Top 10:

This post contains sponsored advertising content. This content is for informational purposes only and is not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: otc Partner ContentPenny Stocks Small Cap Markets