Whose Behavior Changed in Recent Bond Rally?

By Howard Simons, Minyanville

One of the great mysteries of our age is how long-term Treasury notes and bonds -- many of them with negative yields and interest rate risks approaching that of zero-coupon bonds and all of them issued by a government that simply does not have a prayer of getting its fiscal house in order -- have been able to outpace stocks on a year-to-date basis.

The rally since Operation Twist re-entered the lexicon from the early 1960s has had two phases. The first began in August 2011 and ran its course by early October 2011. The second began with the latest unraveling in the eurozone in March 2012.

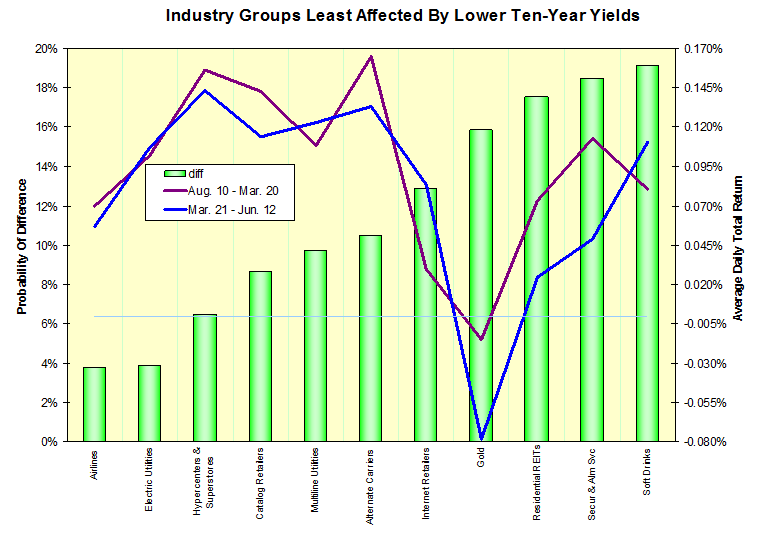

This sets up a very simple test: Which groups’ returns changed at a 90% confidence level between the August 10, 2011 – March 20, 2012 and March 21 – June 12, 2012 periods? The answer is presented in the chart below.

The big changes in group behavior come in groups such as Trading Companies, which has nothing to do with the sort of financial traders observed standing around numerous fires with open cans of kerosene in recent years. The group includes suppliers such as W.W. Grainger (NYSE: GWW), terminal operators such as GATX (NYSE: GMT) and service firms such as United Rentals (NYSE: URI). You have to move down the list to Investment Banking & Brokerage, home of Goldman Sachs (NYSE: GS) and Morgan Stanley (NYSE: MS) or to the strangely named Other Diversified Financial Services group, home of Citigroup (NYSE: C), JPMorgan Chase (NYSE: JPM) and Bank of America (NYSE: BAC) to find stocks you might consider rate-sensitive. Of course, these stocks have been rate-sensitive in the wrong direction: The lower long-term rates have clobbered their gross operating margins.

Now here comes the real punch line: If we turn the question around and ask which issues were affected least by the drop in long-term rates, we would find groups you normally would consider to be rate-sensitive such as Electric Utilities, home of Duke Energy (NYSE: DUK) and Exelon (NYSE: EXC) amongst others, Multiline Utilities, home of firms such as Sempra Energy (NYSE: SRE) and Consolidated Edison (NYSE: ED) and Gold, home of Newmont Mining (NYSE: NEM) and Royal Gold (NASDAQ: RGLD).

What can we conclude here? In addition to re-learning over the past four years that conducting macroeconomic stimulus via monetary accommodation is as effective as conducting brain surgery with a garden hoe, we can re-learn monetary policy is not much of a tool for industrial policy, either. No one has a clue as to what the industry-by-industry impact of a change in long-term interest rates will be; this is why the results above look so counter-intuitive.

A rational person would stop doing what has yet to work. An organization as self-enamored as the Federal Reserve will double-down on its stimulus bets. They can persist in this for a long time, just as Soviet central planners did, and they can have a similar success rate.

More from Minyanville:

- Will The Bullish Stateside Setup Trump Europe's Pandora's Box?

- How To Get A Job In The Financial Sector During a Recession

- Will The Markets Continue to Ignore Bad News?

Latest Ratings for GWW

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Oppenheimer | Maintains | Outperform | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Exelon Goldman SachsLong Ideas Bonds Short Ideas Markets Analyst Ratings Trading Ideas