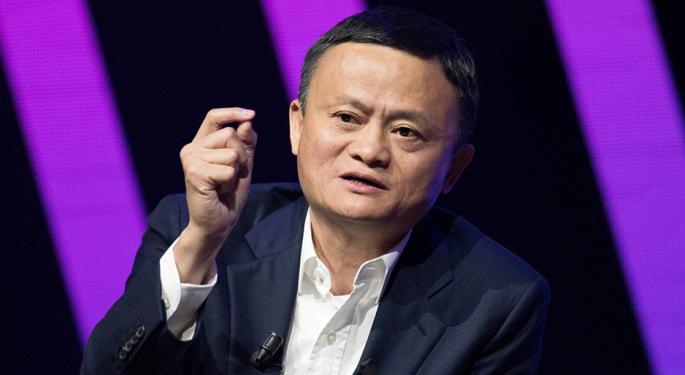

Jack Ma, Joe Tsai Overtake Softbank As Alibaba's Largest Shareholders After Aggressively Buying Tech Giant's Tumbling Shares

In a significant development, Jack Ma and Joe Tsai have emerged as the top shareholders of Alibaba Group Holding Ltd (NYSE:BABA), surpassing SoftBank Corp (OTC:SFBQF).

What Happened: Ma, who retired as Alibaba’s executive chairman in 2019, increased his stake in the company by purchasing approximately $50 million worth of shares in the fourth quarter of 2023. This raised his stake to more than 4.3%, making him the largest single shareholder, reported South China Morning Post, citing sources.

Joe Tsai, who took over as Alibaba’s chairman in September, acquired 1.957 million Alibaba shares, worth $151.7 million, through his family investment vehicle, Blue Pool Management. This purchase made him the second-largest shareholder.

Their aggressive buying during an 11% drop in Alibaba’s stock price in the fourth quarter reflects the co-founders’ confidence in the company’s future despite its recent challenges.

The co-founders’ combined stake in Alibaba now surpasses that of SoftBank Group. The Japanese investor, led by Masayoshi Son, has steadily reduced its Alibaba stake from around 7% in December 2022 to less than 0.5% as of May, using forward contracts, according to calculations by Morgan Stanley.

Why It Matters: This development marks a significant shift in Alibaba’s ownership structure. It comes after a period of turmoil for the company, including a substantial drop in its Hong Kong-listed shares following a report of SoftBank’s near-complete divestment of its Alibaba stake in 2023.

However, Alibaba’s stock experienced a resurgence after Ma and Tsai’s recent share purchases. The co-founders’ renewed confidence in the company’s future has been cited as a key factor in this turnaround, with Alibaba’s shares soaring over 7% following their investments.

Alibaba, once seen as a symbol of China’s economic growth, has faced a shift in investor sentiment due to regulatory risks and a slowdown in the Chinese economy. This has led to a decrease in Alibaba’s stock value, with the company being surpassed by smaller Chinese e-commerce firm PDD Holdings Inc (NASDAQ:PDD) as the most valued Chinese tech firm listed in the US.

Image Via Shutterstock

Engineered by

Benzinga Neuro, Edited by

Kaustubh Bagalkote

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Alibaba Jack Ma Joe TsaiAsia Equities News Global Markets