Duolingo Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on Duolingo. Our analysis of options history for Duolingo (NASDAQ:DUOL) revealed 15 unusual trades.

Delving into the details, we found 60% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $896,740, and 6 were calls, valued at $324,960.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $290.0 to $490.0 for Duolingo over the last 3 months.

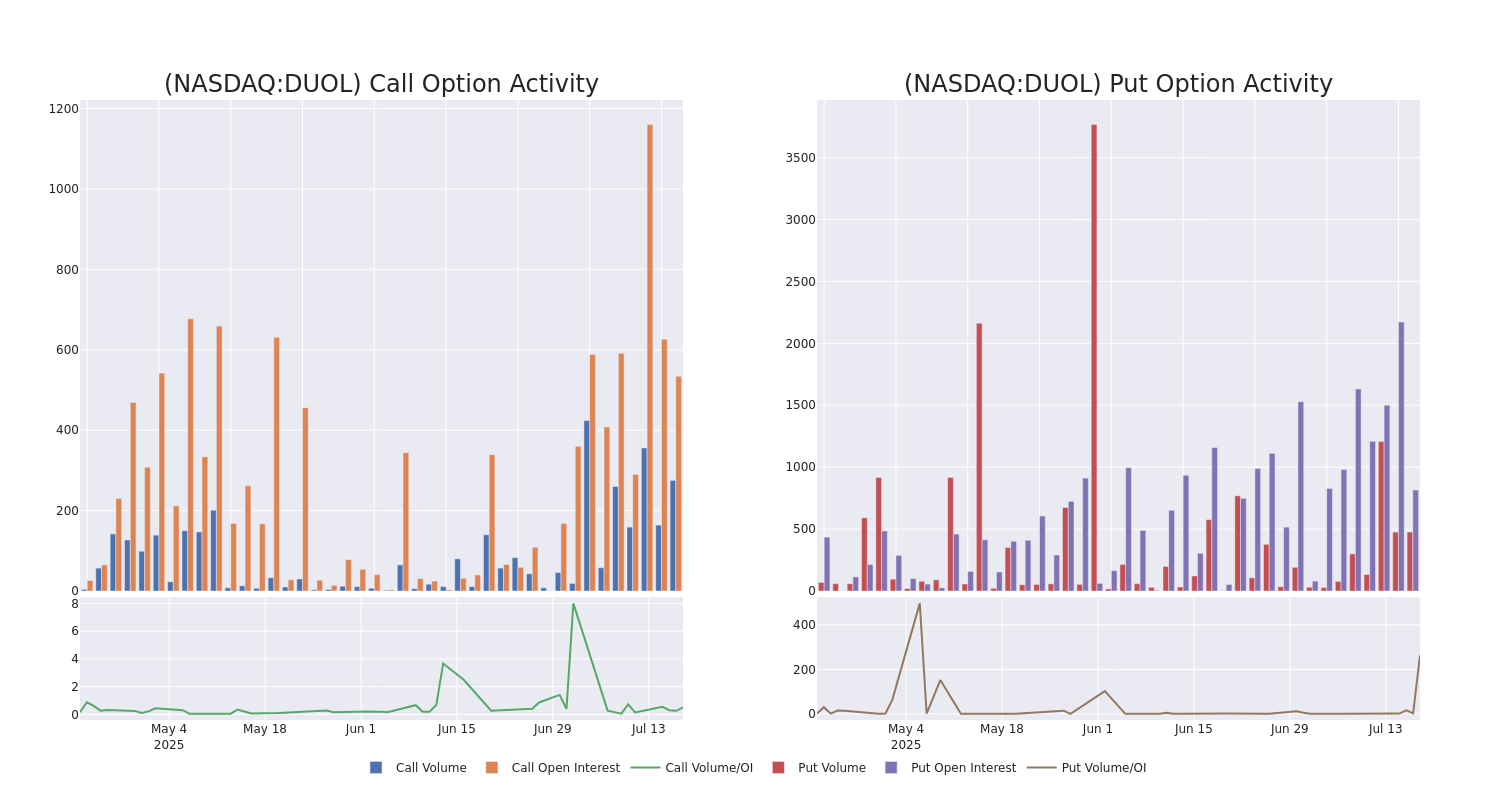

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Duolingo's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Duolingo's substantial trades, within a strike price spectrum from $290.0 to $490.0 over the preceding 30 days.

Duolingo Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DUOL | PUT | TRADE | BULLISH | 09/19/25 | $22.2 | $19.2 | $20.4 | $330.00 | $510.0K | 1 | 250 |

| DUOL | CALL | SWEEP | BEARISH | 08/15/25 | $15.2 | $14.5 | $14.5 | $400.00 | $101.5K | 511 | 77 |

| DUOL | PUT | TRADE | BULLISH | 09/19/25 | $45.6 | $45.3 | $45.3 | $380.00 | $86.0K | 5 | 34 |

| DUOL | PUT | TRADE | BULLISH | 02/20/26 | $80.7 | $80.0 | $80.0 | $400.00 | $80.0K | 27 | 16 |

| DUOL | CALL | TRADE | BEARISH | 09/19/25 | $34.5 | $33.7 | $33.7 | $380.00 | $67.4K | 0 | 20 |

About Duolingo

Duolingo Inc is a technology company that develops a mobile learning platform to learn languages and is the top-grossing app in the Education category on both Google Play and the Apple App Store. Its products are powered by sophisticated data analytics and artificial intelligence and delivered with class art, animation, and design to make it easier for learners to stay motivated master new material, and achieve their learning goals. Its solutions include the Duolingo Language Learning App, Super Duolingo, Duolingo English Test: AI-Driven Language Assessment, Duolingo For Schools, Duolingo ABC, and Duolingo Math. It has four predominant sources of revenue; time-based subscriptions, in-app advertising placement by third parties, and the Duolingo English Test, and In-App Purchases.

Having examined the options trading patterns of Duolingo, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Duolingo Standing Right Now?

- With a trading volume of 784,233, the price of DUOL is down by -1.09%, reaching $358.0.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 19 days from now.

Expert Opinions on Duolingo

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $513.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from DA Davidson continues to hold a Buy rating for Duolingo, targeting a price of $500.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Duolingo, targeting a price of $480.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Duolingo with a target price of $500.

* An analyst from Argus Research has revised its rating downward to Buy, adjusting the price target to $575.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Duolingo options trades with real-time alerts from Benzinga Pro.