Check Out What Whales Are Doing With CAT

Deep-pocketed investors have adopted a bullish approach towards Caterpillar (NYSE:CAT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CAT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for Caterpillar. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 40% bearish. Among these notable options, 2 are puts, totaling $51,720, and 18 are calls, amounting to $2,070,624.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $195.0 and $480.0 for Caterpillar, spanning the last three months.

Analyzing Volume & Open Interest

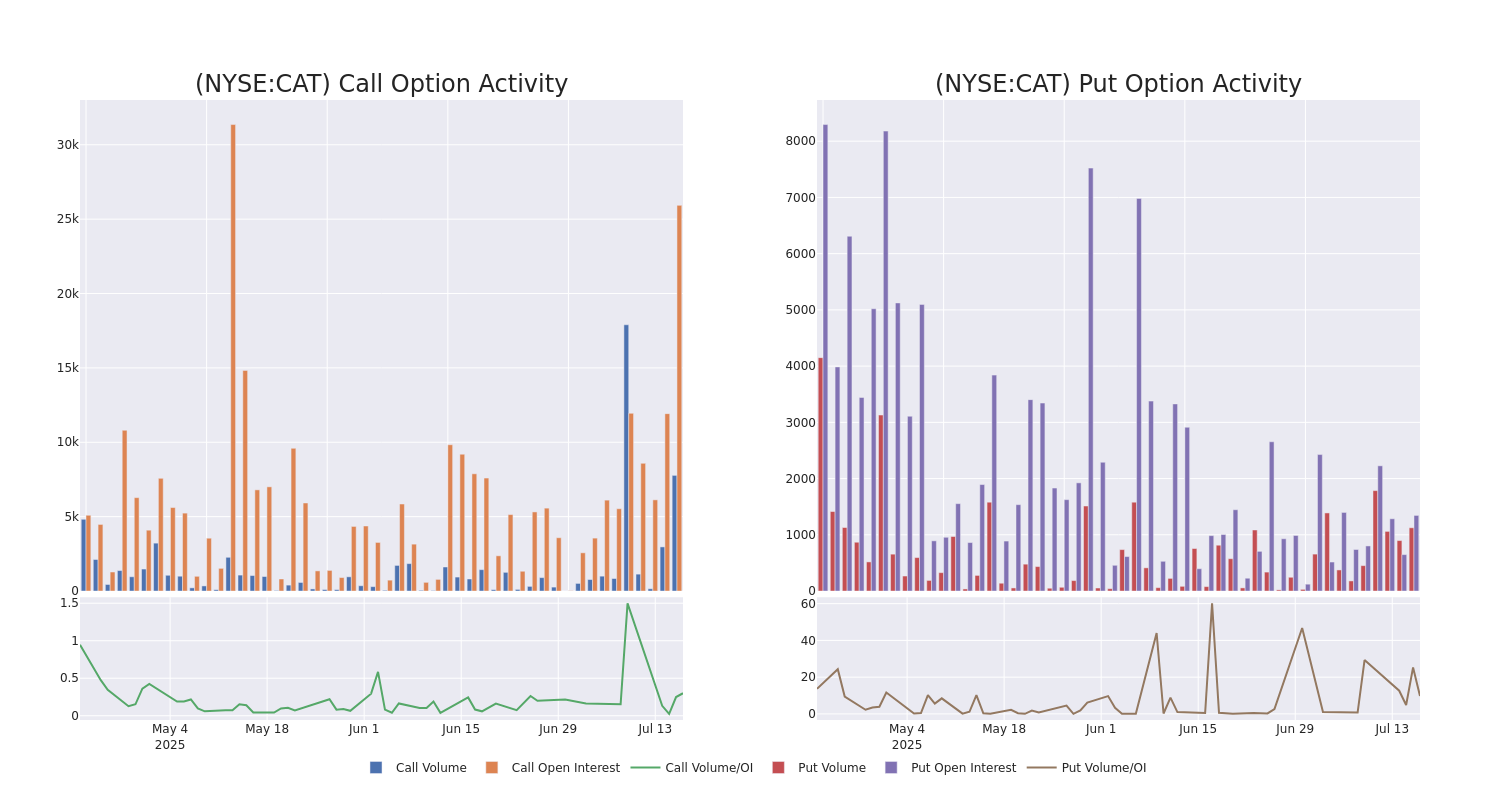

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Caterpillar's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Caterpillar's whale trades within a strike price range from $195.0 to $480.0 in the last 30 days.

Caterpillar Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | TRADE | BULLISH | 07/18/25 | $221.1 | $221.1 | $221.1 | $195.00 | $442.2K | 20 | 20 |

| CAT | CALL | SWEEP | BEARISH | 11/21/25 | $196.35 | $194.4 | $195.4 | $220.00 | $390.8K | 7 | 40 |

| CAT | CALL | TRADE | BULLISH | 07/18/25 | $104.8 | $104.8 | $104.8 | $310.00 | $209.6K | 260 | 20 |

| CAT | CALL | TRADE | BEARISH | 12/17/27 | $150.0 | $146.2 | $147.6 | $300.00 | $177.1K | 3 | 16 |

| CAT | CALL | SWEEP | NEUTRAL | 07/18/25 | $37.8 | $36.45 | $37.06 | $380.00 | $151.9K | 2.4K | 60 |

About Caterpillar

Caterpillar is the world's leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Its reporting segments are: construction industries (40% sales/47% operating profit, or OP), resource industries (20% sales/19% OP), and energy & transportation (40% sales/34% OP). Market share approaches 20% across many products. Caterpillar operates a captive finance subsidiary to facilitate sales. The firm has global reach (46% US sales/54% ex-US). Construction skews more domestic, while the other divisions are more geographically diversified. An independent network of 156 dealers operates approximately 2,800 facilities, giving Caterpillar reach into about 190 countries for sales and support services.

Following our analysis of the options activities associated with Caterpillar, we pivot to a closer look at the company's own performance.

Caterpillar's Current Market Status

- Currently trading with a volume of 551,600, the CAT's price is down by -0.72%, now at $415.05.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 18 days.

Expert Opinions on Caterpillar

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $442.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Caterpillar with a target price of $483.

* Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Caterpillar with a target price of $422.

* An analyst from Citigroup has decided to maintain their Buy rating on Caterpillar, which currently sits at a price target of $420.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Caterpillar, which currently sits at a price target of $475.

* An analyst from Truist Securities persists with their Buy rating on Caterpillar, maintaining a target price of $414.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Caterpillar, Benzinga Pro gives you real-time options trades alerts.