Trading Card Company Panini In Talks With Alex Rodriguez-Led SPAC: What Investors Should Know

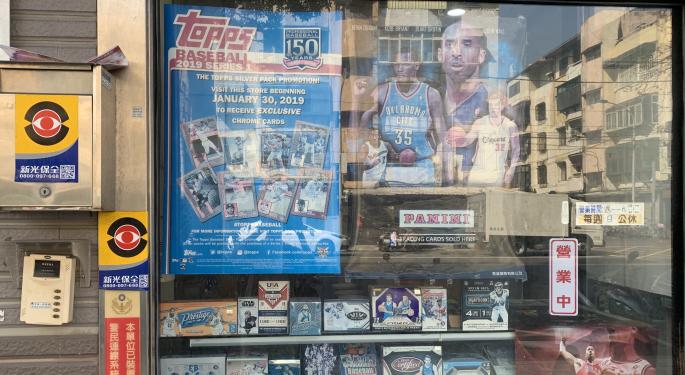

If you collect trading cards or World Cup stickers, chances are you’ve heard of the 60-year-old Italian company Panini. Rival Topps announced a SPAC deal earlier this year, and Panini could also be taking the same route to go public.

What Happened: Panini is in talks to go public with Slam Corp (NASDAQ: SLAM), according to Bloomberg. The merger could value Panini at $3 billion.

Panini sells trading cards, stickers, comics, books, magazines and graphic novels. The company’s products are sold in over 100 countries with over 1,000 products released annually.

Slam raised $575 million in February with the SPAC targeting sectors that include sports, media, entertainment and health and wellness.

Related Link: Alex Rodriguez, Marc Lore To Buy Minnesota Timberwolves For $1.5B, Could It Be A SPAC Deal?

Why It’s Important: Panini has sold stickers for every World Cup since 1970 and is a well-known global brand.

Panini has deals in place with the NFL, NBA, FIFA, Walt Disney Co (NYSE: DIS) and Tencent Holdings (OTC: TCEHY) segment Epic Games.

In January, Panini signed an agreement to be the trading card partner of the UFC, a unit of Endeavor Group Holdings (NYSE: EDR).

Panini’s direct-to-consumer brand “Panini Instant” could offer continued growth of digital collectibles.

Benzinga’s Take: Rival Topps announced a SPAC merger with Mudrick Capital Acquisition Corporation II (NASDAQ: MUDS) earlier this year that valued the company at $1.3 billion.

Topps had revenue of $567 million in fiscal 2020 and is forecasting revenue of $692 million in fiscal 2021. Topps counts Major League Baseball as its big exclusive trading card deal but does not have rights to many of the other leagues.

Privately held Panini does not share annual revenue figures. The company had $1.4 billion in revenue in 2018 with strong demand for the World Cup stickers. The figure was up significantly from $613 million in 2017.

The $3 billion valuation for Panini could value the company similarly to Topps. Panini has more sports leagues at its exposure currently for cards and stickers, which could set it apart to investors.

Price Action: Slam shares closed at $9.78 Wednesday.

Disclosure: The author has a long position in Slam.

Photo by Tbatb on Wikimedia

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Alex RodriguezM&A News Small Cap Sports IPOs Media General