IQVIA Stock: Stuck In A Time Spiral - Value Play Or Bull Trap?

IQVIA (IQV) is currently in Phase 18 of its 18-Phase Adhishthana Cycle. On the surface, the stock might appear poised for a new move, but when analyzed through a multi-timeframe lens using the Adhishthana Principles, the picture is more complex. IQV seems to be caught in a prolonged time spiral that may not resolve until 2030. Let's break down its structure.

The Adhishthana Cycle So Far

IQVIA began its Adhishthana Cycle on 6 May 2013. Up to the completion of Phase 17, the stock maintained an impressive 88.88% alignment with the Adhishthana Principles, our proprietary framework that forecasts stock behavior using cyclical analysis, quantitative signals, and behavioral archetypes.

Here are the major alignment events so far:

Phase 6: Creation of the Level of Nirvana

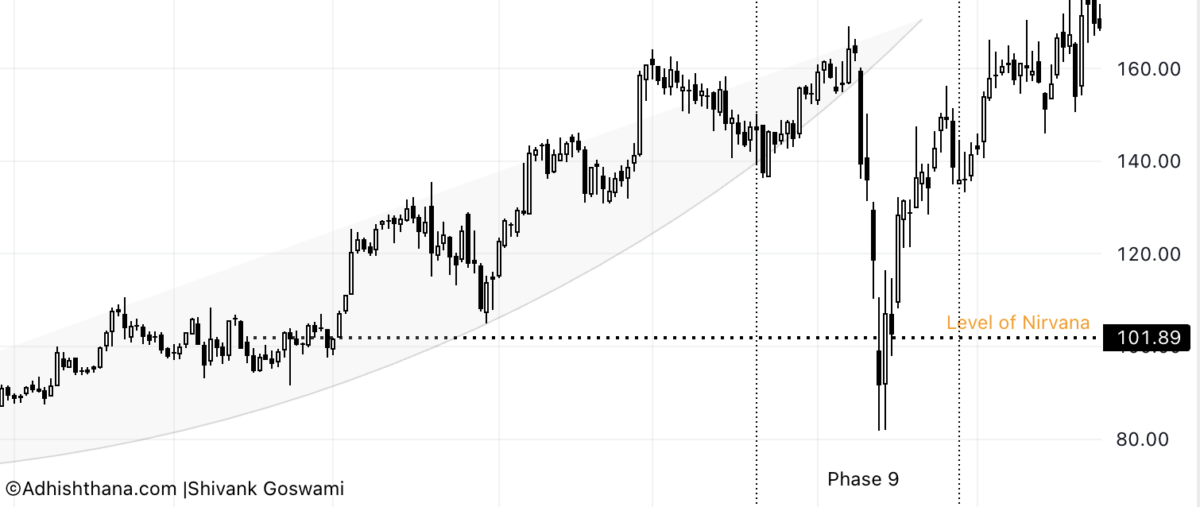

After trading for 24 bars, IQV created its Nirvana level at $101.885. This level now serves as a long-term valuation barometer and also acts as a magnet during periods of extreme bearishness. Notably, the stock recently rebounded near this level, reinforcing its importance.

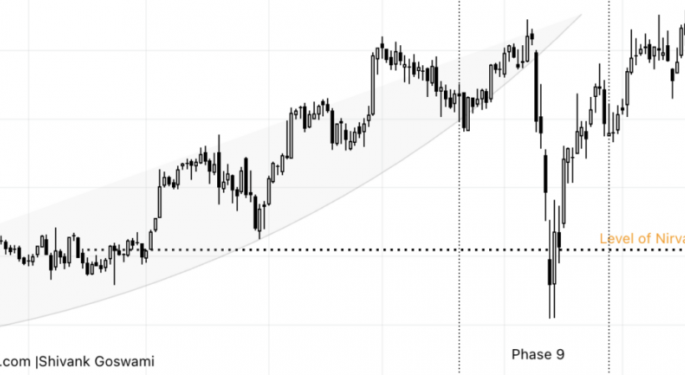

Phases 4 to 8: Formation of the Cakra

Between Phases 4 and 8, IQV built a classic Adhishthana Cakra, a bullish channel with a slight curve. While the structure indicated strength and a potential breakout in Phase 9, the stock instead broke down through the Cakra. This is a critical deviation, and such a breakdown attracts strong selling pressure. IQV witnessed a waterfall correction and garnered support around the Level of Nirvana, reinforcing its importance.

A similar Cakra breakdown occurred recently in Regeneron Pharmaceuticals. You can read more about such breakdowns in my Benzinga article:Why Regeneron Is Falling and Why You Should Avoid It

