Smart Money Is Betting Big In EQT Options

Deep-pocketed investors have adopted a bullish approach towards EQT (NYSE:EQT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in EQT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for EQT. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 68% leaning bullish and 25% bearish. Among these notable options, 3 are puts, totaling $423,020, and 13 are calls, amounting to $1,054,747.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $62.5 for EQT over the recent three months.

Analyzing Volume & Open Interest

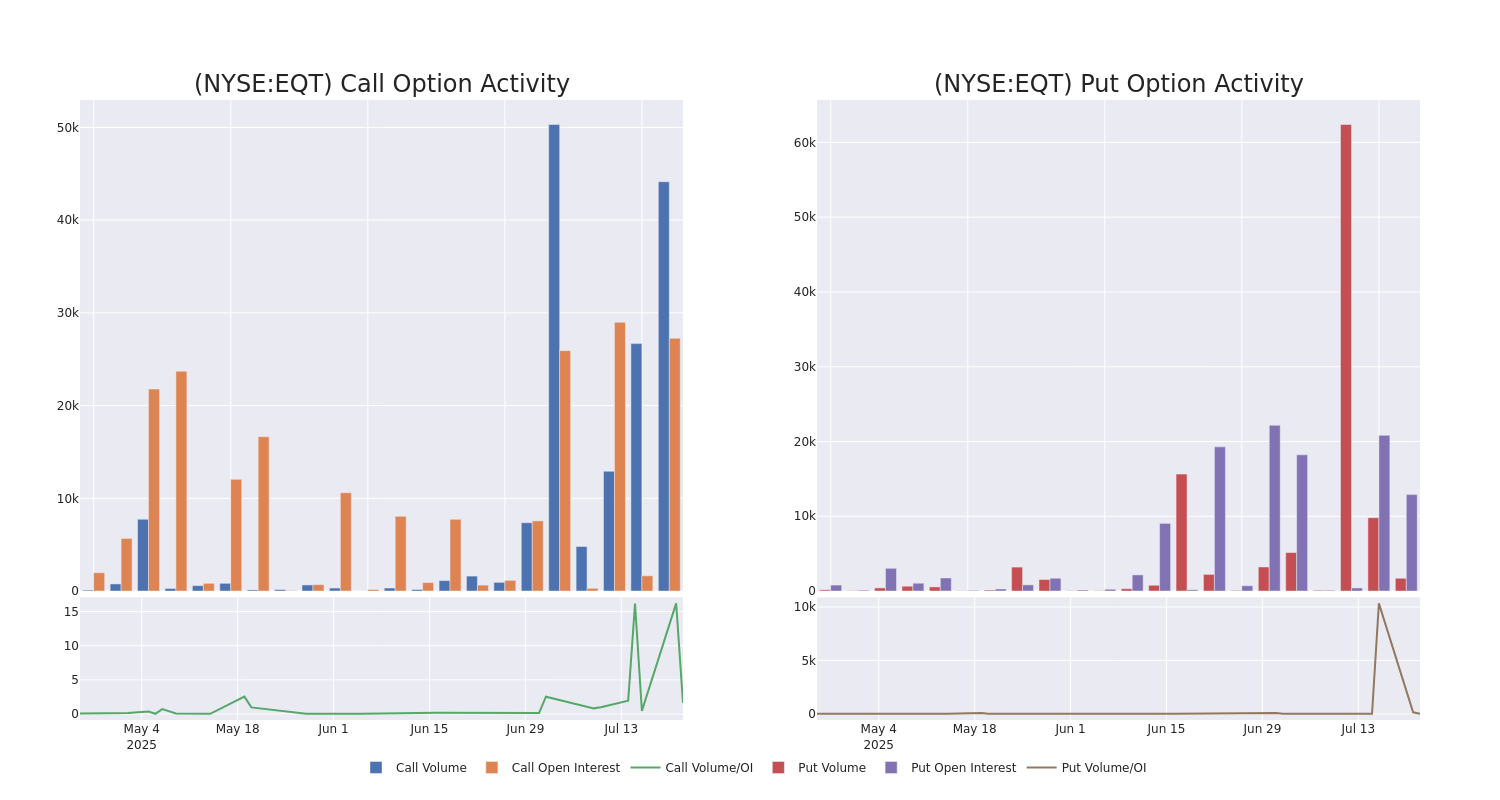

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for EQT's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of EQT's whale trades within a strike price range from $50.0 to $62.5 in the last 30 days.

EQT Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQT | PUT | SWEEP | BULLISH | 12/19/25 | $5.6 | $5.4 | $5.45 | $55.00 | $230.5K | 2.7K | 531 |

| EQT | CALL | TRADE | BULLISH | 08/15/25 | $0.53 | $0.45 | $0.53 | $60.00 | $212.0K | 7.6K | 9.5K |

| EQT | CALL | TRADE | BULLISH | 09/19/25 | $1.31 | $1.19 | $1.3 | $60.00 | $133.7K | 10.0K | 4.5K |

| EQT | PUT | SWEEP | BULLISH | 09/19/25 | $4.1 | $3.95 | $3.95 | $55.00 | $116.5K | 10.1K | 742 |

| EQT | CALL | SWEEP | BULLISH | 09/19/25 | $1.13 | $1.1 | $1.1 | $60.00 | $116.2K | 10.0K | 1.1K |

About EQT

EQT is an independent natural gas production company. It focuses its operations in the cores of the Marcellus and Utica shales, located in the Appalachian Basin in the Eastern United States. Its main customers include marketers, utilities, and industrial operators in the Appalachian Basin. The company has three reportable segments in production, gathering, and its transmission segment, which is now an operated joint venture with Blackstone. All the firm's operating revenue is generated in the US, with most revenue flowing from the Marcellus Shale field and through the sale of natural gas.

EQT's Current Market Status

- With a volume of 7,529,446, the price of EQT is up 1.48% at $54.34.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 0 days.

What The Experts Say On EQT

In the last month, 5 experts released ratings on this stock with an average target price of $66.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Roth Capital lowers its rating to Buy with a new price target of $69.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on EQT with a target price of $60.

* Consistent in their evaluation, an analyst from Scotiabank keeps a Sector Perform rating on EQT with a target price of $66.

* Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on EQT with a target price of $70.

* An analyst from Barclays has revised its rating downward to Overweight, adjusting the price target to $65.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for EQT, Benzinga Pro gives you real-time options trades alerts.