BitMine Surges 14% After Hours As Ethereum Holdings Top $1 Billion Just Days After $250 Million Raise

BitMine Immersion Technologies Inc. (AMEX:BMNR) surged 14.11% in after-hours trading on Thursday, reaching $47.81 per share as the company’s Ethereum (CRYPTO: ETH) holdings crossed the $1 billion threshold following its recent pivot to an ETH treasury strategy.

What Happened: The Las Vegas-based company filed an 8-K with the Securities and Exchange Commission on Thursday, announcing its current ETH holdings position. BitMine recently closed a $250 million private placement and now holds 163,142 ETH tokens, worth approximately $1.18 billion at current prices.

The stock has gained 423.75% year-to-date, transforming from a market cap of $25.86 million in early 2025 to approximately $2.16 billion as of Thursday’s close. Thursday’s regular session saw shares close at $41.90, down 6.47% before the after-hours surge.

Fundstrat‘s Tom Lee, who recently became chairman of BitMine’s board, has been instrumental in the company’s strategic shift. Lee emphasized Ethereum’s role as Wall Street’s preferred blockchain platform for tokenization. “Ethereum is like the preferred choice for Wall Street,” Lee told CNBC. “JP Morgan’s stablecoin is built on Ethereum. Robinhood is building their tokenizing business on Ethereum.”

Why It Matters: The transformation mirrors the success of MicroStrategy Inc. (NASDAQ:MSTR), which pioneered corporate Bitcoin (CRYPTO: BTC) adoption. Lee noted that MicroStrategy’s stock jumped from $13 to over $450 after implementing its Bitcoin treasury strategy, with the treasury approach contributing a 25x rise beyond Bitcoin’s price appreciation.

Institutional validation came on Tuesday when Peter Thiel‘s Founders Fund Growth II Management disclosed a 9.1% stake in BitMine as of July 8. The billionaire PayPal and Palantir co-founder’s investment sparked additional buying interest in the emerging Ethereum treasury play.

Lee sees Ethereum positioned for a significant breakout as stablecoins create a “ChatGPT moment” for cryptocurrency and traditional finance convergence.

The emerging trend has attracted other companies to similar strategies. GameSquare Holdings Inc. (NASDAQ:GAME) announced an Ethereum treasury strategy last week, while SharpLink Gaming, Bit Digital and BTCS Inc. have also adopted ETH-focused approaches this year.

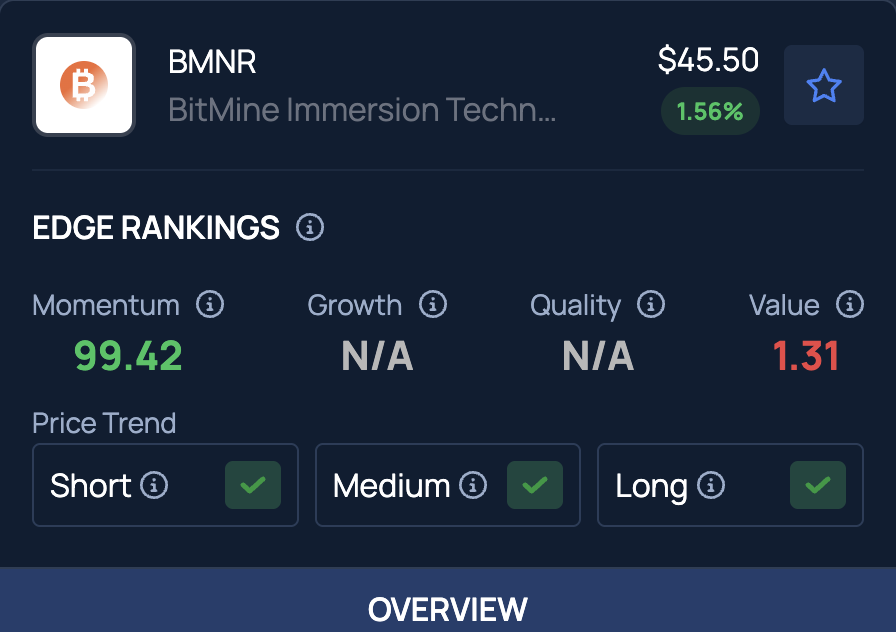

With a strong Momentum in the 99th percentile, Benzinga's Edge Stock Rankings highlight that BMNR has a positive trend across all formats. Track the performance of other players in this segment.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: vectorfusionart on Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: why it's movingCryptocurrency Equities News Events After-Hours Center Markets General