Spotlight on Rocket Lab USA: Analyzing the Surge in Options Activity

Deep-pocketed investors have adopted a bullish approach towards Rocket Lab USA (NASDAQ:RKLB), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RKLB usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 114 extraordinary options activities for Rocket Lab USA. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 47% leaning bullish and 31% bearish. Among these notable options, 21 are puts, totaling $1,215,137, and 93 are calls, amounting to $5,863,118.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $3.0 to $65.0 for Rocket Lab USA over the recent three months.

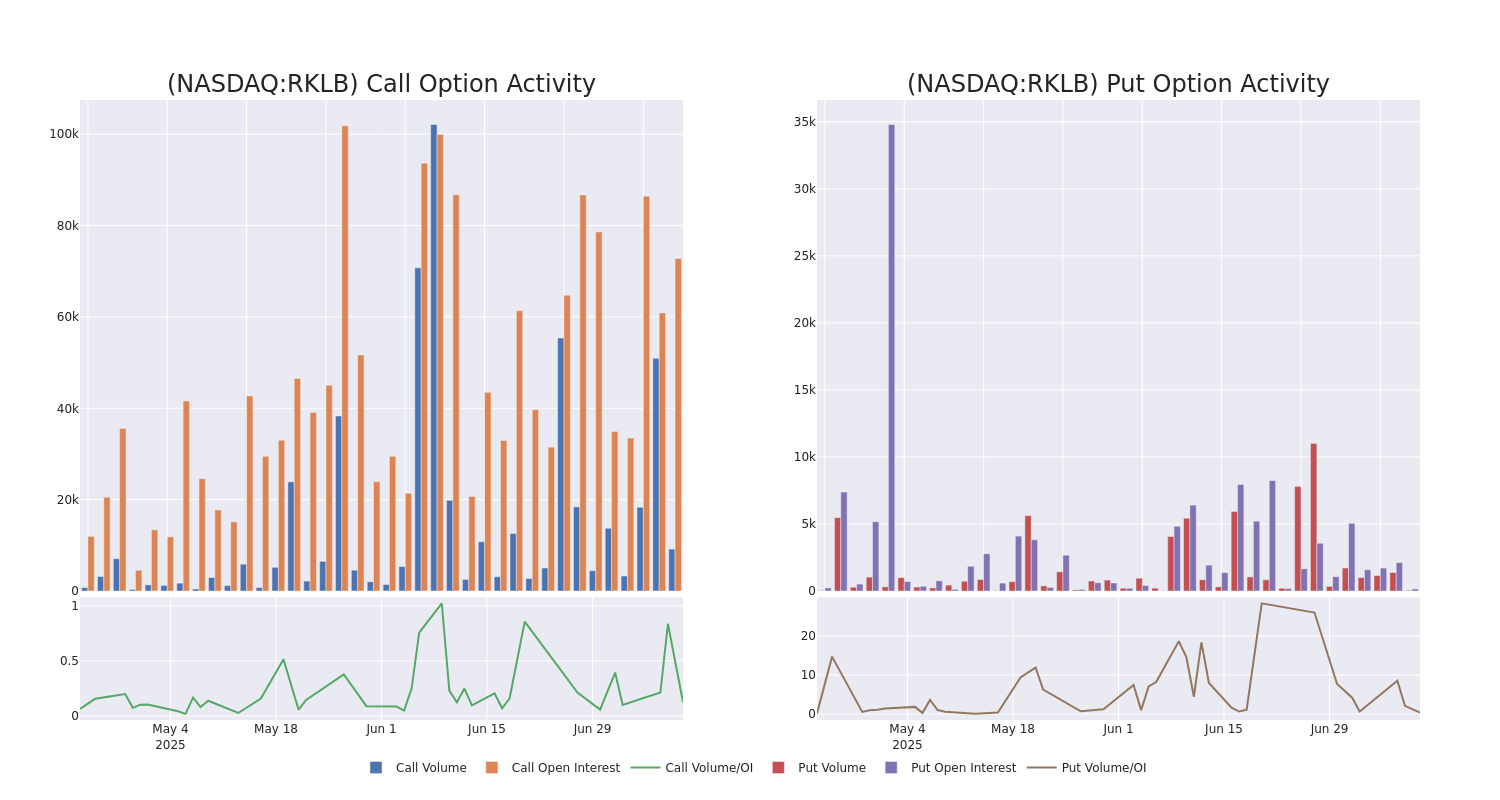

Volume & Open Interest Development

In today's trading context, the average open interest for options of Rocket Lab USA stands at 1970.32, with a total volume reaching 99,501.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Rocket Lab USA, situated within the strike price corridor from $3.0 to $65.0, throughout the last 30 days.

Rocket Lab USA 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RKLB | CALL | TRADE | BULLISH | 12/18/26 | $31.5 | $31.45 | $31.5 | $27.00 | $315.0K | 316 | 102 |

| RKLB | CALL | TRADE | BULLISH | 01/16/26 | $16.85 | $16.55 | $16.85 | $45.00 | $252.7K | 1.7K | 694 |

| RKLB | CALL | TRADE | BEARISH | 12/18/26 | $43.15 | $42.0 | $42.41 | $12.00 | $169.6K | 3.3K | 43 |

| RKLB | CALL | SWEEP | BEARISH | 10/17/25 | $6.8 | $6.7 | $6.7 | $60.00 | $134.0K | 353 | 974 |

| RKLB | CALL | SWEEP | BEARISH | 10/17/25 | $6.85 | $6.7 | $6.7 | $60.00 | $134.0K | 353 | 774 |

About Rocket Lab USA

Rocket Lab USA Inc is engaged in space, building rockets, and spacecraft. It provides end-to-end mission services that provide frequent and reliable access to space for civil, defense, and commercial markets. It designs and manufactures the Electron and Neutron launch vehicles and Photon satellite platform. Rocket Lab's Electron launch vehicle has delivered multiple satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. The business operates in two segments Launch Services and Space Systems. Geographically it serves Japan, Germany, rest of the world and earns key revenue from the United States.

Following our analysis of the options activities associated with Rocket Lab USA, we pivot to a closer look at the company's own performance.

Present Market Standing of Rocket Lab USA

- Currently trading with a volume of 37,553,142, the RKLB's price is up by 9.79%, now at $52.36.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 21 days.

Expert Opinions on Rocket Lab USA

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $41.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup has decided to maintain their Buy rating on Rocket Lab USA, which currently sits at a price target of $50.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Rocket Lab USA, targeting a price of $40.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Rocket Lab USA with a target price of $50.

* An analyst from Goldman Sachs has revised its rating downward to Neutral, adjusting the price target to $27.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Rocket Lab USA, Benzinga Pro gives you real-time options trades alerts.