Chewy Set For Over 50% Upside In Bull Case: 'Entering Beast Mode For 2025,' Says Analyst

Mizuho Securities upgraded Chewy Inc. (NYSE:CHWY) to Outperform from Neutral and raised its price target to $42, representing a 13.29% increase from current price levels, citing improving pet category fundamentals and multiple growth catalysts for 2025.

What Happened: The e-commerce pet supplies retailer is poised to benefit from recovering industry trends and internal initiatives that could drive EBITDA margin expansion toward high single to double digits, according to Mizuho analyst David Bellinger.

“The pet category is beginning to recover into 2025, yielding a return to net active customer growth for Chewy and a subsequent top-line re-acceleration,” Bellinger wrote in a Jan. 6 research note, adding, “Chewy notches to our top pick overall and within our consumer internet vertical. Bull case suggests +50% upside.”

Key growth drivers include Chewy’s underpenetrated mobile app, which currently accounts for about 20% of revenues but could exceed 40-50% penetration over the next 12-24 months. The company’s automation initiatives have already reduced order-to-delivery times by 10% while cutting fulfillment costs by 30% across 40% of volumes.

Mizuho projects Chewy’s revenue growth of 4.5% in fiscal 2025, accelerating to 7.9% in the financial year 2026 and 8.1% in the financial year 2027. The firm forecasts adjusted EBITDA margins reaching 5.5% in the financial year 2025, expanding to 6.5% in the financial year 2026 and 7.2% in the financial year 2027 – slightly ahead of consensus estimates.

Chewy gained significant attention last year when influential trader Keith Gill, known as Roaring Kitty, accumulated and later sold a stake in the company.

Why It Matters: The upgrade follows Chewy’s strong third-quarter performance, where it added approximately 160,000 net active customers. JPMorgan projects this growth could accelerate to 650,000 new customers in 2025.

Bellinger noted that concerns about higher advertising spend are “short-sighted,” as the company maintains a strong return on investment metrics while investing in customer acquisition. The analyst highlighted Chewy’s high revenue visibility through its Autoship subscription program, which accounts for over 80% of sales.

The new price target represents a multiple of 20x the financial year 2026 estimated EBITDA of $868 million, reflecting a premium to e-commerce peers given Chewy’s exposure to the resilient pet category and a clear path to margin expansion. The company also has over $400 million remaining in its share buyback program.

Price Action: Chewy’s stock closed at $37.07 on Monday, reflecting a 3.09% increase. In after-hours trading, the stock fell by 1.97%. Over the past year, Chewy has experienced a notable growth of 79.17%, according to data from Benzinga Pro.

The stock’s 52-week range is between $14.69 and $39.10. With a market capitalization of $14.80 billion, Chewy holds a price-to-earnings ratio of 40.29 and a relative strength index of 53.

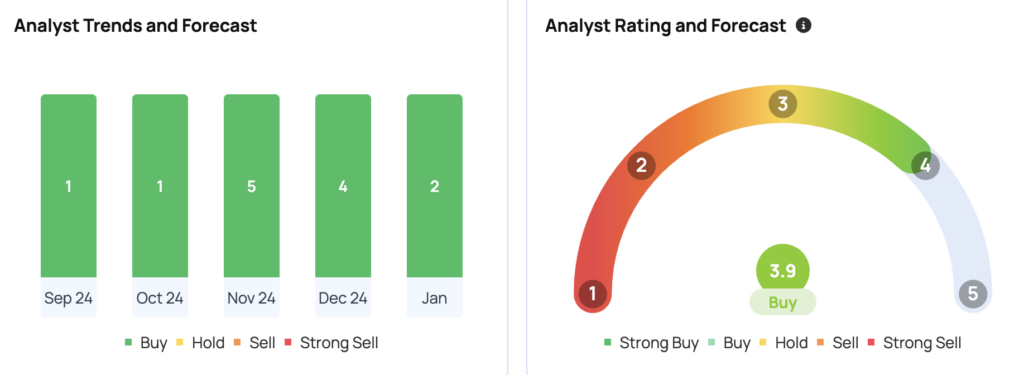

Chewy has a consensus price target of $35.19. The high target is $42, and the low is $25. Recent ratings suggest a $39 target, implying a 7.32% upside.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Latest Ratings for CHWY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Buy | |

| Jan 2022 | RBC Capital | Initiates Coverage On | Outperform | |

| Jan 2022 | Piper Sandler | Downgrades | Overweight | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: David Bellinger Kaustubh Bagalkote Mizuho SecuritiesEquities News Markets Analyst Ratings