Behind the Scenes of Thermo Fisher Scientific's Latest Options Trends

Financial giants have made a conspicuous bullish move on Thermo Fisher Scientific. Our analysis of options history for Thermo Fisher Scientific (NYSE:TMO) revealed 49 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 20 were puts, with a value of $2,571,663, and 29 were calls, valued at $2,836,471.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $330.0 to $470.0 for Thermo Fisher Scientific over the recent three months.

Insights into Volume & Open Interest

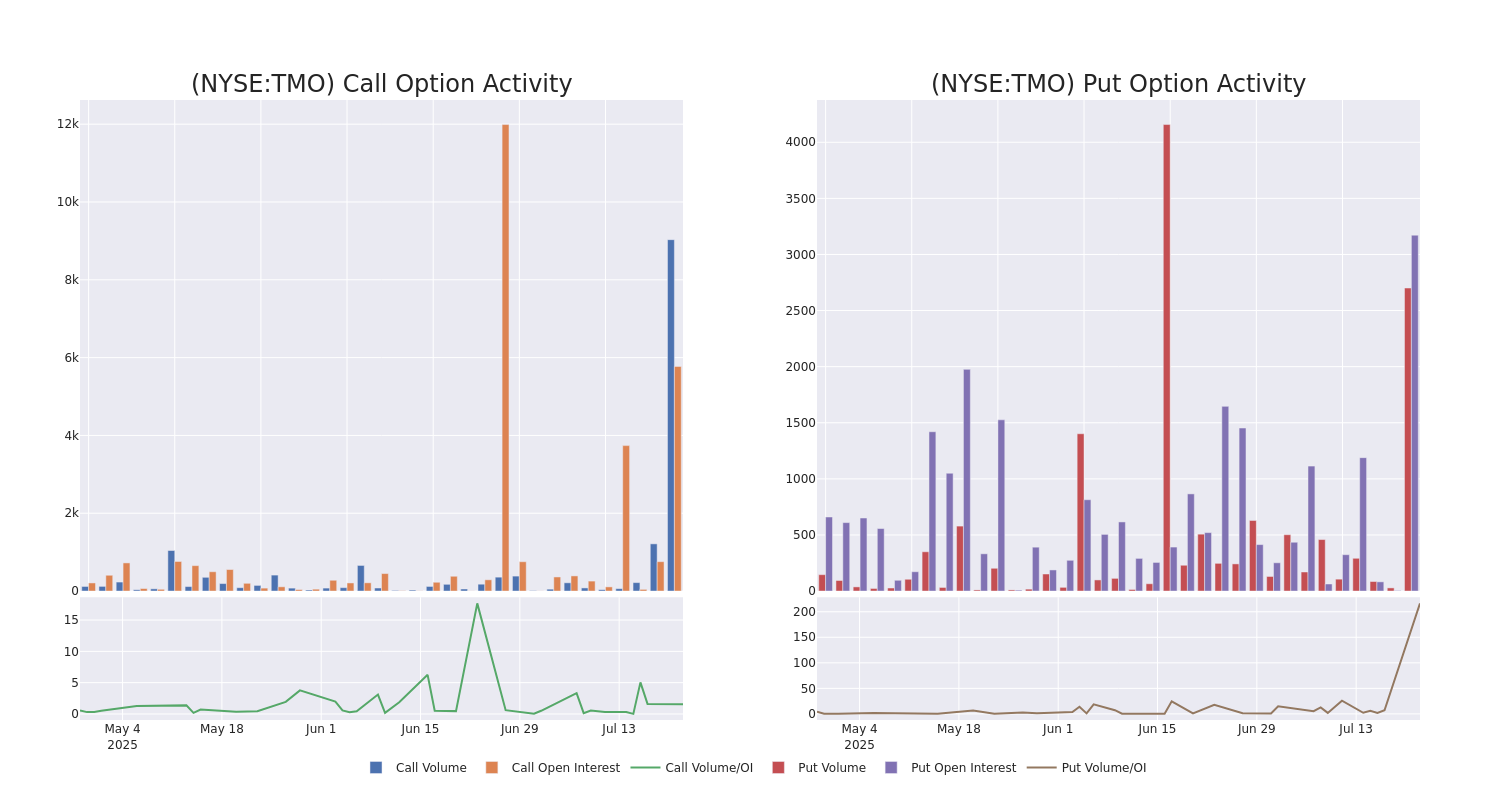

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Thermo Fisher Scientific's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Thermo Fisher Scientific's significant trades, within a strike price range of $330.0 to $470.0, over the past month.

Thermo Fisher Scientific 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | PUT | TRADE | NEUTRAL | 10/17/25 | $22.6 | $21.1 | $21.8 | $420.00 | $1.6M | 92 | 763 |

| TMO | CALL | TRADE | BEARISH | 09/19/25 | $8.1 | $7.7 | $7.7 | $470.00 | $385.0K | 416 | 526 |

| TMO | CALL | SWEEP | BULLISH | 08/01/25 | $15.0 | $14.9 | $15.0 | $420.00 | $325.5K | 1.0K | 365 |

| TMO | CALL | SWEEP | BULLISH | 08/01/25 | $15.4 | $14.7 | $15.4 | $420.00 | $209.4K | 1.0K | 560 |

| TMO | CALL | SWEEP | BULLISH | 08/01/25 | $17.7 | $16.9 | $17.7 | $420.00 | $173.4K | 1.0K | 1.2K |

About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of year end-2024 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (11%); life science solutions (23%); and lab products and services, which includes CRO services (the remainder).

Having examined the options trading patterns of Thermo Fisher Scientific, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Thermo Fisher Scientific

- Currently trading with a volume of 2,776,071, the TMO's price is up by 0.27%, now at $406.05.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 1 days.

What The Experts Say On Thermo Fisher Scientific

5 market experts have recently issued ratings for this stock, with a consensus target price of $506.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Barclays persists with their Equal-Weight rating on Thermo Fisher Scientific, maintaining a target price of $450.

* An analyst from Scotiabank upgraded its action to Sector Outperform with a price target of $590.

* An analyst from Baird has decided to maintain their Outperform rating on Thermo Fisher Scientific, which currently sits at a price target of $553.

* In a cautious move, an analyst from UBS downgraded its rating to Neutral, setting a price target of $460.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Thermo Fisher Scientific, which currently sits at a price target of $480.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Thermo Fisher Scientific, Benzinga Pro gives you real-time options trades alerts.