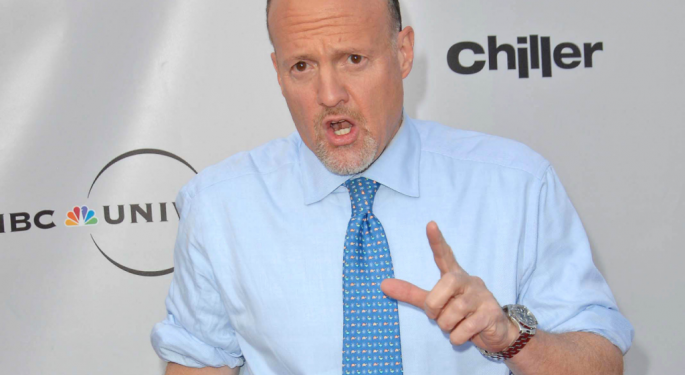

Jim Cramer Sees Nvidia As Going 'From Star Of The Show To Being The Goat Of The Game'

CNBC’s Jim Cramer, on Monday, highlighted the positive performance of the stock market but cautioned that the upcoming Big Tech earnings could determine the market’s future.

What Happened: Despite the positive market performance, Cramer warned that the upcoming Big Tech earnings, including those of Tesla Inc (NASDAQ:TSLA), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), and Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL), could determine the market’s future. These reports will indicate whether the recent tech sell-off will continue or come to an end, reported CNBC.

Chipmaker NVIDIA Corp (NASDAQ:NVDA) experienced a 4% rise on Monday, following a 10% drop on Friday. Cramer noted that while the stock has recovered, it may not be enough to offset the losses from Friday.

See Also: General Motors And Ford Are Facing The Same Challenge As They Run Back To Gas-Powered Trucks

“Nvidia’s gone from being the star of the show to being the goat of the game, and I’m not talking about the greatest of all time,” Cramer said. “We’ve learned from multiple pieces of research that Nvidia is doing quite well. I think the stock finally gets cheap enough to start tempting people.”

Why It Matters: The stock market has been experiencing a period of volatility, with experts offering differing opinions on its future. Cramer recently warned that the market hasn’t hit rock bottom yet, advising against buying the dip. He suggested that the market is still in a downward trend and that buying at the start of the session is not the right move.

Despite these concerns, Wall Street veterans remain confident that the bull market will persist, citing a robust U.S. economy and the potential of artificial intelligence (AI) as key drivers. The recent dip was triggered by higher-than-expected inflation in March, which led to a reevaluation of rate cut expectations for 2024. The situation was further exacerbated by Iran's attack on Israel over the weekend, prompting investors to seek refuge in safe havens like U.S. Treasuries.

However, Cramer also outlined potential factors that could lead to further market decline, advising investors to be cautious about their buying and selling decisions. He warned investors against making sudden decisions to buy or sell.

Price Action: According to data from Benzinga Pro, Nvidia closed Monday’s trading at $795.18, marking a 4.35% increase. However, in after-hours trading, the stock saw a slight decline of 0.22%. Nonetheless, the chipmaker’s stock has surged by 65.08% year-to-date.

Image Via Shutterstock

Engineered by

Benzinga Neuro, Edited by

Kaustubh Bagalkote

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: big tech Kaustubh Bagalkote Jim CramerEquities News Markets Tech