Jim Cramer Attributes Nvidia's Premarket Dip To 'Meme Money' Frenzy: 'Just Small Motivated Shareholders Knocking It Down'

CNBC’s Jim Cramer has weighed in on Nvidia Corp.‘s (NASDAQ:NVDA) recent pre-market dip, attributing its slight decline to the influence of “meme money” rather than significant institutional selling.

What Happened: In a post on X on Friday, Cramer expressed his disappointment, stating, “I was hoping there would be less meme money in Nvidia but I was wrong.” He pointed to Nvidia’s pre-market movement, noting, “Witness the stock in premarket is down 87 cents.”

Cramer quickly downplayed the significance of this dip, characterizing it as the work of less substantial investors. He elaborated, “That’s just small motivated shareholders knocking it down.”

To underscore his point about the limited impact of such activity, Cramer estimated that “Probably no more than 35,000 shares sold took the biggest stock down a huge percentage,” suggesting that even a relatively small volume of trading by certain types of investors can create noticeable, though not fundamentally impactful, price fluctuations in highly-watched stocks like Nvidia.

Why It Matters: Nvidia was down 0.21% at $138.90 per share in premarket on Friday, as of the publication of this article. It closed 3.25% higher on Thursday following strong earnings after Wednesday’s market close.

Gene Munster, managing partner at Deepwater Asset Management, expressed disappointment on X Thursday with the market’s subdued reaction to Nvidia’s robust first-quarter results.

He believes the company’s guidance alone, specifically its $45 billion revenue forecast for the second quarter—even with an estimated $8 billion loss from export restrictions—should have triggered an 8% to 10% stock rally, especially given current macroeconomic uncertainties.

Nvidia shares were up 0.64% on a year-to-date basis and 25.96% higher over a year.

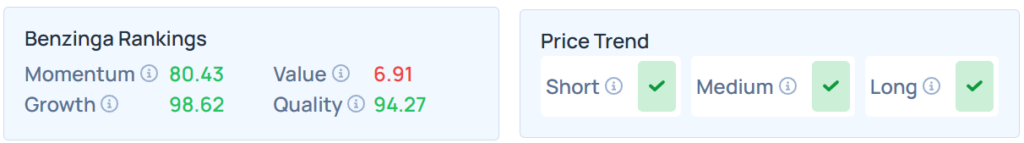

Benzinga Edge Stock Rankings shows that Nvidia had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, however, its value ranking was poor at the 6.91th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were mixed in premarket on Friday. The SPY was down 0.014% at $589.97, while the QQQ advanced 0.058% to $520.23, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Jack Hong / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Consumer Tech Gene Munster Meme StockEquities Market Summary News Markets Tech