Texas Instruments Reports 'Shallow' Auto Recovery, Cites Geopolitical Risks And Tariff Impact On Supply Chains

Texas Instruments Inc. (NASDAQ:TXN) delivered better-than-expected second quarter earnings on Tuesday, but issued a cautious outlook clouded by persistent geopolitical uncertainties and a “shallow” recovery in the crucial automotive sector.

Check out the current price of TI stock here.

What Happened: CEO Haviv Ilan highlighted two dominant dynamics at play, which included the ongoing cyclical recovery in the semiconductor cycle and the disruptive influence of tariffs and geopolitics “reshaping global supply chains.”

He highlighted that despite semiconductor tariffs being on a pause, “the situation of tariffs and geopolitics is rough on supply chains,” adding that “We are and will remain flexible to navigate, especially in the immediate term.”

The automotive market, a significant segment for TI, particularly in areas like advanced driver-assistance systems (ADAS), powertrain, and connectivity, grew by mid-single digits year-over-year but saw a low single-digit sequential decrease in the second quarter.

Ilan described the automotive recovery as “shallow,” noting that customers, including original equipment manufacturers and Tier 1 suppliers, are operating on a real-time, consignment-driven inventory management basis with “no inventory replenishment there.”

This contrasts with the industrial market, which “ran a little hot” in the second quarter, with revenue increasing by upper teens year-over-year and mid-teens sequentially, partially driven by a significant 32% year-over-year spike in China.

Management expressed concern that some of the strong demand in the second quarter, particularly from China, might reflect short-term “pull-ins” tied to tariff risks rather than purely structural demand.

CFO Rafael Lizardi reiterated the company’s commitment to returning all free cash flow to shareholders through dividends and buybacks, while acknowledging the current “high CapEx environment.”

Why It Matters: Looking ahead at the third quarter, TI projects revenue between $4.45 billion and $4.8 billion.

The company continues to invest heavily in its manufacturing capabilities, including its Sherman, Texas facility, emphasizing its “geopolitically dependable capacity” as a key advantage in the evolving global landscape.

Its second-quarter revenue of $4.44 billion beat estimates of $4.33 billion, and adjusted earnings of $1.41 per share beat estimates of $1.33 per share.

Price Action: Shares of TI dropped 11.87% in after-hours following its earnings results. The stock was up 14.96% year-to-date and 8.39% over the past year.

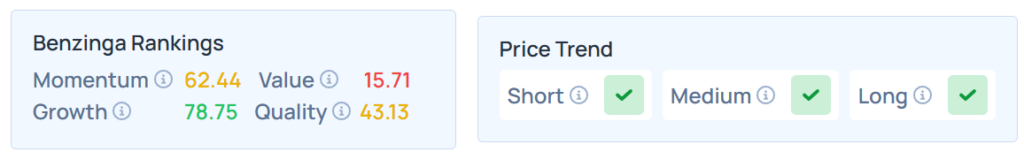

Benzinga Edge Stock Rankings shows that TI had a stronger price trend over the short, medium, and long term. Its momentum ranking was moderate, and its value ranking was poor at the 15.71th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended on a mixed note on Tuesday. The SPY was up 0.014% at $628.86, while the QQQ declined 0.52% to $561.25, according to Benzinga Pro data.

On Wednesday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading higher.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News