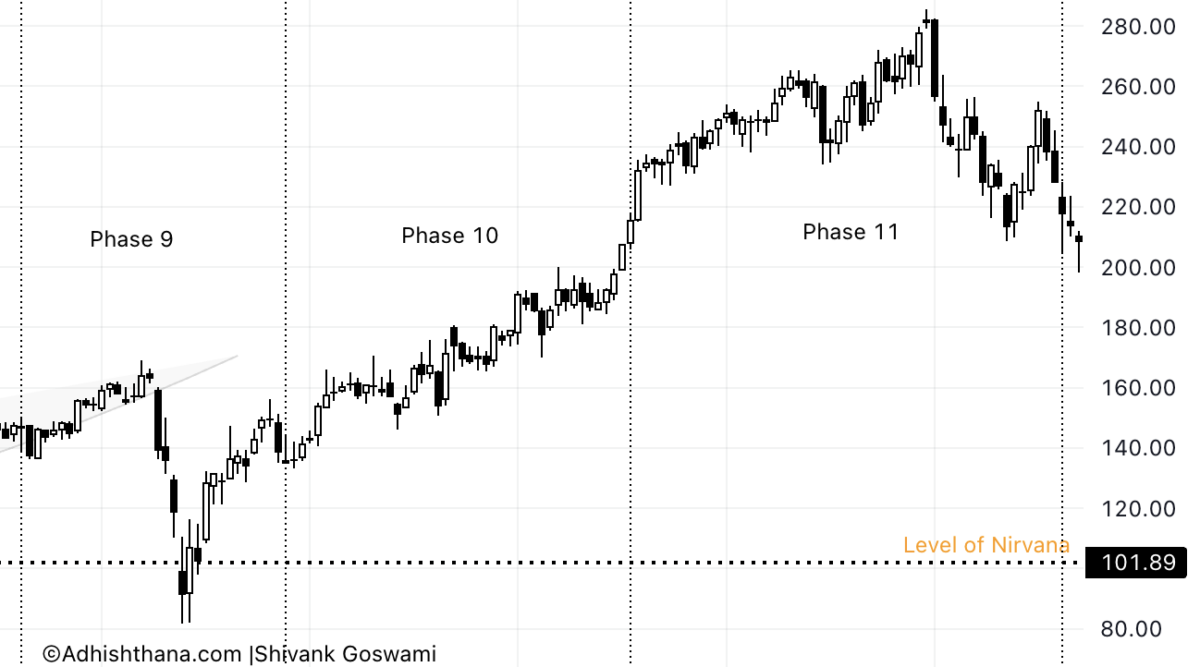

Phases 10 and 11: The Illusory Himalayan Formation

Phases 10 and 11 are typically stages of ascent within the Adhishthana Himalayan Formation. While IQV initially appeared to follow this pattern, the earlier breakdown from the Cakra invalidated the bullish setup. The Principles caution against such setups unless the Guna Triads (Phases 14, 15, and 16) are well-formed. In IQV's case, the entire Phase 10-11 rally was illusory, especially as the stock has remained in a bearish grip for more than 1200 days.

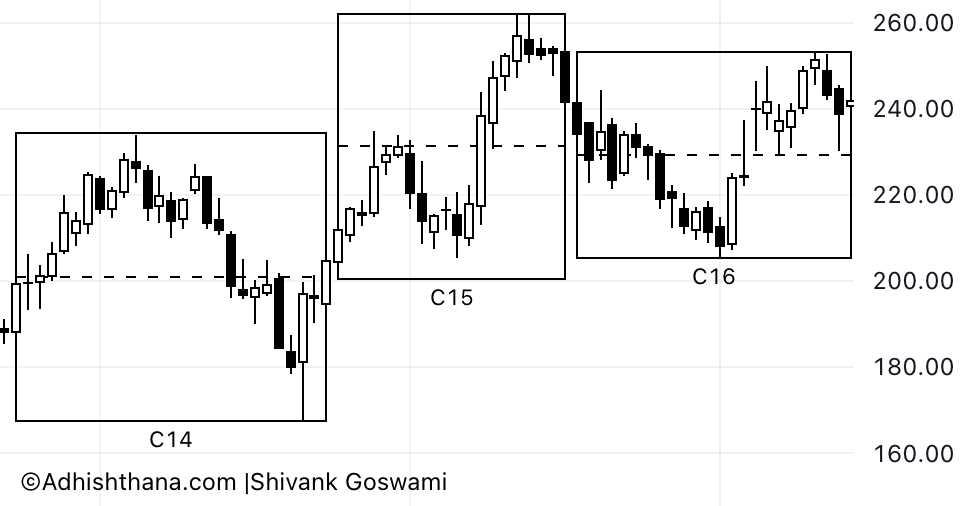

The Weak Guna Triads

During Phases 14 through 16, the stock failed to exhibit clear signs of Satoguna, the bullish energy required to fuel a proper ascent in Phase 18. Phase 15 did show a mild upward move, but it lacked conviction and clarity. With this poor triadic formation, the chances of the stock reaching its Phase 18 peak appear low.

Stuck in a Time Spiral Until 2030

Here's where the time spiral becomes evident:

- Phase 18 ends on 4 October 2026 on the weekly charts.

- On the monthly charts, IQV is in Phase 3, which is the Yajya Formation. This explains its prolonged downtrend.

- Monthly Phase 3 ends on 1 November 2026, followed by Phase 4, a phase of inaction that lasts until 30 April 2030.

According to the Adhishthana Principles, Phase 4 is a period where no action shall be taken, regardless of price action. This means IQV either could stay stuck in limbo for years or create bull traps for investors.

Investor Takeaway

Patience will be required, as this is not a quick-exit stock. For those considering a buy simply because it has dropped over 50% from its all-time highs, it might be wise to think twice – IQV is caught in a prolonged time spiral and does not appear to offer fast returns anytime soon.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas