Market Whales and Their Recent Bets on Bloom Energy Options

Financial giants have made a conspicuous bearish move on Bloom Energy. Our analysis of options history for Bloom Energy (NYSE:BE) revealed 76 unusual trades.

Delving into the details, we found 34% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $195,187, and 71 were calls, valued at $10,546,291.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $44.0 for Bloom Energy over the recent three months.

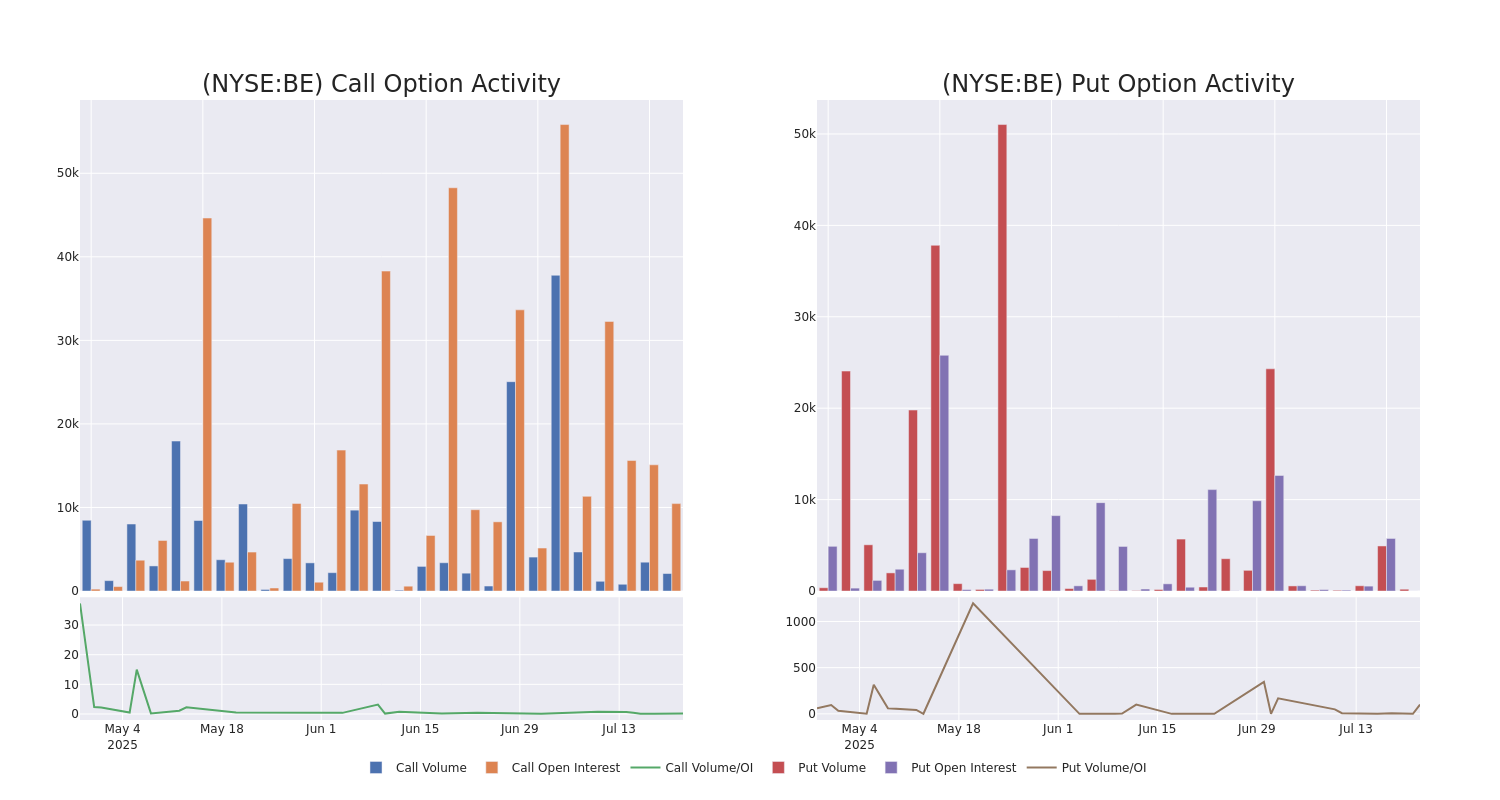

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Bloom Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Bloom Energy's significant trades, within a strike price range of $10.0 to $44.0, over the past month.

Bloom Energy Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BE | CALL | TRADE | BEARISH | 11/21/25 | $5.3 | $5.0 | $4.95 | $35.00 | $1.0M | 3.5K | 6.7K |

| BE | CALL | SWEEP | BEARISH | 11/21/25 | $6.2 | $6.0 | $6.0 | $33.00 | $600.0K | 326 | 1.1K |

| BE | CALL | SWEEP | BEARISH | 11/21/25 | $7.4 | $7.2 | $7.2 | $30.00 | $277.2K | 17.6K | 9.2K |

| BE | CALL | SWEEP | NEUTRAL | 11/21/25 | $7.3 | $7.2 | $7.25 | $30.00 | $232.7K | 17.6K | 8.2K |

| BE | CALL | SWEEP | BULLISH | 01/15/27 | $8.8 | $8.7 | $8.71 | $42.00 | $163.5K | 1.0K | 2.1K |

About Bloom Energy

Bloom Energy designs, manufactures, sells, and installs solid-oxide fuel cell systems ("Energy Servers") for on-site power generation. Bloom Energy Servers are fuel-flexible and can use natural gas, biogas, and hydrogen to create 24/7 electricity for stationary applications. In 2021, the company announced plans to leverage its technology and enter the electrolyzer market. Bloom primarily sells its systems in the United States and internationally.

Having examined the options trading patterns of Bloom Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Bloom Energy

- With a trading volume of 27,457,213, the price of BE is up by 24.66%, reaching $33.52.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 7 days from now.

Expert Opinions on Bloom Energy

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $29.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Roth Capital continues to hold a Neutral rating for Bloom Energy, targeting a price of $25.

* An analyst from Susquehanna has decided to maintain their Positive rating on Bloom Energy, which currently sits at a price target of $30.

* Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Bloom Energy with a target price of $31.

* Showing optimism, an analyst from JP Morgan upgrades its rating to Overweight with a revised price target of $33.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Bloom Energy, Benzinga Pro gives you real-time options trades alerts.