Check Out What Whales Are Doing With NET

Deep-pocketed investors have adopted a bullish approach towards Cloudflare (NYSE:NET), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NET usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Cloudflare. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 33% bearish. Among these notable options, 4 are puts, totaling $118,255, and 14 are calls, amounting to $1,820,676.

Expected Price Movements

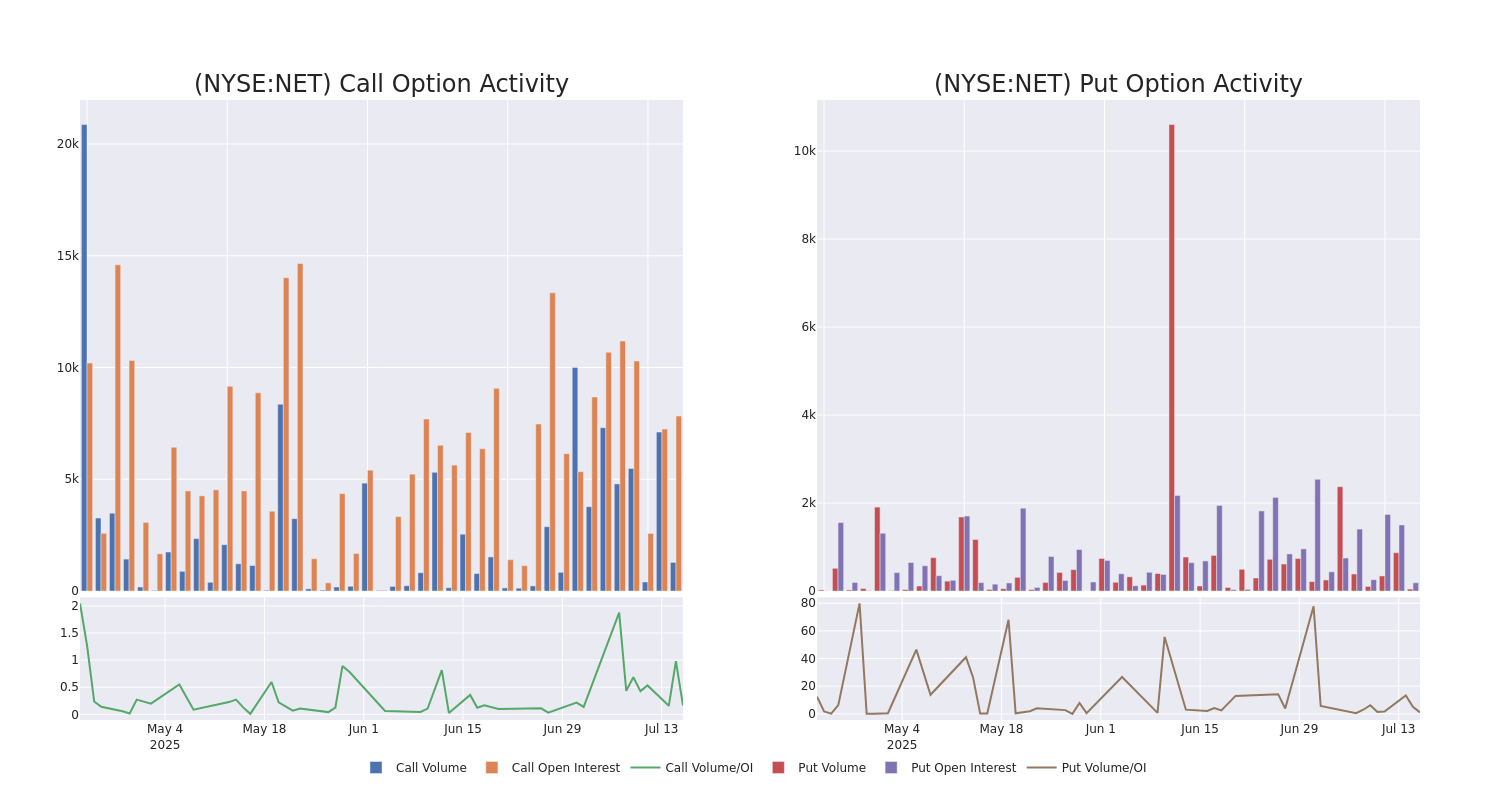

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $115.0 to $210.0 for Cloudflare during the past quarter.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Cloudflare options trades today is 534.27 with a total volume of 1,316.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cloudflare's big money trades within a strike price range of $115.0 to $210.0 over the last 30 days.

Cloudflare Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET | CALL | TRADE | BULLISH | 08/15/25 | $19.55 | $19.05 | $19.35 | $180.00 | $870.7K | 1.2K | 451 |

| NET | CALL | TRADE | BEARISH | 01/15/27 | $94.05 | $92.35 | $92.8 | $115.00 | $343.3K | 2.1K | 37 |

| NET | CALL | SWEEP | BULLISH | 08/01/25 | $10.1 | $10.05 | $10.1 | $195.00 | $99.9K | 203 | 1 |

| NET | CALL | TRADE | BULLISH | 01/16/26 | $25.2 | $24.6 | $25.2 | $200.00 | $78.1K | 901 | 174 |

| NET | CALL | TRADE | BULLISH | 08/15/25 | $51.95 | $50.35 | $51.33 | $140.00 | $71.8K | 721 | 14 |

About Cloudflare

Cloudflare is a software company based in San Francisco, California, that offers security and web performance offerings by utilizing a distributed, serverless content delivery network, or CDN. The firm's edge computing platform, Workers, leverages this network by providing clients the ability to deploy, and execute code without maintaining servers.

Following our analysis of the options activities associated with Cloudflare, we pivot to a closer look at the company's own performance.

Where Is Cloudflare Standing Right Now?

- Trading volume stands at 1,641,872, with NET's price up by 0.4%, positioned at $187.71.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 15 days.

What The Experts Say On Cloudflare

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $222.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Cloudflare with a target price of $220.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Cloudflare, which currently sits at a price target of $225.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cloudflare with Benzinga Pro for real-time alerts.