Thermo Fisher Scientific Stock: Big Upside Potential After Sluggishness Through November?

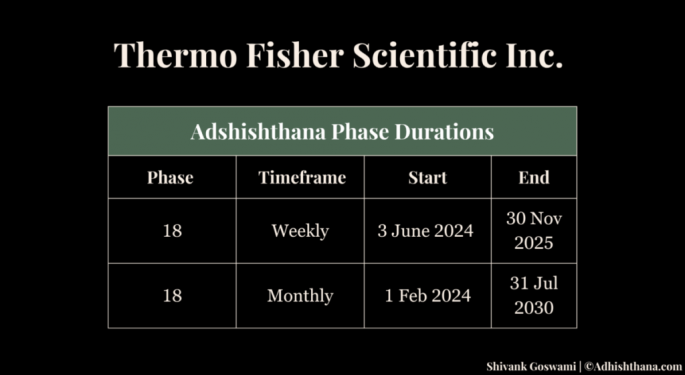

Thermo Fisher Scientific Inc. (NYSE:TMO) is currently navigating a rare and telling phase in its journey through the Adhishthana Cycle. The stock is in its 18th Phase, simultaneously on both the weekly and monthly charts, a unique alignment that brings a powerful cyclical signal. Yet, while this convergence might appear synchronistic, the behavior across these timeframes paints two vastly different narratives.

Where Are We in the Cycle?

TMO is now in the 18th and final phase of the Adhishthana Cycle across both weekly and monthly timeframes. This rare dual alignment signals a transitional moment for the stock, but not without turbulence.

TMO Weekly Chart Breakdown

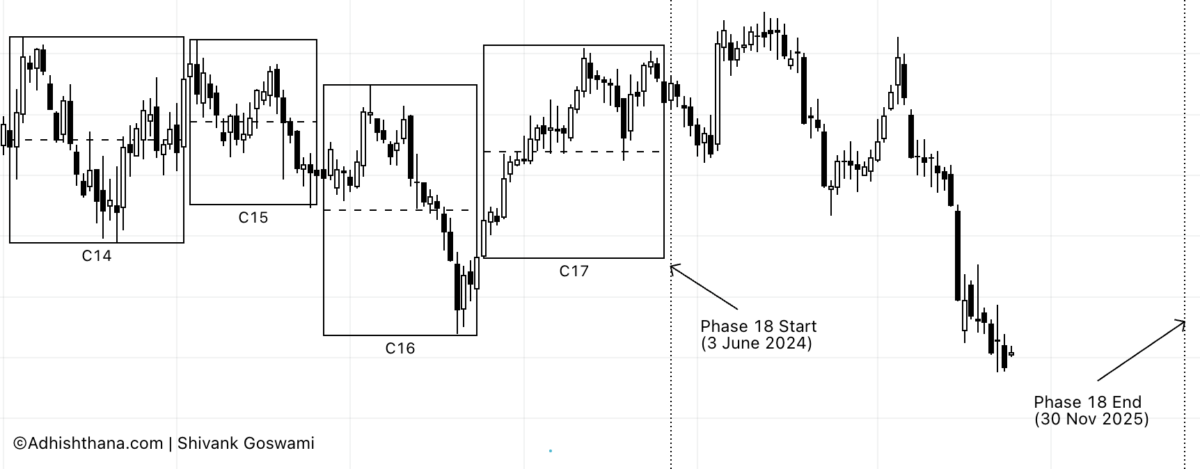

According to the Adhishthana Principles, our proprietary cyclical framework that combines quantitative signals with behavioral archetypes, the structure of Phases 14, 15, and 16, also called the Guna Triads, determines how Phase 18 unfolds.

On the weekly timeframe, TMO's Guna Triads (Phase 14-16) were dominated by Rajoguna and Tamoguna. These archetypes reflect indecision, volatility, and bearish sentiment. In such conditions, the stock typically fails to attain Nirvana, which represents the highest point across the 18-phase cycle.

This explains the consolidation and persistent weakness we have been seeing in TMO since it entered the 18th Phase. So far, it's down by 38%.

TMO Monthly Chart Outlook

In contrast, the monthly charts tell a different story.

Here, the Guna Triads (Phases 14–16) were characterized by Satoguna, the most constructive of the three. This suggests high potential for Nirvana on the monthly timeframe. However, if that's the case, then why is TMO falling?

So Why Is TMO Falling?

The current weakness is primarily driven by the weekly chart’s bearish 18th phase, which ends on November 30, 2025. Until then, the stock is expected to remain under pressure. Only after this date do the bullish signals on the monthly chart begin to take precedence according to the Adhishthana Principles. This decline also aligns with what’s known as the ‘Death Move’, a pattern where a stock often undergoes a significant correction after entering Phase 18, before eventually reaching Nirvana.

This rare phase conjunction between the weekly and monthly charts has created a temporal dislocation: near-term pain, long-term potential.

Our clients pursuing shorter timeframes have been deploying bearish spreads since the weekly 18th phase began. However, once the phase concludes in late 2025, the strategy shifts. We expect increased bullish exposure into the stock, as the setup for long-term value and Nirvana on the monthly chart becomes dominant.

Final Thoughts

TMO is experiencing a rare and telling moment within its Adhishthana Cycle. The near-term outlook remains challenged due to a bearish guna triad on the weekly charts, but this consolidation may prove to be a healthy precursor to long-term upside. The monthly Phase 18 doesn't conclude until July 31, 2030, meaning long-term upside remains very much on the table after near-term turbulence subsides. TMO makes a compelling candidate for patient investors looking to capitalize on deep-cycle insights, if they time it right.

Posted-In: contributorsEquities Long Ideas WIIM Technicals Opinion Signals Trading Ideas