Rivian Faces Technical Headwinds As Death Cross Looms In Stock Chart

Investors in electric vehicle Rivian Automotive Inc (NASDAQ:RIVN) are closely observing a notable technical development that has emerged on the stock charts: the foreboding Death Cross.

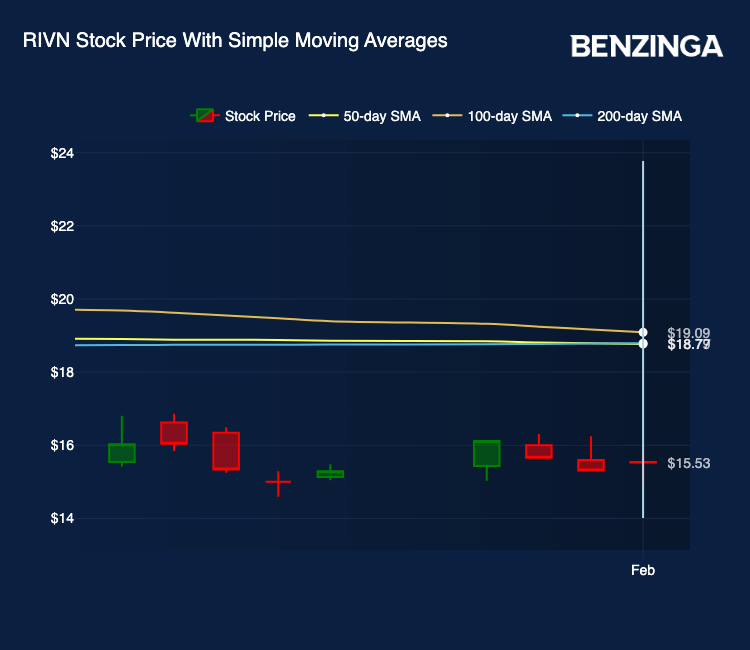

This bearish signal, marked by the 50-day moving average (yellow line above) slipping below the 200-day moving average (blue line above), is signaling potential challenges for Rivian’s stock, adding a layer of uncertainty for shareholders in the growing EV company.

Rivian Stock Made A Death Cross

A death cross is often interpreted as a signal that a stock’s upward momentum may be waning, prompting caution among investors. For Rivian, the company faces stiff competition from behemoth and first-mover Tesla Inc (NASDAQ:TSLA) and Chinese EV makers such as BYD Co Ltd (OTCPK: BYDDF), NIO Inc – ADR (NYSE:NIO), XPeng Inc – ADR (NYSE:XPEV) and Li Auto Inc (NASDAQ:LI).

Also Read: Tesla Vs. Rivian: Which EV Stock Offers More Upside?

Nonetheless, over the past two years, Rivian has sustained in the market and grown its revenue, at the same time managing to reduce its negative EPS every year. The appearance of the death cross, however, raises questions about the sustainability of what it has been able to achieve so far.

The Challenging EV Landscape

Rivian, like its EV counterparts, is navigating a rapidly evolving industry landscape. While the electric vehicle sector holds immense promise, it is not without challenges. Supply chain disruptions, global macroeconomic conditions and increased competition in the EV market pose potential headwinds for Rivian’s growth.

Consensus analyst ratings on Rivian stock stand a a Buy with a price target of $23.83. But recent ratings received in January have seen analysts reducing their price targets for Rivian stock.

What Lies Ahead

The dynamic nature of the stock market, coupled with the intricacies of the electric vehicle industry, leaves room for potential reversals or shifts in sentiment. Rivian’s strategic decisions and market responses will play a pivotal role in determining whether the death cross is a temporary setback or a precursor to more sustained challenges ahead.

Read Next: Li Auto Leads NIO And XPeng In January 2024 EV Deliveries

Photo: Courtesy Rivian

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: auto automotive Death CrossEquities Large Cap Technicals Top Stories Trading Ideas