Trump's Push For Cane Sugar In Coca-Cola Could Trigger Massive Job Losses, Warns Corn Refiners Association: ADM, INGR Slip In Pre-Market

President Donald Trump‘s recent announcement about a potential shift to cane sugar in Coca-Cola Co‘s (NYSE:KO) products could have dire consequences for the U.S. job market, according to a prominent industry group.

What Happened: The proposed change could result in significant job losses, decreased farm income, and increased imports of foreign sugar, with no added nutritional benefits, cautioned John Bode, the President and CEO of the Corn Refiners Association (CRA).

Check out the current price of KO stock here.

The potential shift from high fructose corn syrup to cane sugar could have a significant economic impact on states like Iowa, the largest corn producer, and Florida, the leading cane sugar producer, as highlighted by Axios.

This news has already affected the stock market, with shares in corn processor, Archer Daniels Midland (NYSE:ADM), a corn refiner Ingredion (NYSE:INGR),dropping 2.69% and 5.69%, respectively in Thursday pre-market.

SEE ALSO: Pudgy Penguins Coin PENGU Leaps Past Dogecoin, Shiba Inu, Pepe With 93% Weekly Gain – Benzinga

Why It Matters: Trump’s Truth Social announcement suggested that Coca-Cola had agreed to start using real cane sugar in its products, citing it as “just better.” However, the company’s subsequent statement did not confirm a complete switch to cane sugar, only hinting at “new innovative offerings.”

This development comes on the heels of Coca-Cola’s recent escape from new tariff costs due to its U.S.-based production, giving it a cost advantage over competitors like PepsiCo Inc. (NASDAQ:PEP). However, earlier this year, Coca-Cola warned that Trump’s tariffs could force it to use more plastic if aluminum cans become more expensive, indicating a potential shift in its production strategy.

As the situation unfolds, stakeholders across the food manufacturing sector will be closely monitoring the developments.

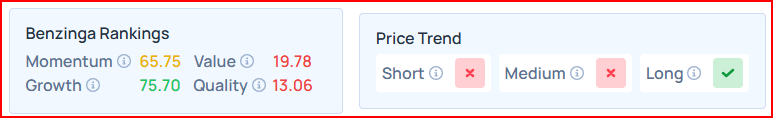

Coca-Cola offers strong Growth, while scoring weak on the Value and Quality metrics as per Benzinga's Proprietary Edge Rankings.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities