Roblox's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on Roblox. Our analysis of options history for Roblox (NYSE:RBLX) revealed 9 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $88,550, and 7 were calls, valued at $378,795.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $62.5 to $135.0 for Roblox over the recent three months.

Insights into Volume & Open Interest

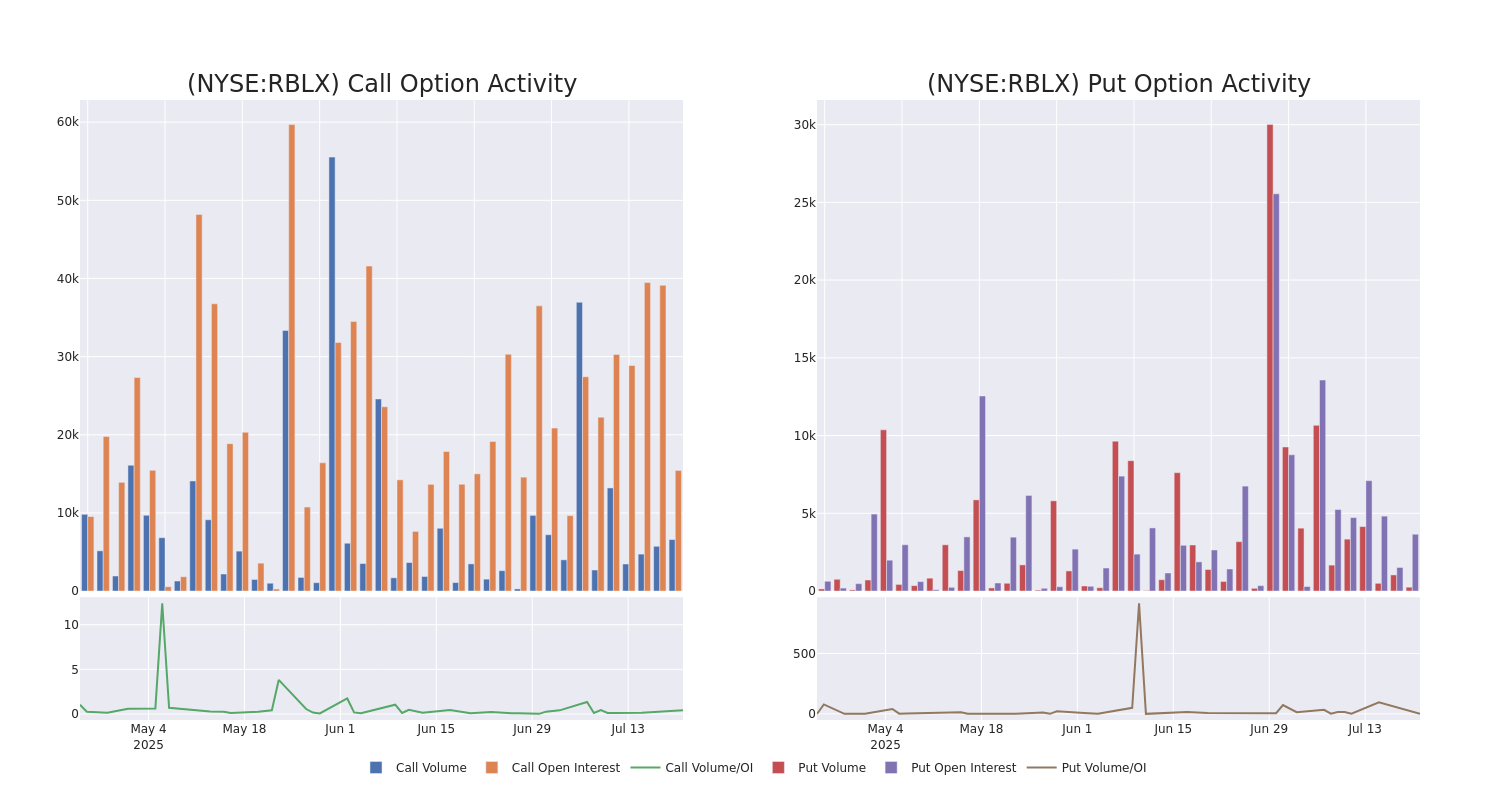

In terms of liquidity and interest, the mean open interest for Roblox options trades today is 2386.12 with a total volume of 6,835.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Roblox's big money trades within a strike price range of $62.5 to $135.0 over the last 30 days.

Roblox Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | CALL | SWEEP | BULLISH | 08/15/25 | $20.85 | $20.8 | $20.85 | $105.00 | $83.4K | 5.8K | 110 |

| RBLX | CALL | SWEEP | BEARISH | 07/25/25 | $0.83 | $0.8 | $0.8 | $130.00 | $80.0K | 3.1K | 2.0K |

| RBLX | CALL | TRADE | BEARISH | 10/17/25 | $62.95 | $62.0 | $62.0 | $62.50 | $74.4K | 1.6K | 12 |

| RBLX | CALL | TRADE | BEARISH | 11/21/25 | $21.0 | $20.6 | $20.6 | $120.00 | $51.5K | 570 | 0 |

| RBLX | PUT | TRADE | BULLISH | 07/25/25 | $2.5 | $2.29 | $2.29 | $122.00 | $45.8K | 771 | 228 |

About Roblox

Roblox operates a free-to-play online video game platform with about 85 million daily active users. This platform has spawned a virtual universe and a Roblox economy based on the Robux currency. The platform houses millions of games from a wide range of creators spanning from young gamers themselves to professional development studios. Roblox offers creators the tools, publishing abilities, and platform for their games, enabling anyone to create a game. Creators earn money when gamers make optional in-game purchases within their games and by offering space for real-world advertising, and Roblox earns revenue primarily by taking a cut of these earnings.

Current Position of Roblox

- Currently trading with a volume of 1,180,439, the RBLX's price is up by 0.08%, now at $124.6.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 10 days.

What The Experts Say On Roblox

In the last month, 5 experts released ratings on this stock with an average target price of $121.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Roblox, targeting a price of $124.

* An analyst from JP Morgan persists with their Overweight rating on Roblox, maintaining a target price of $125.

* An analyst from Citigroup has decided to maintain their Buy rating on Roblox, which currently sits at a price target of $123.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Roblox, targeting a price of $120.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Roblox with a target price of $116.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roblox options trades with real-time alerts from Benzinga Pro.