Smart Money Is Betting Big In NDAQ Options

Investors with a lot of money to spend have taken a bullish stance on Nasdaq (NASDAQ:NDAQ).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NDAQ, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for Nasdaq.

This isn't normal.

The overall sentiment of these big-money traders is split between 45% bullish and 18%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $33,010, and 10, calls, for a total amount of $608,200.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $105.0 for Nasdaq during the past quarter.

Insights into Volume & Open Interest

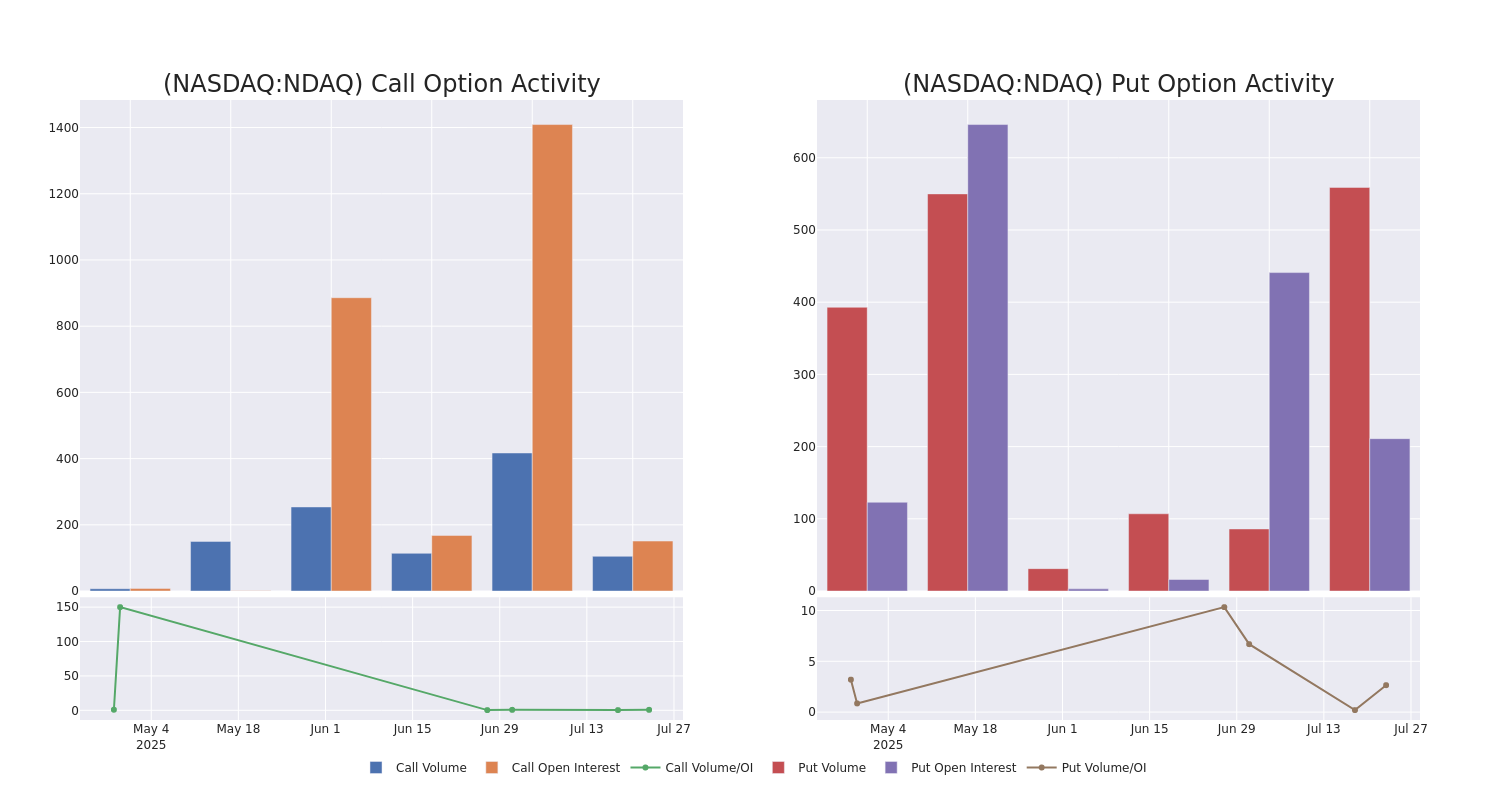

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Nasdaq's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nasdaq's whale trades within a strike price range from $50.0 to $105.0 in the last 30 days.

Nasdaq Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NDAQ | CALL | SWEEP | BULLISH | 09/19/25 | $5.5 | $5.3 | $5.5 | $90.00 | $109.5K | 2.5K | 303 |

| NDAQ | CALL | TRADE | NEUTRAL | 08/15/25 | $45.7 | $41.6 | $43.44 | $50.00 | $108.6K | 25 | 0 |

| NDAQ | CALL | TRADE | BULLISH | 01/16/26 | $6.4 | $6.1 | $6.3 | $95.00 | $94.5K | 242 | 150 |

| NDAQ | CALL | TRADE | NEUTRAL | 09/19/25 | $6.2 | $5.8 | $6.0 | $90.00 | $60.0K | 2.5K | 418 |

| NDAQ | CALL | TRADE | NEUTRAL | 08/15/25 | $14.2 | $14.0 | $14.1 | $80.00 | $56.4K | 19 | 69 |

About Nasdaq

Founded in 1971, Nasdaq is primarily known for its equity exchange, but in addition to its trading business (about 22.5% of sales), the company sells market and financial data to investors, offers Nasdaq-branded indexes, and lists companies through its capital access segment (42.5%). Nasdaq's newest segment, financial technology, was primarily constructed through the acquisitions of Verafin and Adenza and has expanded the company into capital management, financial crime, and regulatory compliance software (35%) as the firm seeks to become a diversified technology company.

Following our analysis of the options activities associated with Nasdaq, we pivot to a closer look at the company's own performance.

Current Position of Nasdaq

- Currently trading with a volume of 6,255,527, the NDAQ's price is up by 6.26%, now at $93.8.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 0 days.

What The Experts Say On Nasdaq

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $95.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Nasdaq, targeting a price of $101.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Nasdaq, which currently sits at a price target of $97.

* An analyst from Raymond James has decided to maintain their Outperform rating on Nasdaq, which currently sits at a price target of $96.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Nasdaq, maintaining a target price of $86.

* An analyst from UBS persists with their Neutral rating on Nasdaq, maintaining a target price of $95.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nasdaq with Benzinga Pro for real-time alerts.