Behind the Scenes of IREN's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bullish stance on IREN.

Looking at options history for IREN (NASDAQ:IREN) we detected 42 trades.

If we consider the specifics of each trade, it is accurate to state that 64% of the investors opened trades with bullish expectations and 26% with bearish.

From the overall spotted trades, 15 are puts, for a total amount of $7,139,068 and 27, calls, for a total amount of $2,315,930.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $12.0 and $32.0 for IREN, spanning the last three months.

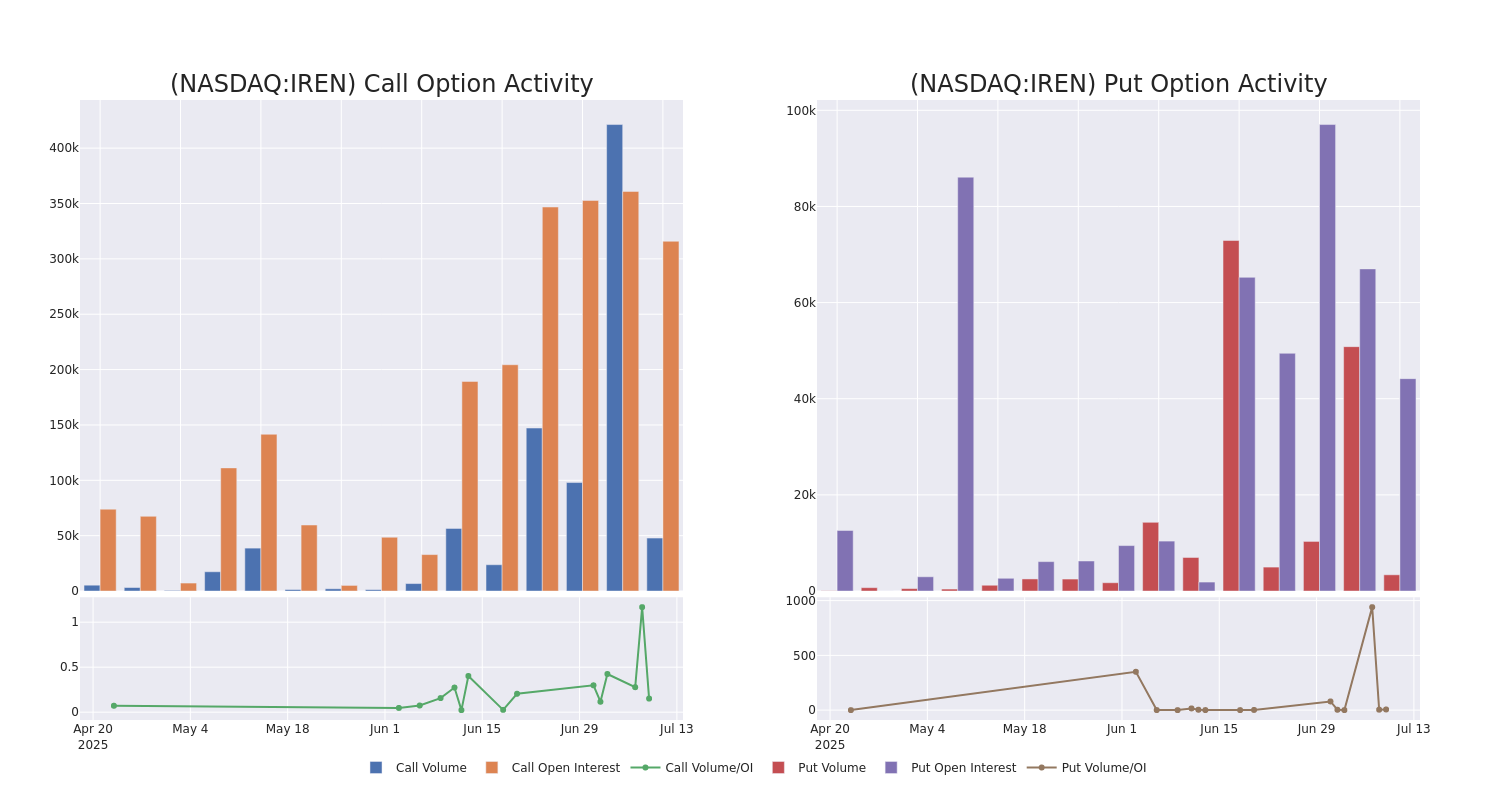

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for IREN's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across IREN's significant trades, within a strike price range of $12.0 to $32.0, over the past month.

IREN Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IREN | PUT | SWEEP | BEARISH | 01/16/26 | $4.25 | $4.2 | $4.2 | $17.50 | $2.9M | 31.4K | 19.6K |

| IREN | PUT | SWEEP | BEARISH | 01/16/26 | $4.2 | $4.1 | $4.2 | $17.50 | $1.1M | 31.4K | 6.0K |

| IREN | PUT | SWEEP | BEARISH | 01/16/26 | $4.25 | $4.1 | $4.2 | $17.50 | $1.0M | 31.4K | 8.5K |

| IREN | CALL | SWEEP | NEUTRAL | 03/20/26 | $7.1 | $7.0 | $7.0 | $12.00 | $885.6K | 15.6K | 1.2K |

| IREN | PUT | SWEEP | BULLISH | 01/16/26 | $4.25 | $4.2 | $4.2 | $17.50 | $682.9K | 31.4K | 11.4K |

About IREN

IREN Ltd is engaged in data center business powering the future of Bitcoin, AI and beyond utilizing renewable energy.

In light of the recent options history for IREN, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of IREN

- With a trading volume of 11,599,007, the price of IREN is up by 3.29%, reaching $17.59.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 47 days from now.

Professional Analyst Ratings for IREN

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $22.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B. Riley Securities has decided to maintain their Buy rating on IREN, which currently sits at a price target of $22.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for IREN with Benzinga Pro for real-time alerts.