Nvidia Now Bigger Than China And Japan In This Global Stock Index: $4 Trillion Chip Giant's Contribution Crushes Entire Nations — 'Historic Is An Understatement'

Chip giant Nvidia Corp. (NASDAQ:NVDA) has reached a new milestone in the global equity markets, now standing as the single-largest contributor to the MSCI All Country World Index (ACWI).

Check out the current price of NVDA stock here.

What Happened: On Wednesday, in a post on X, The Kobeissi Letter highlighted Nvidia’s impressive standing among global equity markets, with a weightage of 4.73%, which now exceeds the weight of Japan’s entire stock market, the third largest in the world, at 4.65%.

The MSCI ACWI tracks large and mid-cap stocks across 23 developed and 24 emerging markets, representing approximately 85% of global equity market capitalization. Nvidia, whose valuation recently touched $4 trillion, now stands as the single-largest contributor to this benchmark.

“Nvidia's weight ALONE is now larger than Japan's 4.65% share,” the post says, calling this “incredible,” while listing other countries that now trail the chipmaker, with the U.K., China and Canada accounting for “3.28%, 2.97%, and 2.87%, respectively.”

It further notes that the company is now tied with the combined weight of France and Germany, two of Europe’s largest economies.

The post concludes by saying that the term “Historic is an understatement” for the stock and its performance over the past couple of years.

Why It Matters: Last week, Nvidia became the first company in history to be valued at more than $4 trillion, within just two years of joining the $1 trillion club. The stock is up 1,580% over the past five years.

With President Donald Trump greenlighting shipments of Nvidia’s H20 AI chips to China after a months-long ban, leading the stock to surge higher, as it stands to regain its lost $15 billion in China sales.

Recently, Benzinga readers predicted that the company will be the first to reach the $5 trillion mark as well, beating both Microsoft Corp. (NASDAQ:MSFT) and Apple Inc. (NASDAQ:AAPL).

Price Action: Nvidia shares were up 0.39% on Wednesday, trading at $171.37, and are down 0.09% after hours.

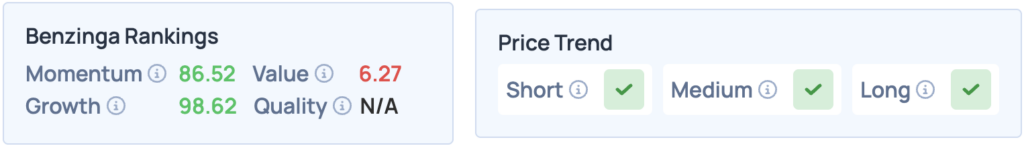

The stock scores high on Momentum and Growth according to Benzinga’s Edge Stock Rankings, and has a favorable price trend in the short, medium and long terms. Click here to see how it compares with competitors Broadcom Inc. (NASDAQ:AVGO) and Advanced Micro Devices Inc. (NASDAQ:AMD).

Photo: Hepha1st0s On Shutterstock.com

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.