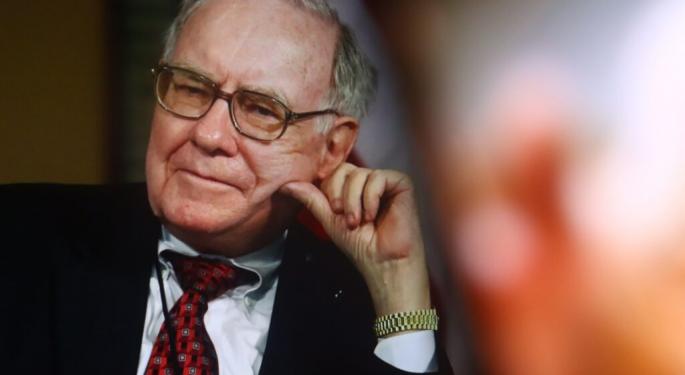

Warren Buffett Advocates For Stocks Over Real Estate As Long-Term Investments: 'There's So Much More Opportunity In Stock Market Than In Real Estate'

Warren Buffett, the CEO and chairman of Berkshire Hathaway, has shown a clear preference for stocks over real estate when it comes to long-term investment opportunities.

What Happened: Buffett, during the Berkshire Hathaway annual shareholder meeting, was queried about his continued interest in buying stocks over property. He responded by emphasizing the vast opportunities offered by the US stock market.

“The security market in the United States presents much more opportunities than real estate,” Buffett stated.

Buffett underscored his argument by comparing the performance of the stock market and real estate over the past four decades.

As per the report by CNBC, the S&P 500 has seen a rise of 2,218% since 1988, while the S&P CoreLogic Case-Shiller U.S. National Home Price Index has only seen a 374% increase.

[Benzinga Exclusive] Master Trader Reveals “Power Patterns” Behind 100% Gains

Trading legend (who’s trained 300,000 investors) reveals the market’s hidden ‘Power Patterns.’ These are the same ones he’s already used in 2025 to lock in gains like 105% from Adobe... 128% from Progressive... and 150% from Costco in less than two weeks. Reserve Your Seat to Power Patterns Profits LIVE.

Buffett also pointed out the ease and speed of trading stocks as a significant advantage over real estate transactions, which often involve lengthy negotiations and complexities.

“You can conduct billions of dollars worth of business, completely anonymous, and you can do it in five minutes at the New York Stock Exchange. The trades are complete when they’re complete,” Buffett elaborated. “In real estate, when you make a deal with a distressed lender, when you sign the deal, that’s just the beginning.”

Despite Berkshire Hathaway’s capacity to invest in various types of real estate, Buffett expressed his preference for the simplicity and potential for significant returns offered by the stock market.

Why It Matters: Buffett’s preference for stocks over real estate is noteworthy, given his significant influence in the investment world.

His views could potentially shape investor behavior, leading to a shift in investment strategies. The comparison of the performance of the stock market and real estate over the past four decades further highlights the potential of stocks as a long-term investment.

Buffett’s comments also underscore the ease and speed of trading stocks, which could be a deciding factor for investors when choosing between these two investment options.

Read Next

3 Summer 'Power Patterns' About to Trigger (That Have Been Accurate 9/10 Times!)

For the last decade, these 3 'Power Patterns' have delivered winning trades during the summer - one pattern accurate an astonishing 90% of the time. Now they're firing up again over the next 75 days. Want a 30-year veteran trader to show you how to play them? See How a Master Trader Plays These “Power Patterns”

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: investment Real Estate stock market Warren BuffettNews Top Stories Markets Real Estate