Spotlight on McDonald's: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bearish move on McDonald's. Our analysis of options history for McDonald's (NYSE:MCD) revealed 15 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 53% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $82,060, and 12 were calls, valued at $488,012.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $270.0 to $350.0 for McDonald's during the past quarter.

Insights into Volume & Open Interest

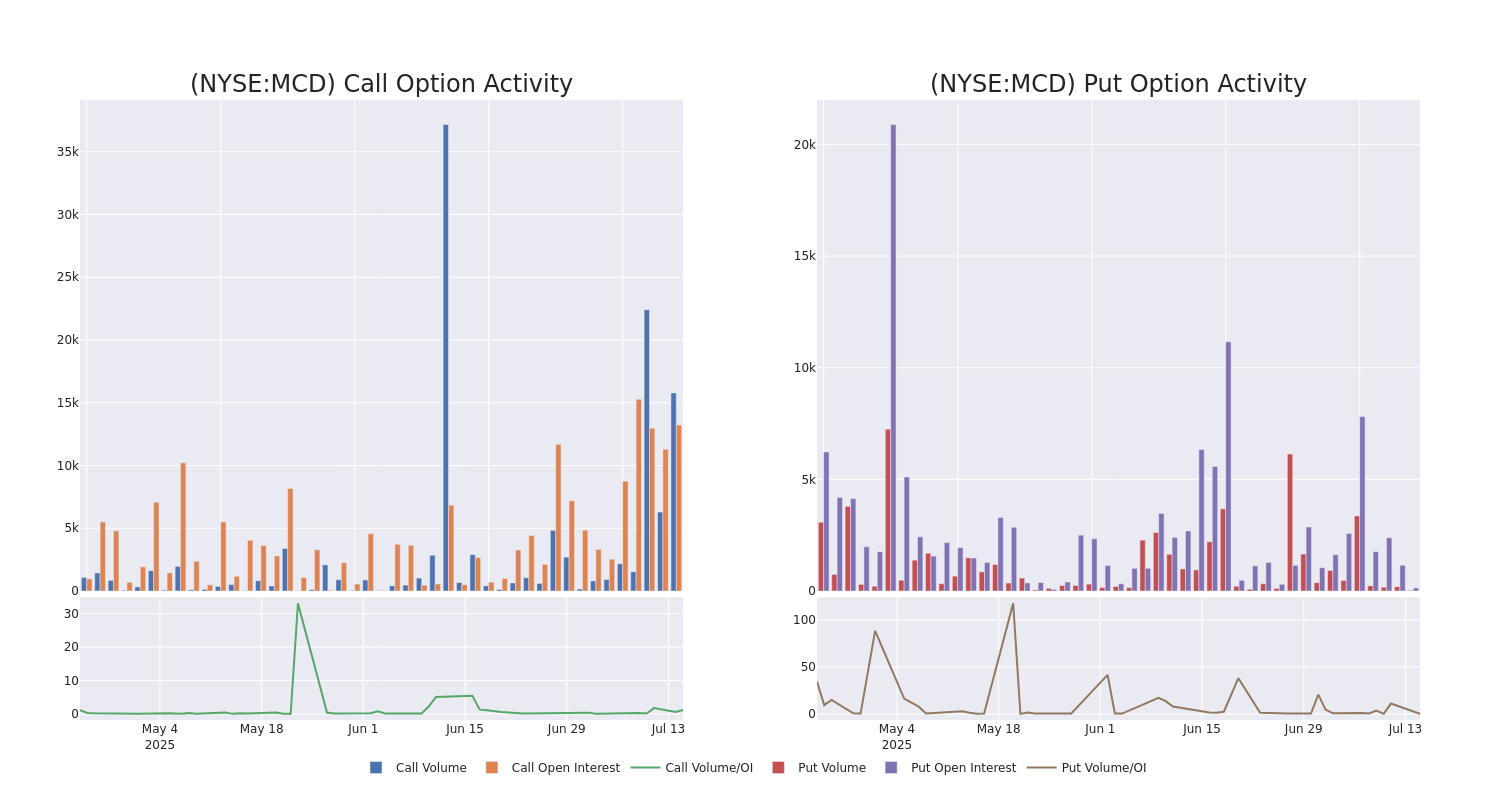

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in McDonald's's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to McDonald's's substantial trades, within a strike price spectrum from $270.0 to $350.0 over the preceding 30 days.

McDonald's Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCD | CALL | TRADE | BEARISH | 11/21/25 | $11.45 | $11.25 | $11.25 | $310.00 | $59.6K | 196 | 59 |

| MCD | CALL | SWEEP | BULLISH | 07/18/25 | $1.26 | $1.25 | $1.26 | $300.00 | $56.9K | 5.2K | 1.0K |

| MCD | CALL | SWEEP | BULLISH | 09/19/25 | $8.8 | $8.4 | $8.71 | $305.00 | $52.2K | 611 | 61 |

| MCD | CALL | SWEEP | BULLISH | 11/21/25 | $7.25 | $7.2 | $7.25 | $320.00 | $44.9K | 1.6K | 125 |

| MCD | CALL | SWEEP | BEARISH | 09/19/25 | $17.55 | $17.5 | $17.5 | $290.00 | $43.7K | 474 | 25 |

About McDonald's

McDonald's is the largest restaurant owner-operator in the world, with 2024 system sales of $131 billion across more than 43,000 stores and 115 markets. McDonald's pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

Following our analysis of the options activities associated with McDonald's, we pivot to a closer look at the company's own performance.

Where Is McDonald's Standing Right Now?

- With a trading volume of 1,514,771, the price of MCD is up by 0.26%, reaching $299.68.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 20 days from now.

What Analysts Are Saying About McDonald's

In the last month, 5 experts released ratings on this stock with an average target price of $343.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on McDonald's with a target price of $325.

* An analyst from Truist Securities has decided to maintain their Buy rating on McDonald's, which currently sits at a price target of $356.

* In a positive move, an analyst from Goldman Sachs has upgraded their rating to Buy and adjusted the price target to $345.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for McDonald's, targeting a price of $365.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on McDonald's with a target price of $326.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for McDonald's with Benzinga Pro for real-time alerts.