Coinbase Global Unusual Options Activity

Financial giants have made a conspicuous bullish move on Coinbase Global. Our analysis of options history for Coinbase Global (NASDAQ:COIN) revealed 97 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 42 were puts, with a value of $2,482,384, and 55 were calls, valued at $5,757,513.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $85.0 to $880.0 for Coinbase Global over the last 3 months.

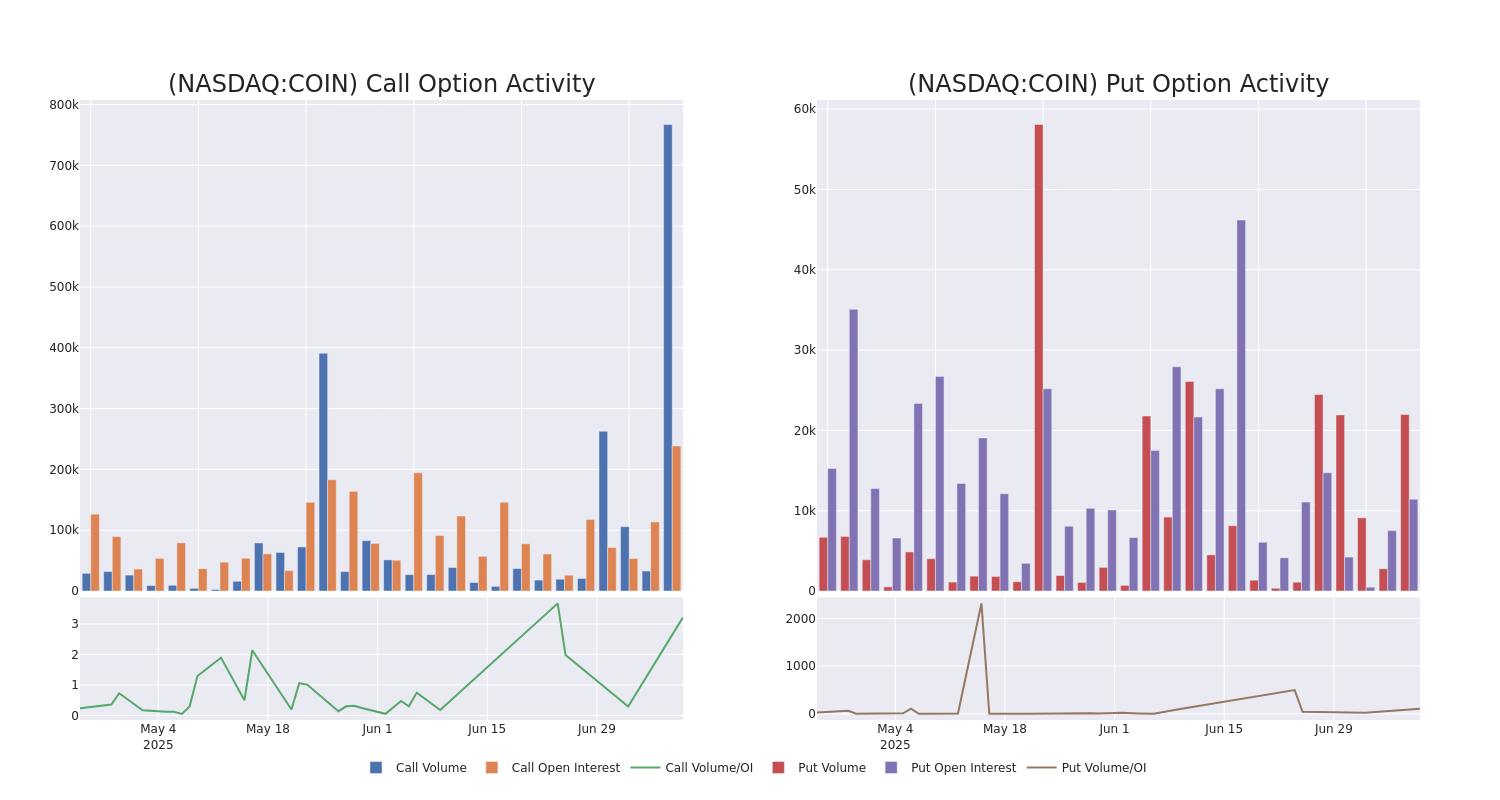

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Coinbase Global's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Coinbase Global's substantial trades, within a strike price spectrum from $85.0 to $880.0 over the preceding 30 days.

Coinbase Global Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COIN | CALL | SWEEP | BEARISH | 07/25/25 | $76.6 | $76.0 | $76.0 | $330.00 | $1.9M | 669 | 59 |

| COIN | CALL | TRADE | BULLISH | 06/18/26 | $224.9 | $218.95 | $223.6 | $200.00 | $447.2K | 64 | 0 |

| COIN | CALL | TRADE | BULLISH | 08/08/25 | $25.1 | $23.9 | $25.1 | $405.00 | $251.0K | 168 | 249 |

| COIN | CALL | TRADE | BULLISH | 08/01/25 | $38.0 | $37.45 | $38.0 | $380.00 | $190.0K | 761 | 85 |

| COIN | PUT | SWEEP | BEARISH | 07/25/25 | $9.75 | $9.7 | $9.75 | $400.00 | $117.0K | 5.2K | 6.1K |

About Coinbase Global

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage and data analytics.

After a thorough review of the options trading surrounding Coinbase Global, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Coinbase Global

- With a volume of 10,905,250, the price of COIN is down -2.03% at $405.24.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 9 days.

What Analysts Are Saying About Coinbase Global

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $403.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Oppenheimer persists with their Outperform rating on Coinbase Global, maintaining a target price of $395.

* An analyst from Argus Research has revised its rating downward to Buy, adjusting the price target to $400.

* An analyst from Piper Sandler persists with their Neutral rating on Coinbase Global, maintaining a target price of $350.

* Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Coinbase Global with a target price of $470.

* Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $400.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Coinbase Global options trades with real-time alerts from Benzinga Pro.