Wayfair Options Trading: A Deep Dive into Market Sentiment

Deep-pocketed investors have adopted a bullish approach towards Wayfair (NYSE:W), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in W usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Wayfair. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 77% leaning bullish and 22% bearish. Among these notable options, 7 are puts, totaling $465,080, and 2 are calls, amounting to $250,600.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $55.0 for Wayfair over the last 3 months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Wayfair options trades today is 281.14 with a total volume of 1,775.00.

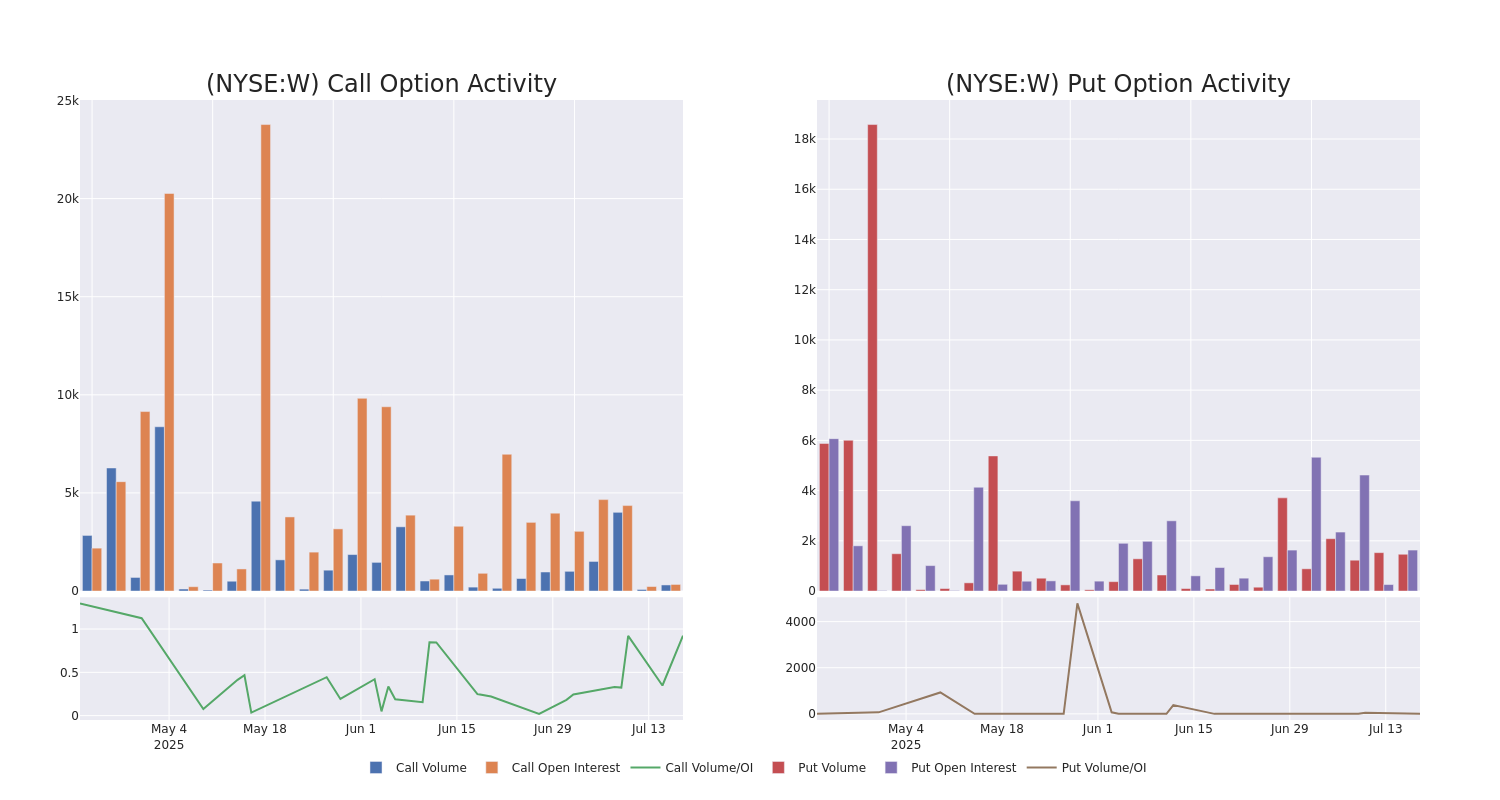

In the following chart, we are able to follow the development of volume and open interest of call and put options for Wayfair's big money trades within a strike price range of $30.0 to $55.0 over the last 30 days.

Wayfair Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| W | CALL | TRADE | BEARISH | 07/18/25 | $8.75 | $6.25 | $6.8 | $49.00 | $197.2K | 305 | 290 |

| W | PUT | SWEEP | BULLISH | 09/19/25 | $5.25 | $5.1 | $5.1 | $55.00 | $102.0K | 213 | 400 |

| W | PUT | SWEEP | BULLISH | 09/19/25 | $6.0 | $5.0 | $5.0 | $55.00 | $100.0K | 213 | 0 |

| W | PUT | TRADE | BULLISH | 09/19/25 | $4.05 | $4.0 | $4.0 | $52.50 | $79.2K | 204 | 202 |

| W | PUT | SWEEP | BULLISH | 08/15/25 | $2.21 | $2.2 | $2.2 | $50.00 | $56.5K | 1.1K | 510 |

About Wayfair

Wayfair engages in e-commerce in the United States (88% of 2024 sales), Canada, the United Kingdom, and Ireland. It's also embarked on expansion into the brick-and-mortar landscape, with a handful of stores between the AllModern, Birch Lane, Joss & Main, and Wayfair banners. At the end of 2024, the firm offered more than 30 million products from more than 20,000 suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Its offerings include furniture, everyday and seasonal decor, decorative accents, housewares, and other home goods. Wayfair was founded in 2002 and began trading publicly in 2014.

Following our analysis of the options activities associated with Wayfair, we pivot to a closer look at the company's own performance.

Present Market Standing of Wayfair

- Trading volume stands at 1,537,844, with W's price down by -0.03%, positioned at $56.55.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 17 days.

What The Experts Say On Wayfair

3 market experts have recently issued ratings for this stock, with a consensus target price of $67.33.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Wayfair with a target price of $70.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Wayfair, which currently sits at a price target of $60.

* An analyst from Zelman & Assoc has decided to maintain their Outperform rating on Wayfair, which currently sits at a price target of $72.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Wayfair, Benzinga Pro gives you real-time options trades alerts.