Tech, AI Drive $12.2B Inflows Into Growth ETFs, Marking Record Outperformance Over Value

Exchange-traded funds (ETFs) focused on growth equities – characterized by robust revenue growth, high valuations, and strong potential for innovation – experienced elevated inflows in June.

This surge in interest towards growth-linked funds coincided with a significant outperformance of growth over value stocks, reflecting increased investor confidence in the tech sector and disruptive innovations like artificial intelligence.

The eight largest growth-linked ETFs by assets under management (AUM) collectively experienced a substantial $12.2 billion in inflows from the beginning of the month through June 24.

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF’s record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).

Growth ETF

AUM

June Flows

(as of June 24)

Vanguard Growth ETF

$139.84B

$5.68B

IShares Russell 1000 Growth ETF (NYSE:IWF)

$97.00B

$0.03B

IShares S&P 500 Growth ETF (NYSE:IVW)

$52.96B

$4.01B

Schwab U.S. Large-Cap Growth ETF (NYSE:SCHG)

$30.62B

$0.44B

SPDR Portfolio S&P 500 Growth ETF (NYSE:SPYG)

$29.40B

$0.47B

Vanguard Mega Cap Growth ETF (NYSE:MGK)

$22.39B

$1.08B

Vanguard Russell 1000 Growth ETF (NYSE:VONG)

$20.81B

$0.08B

IShares Core S&P U.S. Growth ETF (NYSE:IUSG)

$18.94B

$0.15B

Vanguard Small-Cap Growth ETF (NYSE:VBK)

$17.25B

$0.26B

Total

$12.2B

Growth Stocks Surge To Record Highs Against Value

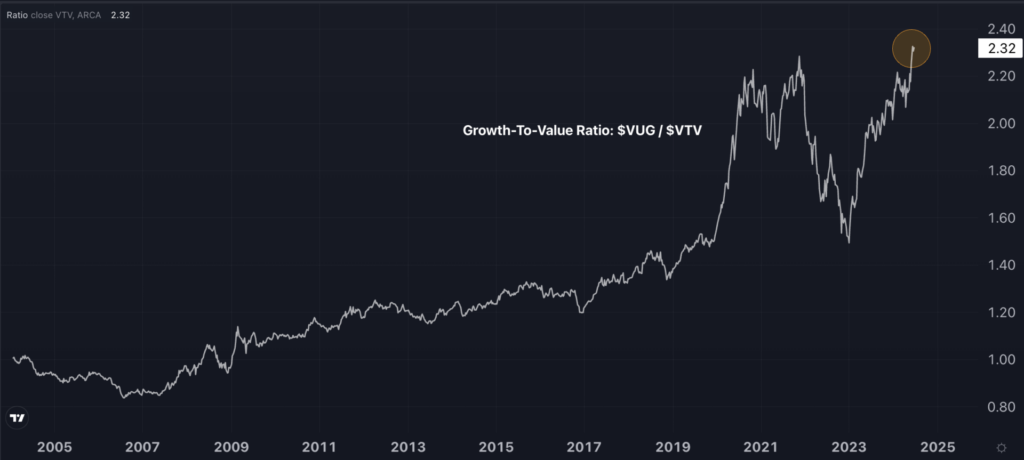

The Vanguard Growth ETF’s relative performance against its counterpart, the Vanguard Value ETF (NYSE:VTV), set new record highs in June, surpassing the previous peaks achieved in November 2021, as illustrated in the chart below, sourced from Benzinga Pro.

The primary drivers of the growth style’s outperformance in June were tech giants Nvidia Corp. (NASDAQ:NVDA) and Apple Inc. (NASDAQ:AAPL), which saw robust rallies of 15% and 8.8%, respectively.

Read Next:

Image generated using artificial intelligence via Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities Large Cap Sector ETFs Broad U.S. Equity ETFs New ETFs Top Stories Markets Tech